Introduction:

Image: atas.net

In the realm of financial markets, option trading presents a gateway to potentially lucrative returns. However, navigating this complex landscape requires a solid foundation in the intricacies of options contracts and the ability to identify optimal entry points. For aspiring traders seeking to embark on this journey, this article meticulously outlines the essential steps involved in taking entry in option trading.

Understanding Option Contracts:

Option contracts are financial agreements that grant the holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined strike price on or before a specific date known as the expiration date. Crucially, unlike futures contracts, options do not carry an obligation to exercise, providing traders with flexibility in their trading decisions.

Types of Option Entries:

There are two main types of option entries:

- In-the-Money (ITM): ITM options are bought or sold when the underlying asset’s price is above (for call options) or below (for put options) the strike price, respectively.

- Out-of-the-Money (OTM): OTM options are bought or sold when the underlying asset’s price is below (for call options) or above (for put options) the strike price, respectively.

Choosing an Entry Point:

The selection of an entry point in option trading entails meticulous consideration of several factors:

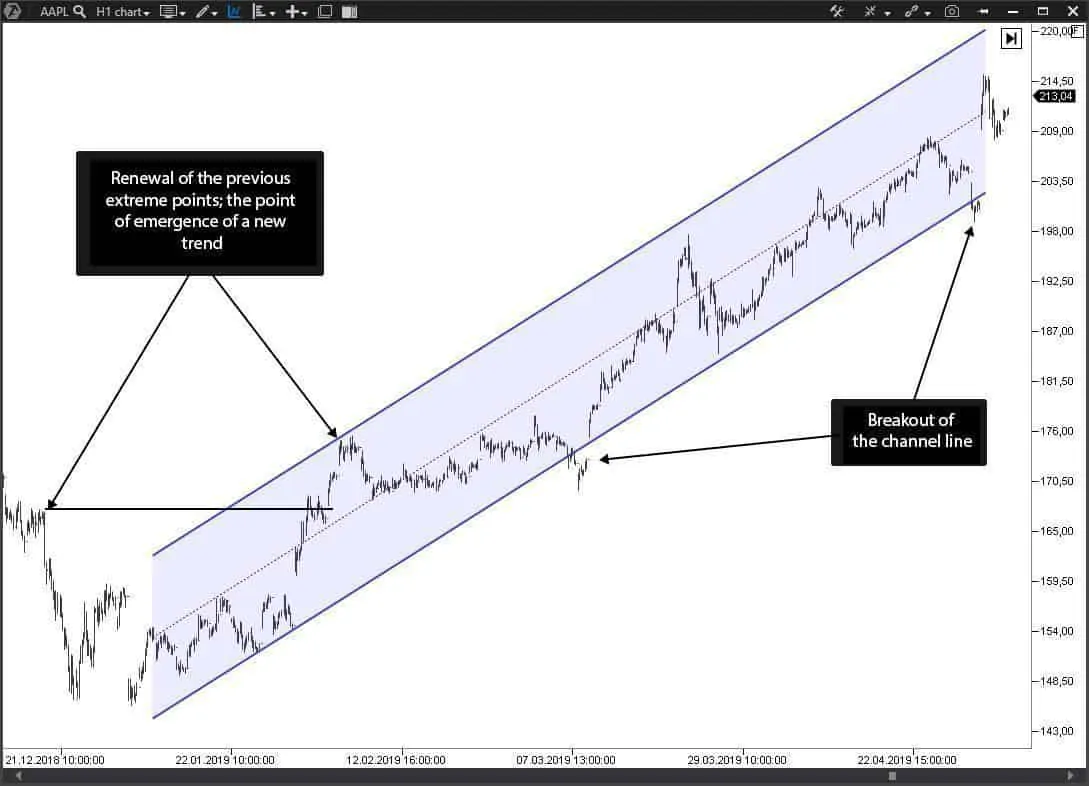

- Technical Analysis: Analyzing price charts and indicators can provide insights into potential market trends and support levels, informing entry point decisions.

- Fundamental Analysis: Evaluating economic data, company news, and industry reports helps traders gauge the intrinsic value of an underlying asset, influencing their choice of strike price and expiration date.

- Risk Tolerance: Traders must assess their risk tolerance and appropriate position sizes based on their financial situation and trading objectives.

Risk Management:

Options trading carries inherent risk, and effective risk management strategies are essential to mitigate potential losses. Key risk management techniques include:

- Stop-Loss Orders: Predetermined orders placed to automatically exit a trade when the underlying asset’s price reaches a specified level, limiting potential losses.

- Hedging: Using multiple options contracts or combining options with other financial instruments to reduce risk exposure while increasing potential returns.

Conclusion:

Entering the world of option trading requires a comprehensive understanding of option contracts, careful entry point selection, and disciplined risk management. By thoroughly embracing these concepts, aspiring traders can equip themselves with the knowledge and strategies necessary to navigate this complex arena and potentially reap the rewards of option trading while mitigating risk. Remember, continuous learning and diligent practice remain indispensable for success in this dynamic and ever-evolving market.

Image: optionboxer.com

How To Take Entry In Option Trading

Image: www.stockbrokers.com