Introduction

In the labyrinthine world of finance, options trading emerged as a formidable tool for investors seeking to amplify their returns and hedge against potential losses. Like a chessboard, it invites strategic thinking and the ability to anticipate market movements.

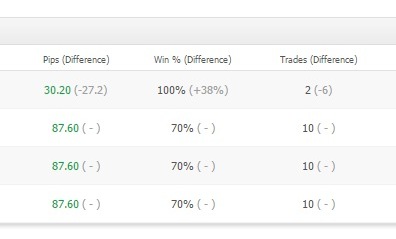

Image: www.forexfactory.com

Understanding Options Trading

An option contract grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This flexibility allows investors to capitalize on market fluctuations or protect their existing investments.

Historical Evolution

The roots of options trading can be traced back to the Dutch East India Company in the 17th century. However, it wasn’t until the 1800s that options began to take their modern form. Over time, exchanges such as the Chicago Board Options Exchange (CBOE) were established to facilitate the trading of standardized options contracts.

Types of Options

The two primary types of options are calls and puts. Call options confer the right to buy the underlying asset, while put options grant the right to sell it. Each type has its own unique characteristics and strategies associated with it.

Image: www.studocu.com

Options in Practice

To fully grasp options trading, consider the following scenario. Suppose you believe that the stock price of XYZ Corporation is poised to rise. You can purchase a call option that gives you the right to buy XYZ shares at $50 per share within the next month. If the stock price climbs above $50, you can exercise your option and profit from the difference between the market price and the strike price.

Conversely, if you anticipate a decline in XYZ’s stock price, you could buy a put option that allows you to sell XYZ shares at $50 per share within the same timeframe. Should the stock price fall below $50, you can exercise your option to sell your shares at the higher strike price, mitigating your potential losses.

Market Outlook and Recent Trends

The options trading landscape is constantly evolving, influenced by economic, political, and global events. Recent trends include:

- Growing popularity of exchange-traded funds (ETFs)

- Rise of algorithmic trading and automated execution

- Increased availability of online trading platforms

Expert Advice and Tips

Navigating the options market can be challenging, but seasoned traders offer invaluable insights to enhance your success:

- Educate yourself: Conduct thorough research and gain a deep understanding of options concepts and strategies.

- Manage your risk: Options are leveraged instruments that can amplify both profits and losses. Exercise caution and establish clear risk management protocols.

- Plan your trades: Before entering an options contract, determine your goals, exit strategies, and potential risk-reward ratio.

- Monitor market trends: Stay abreast of market news, economic indicators, and geopolitical developments that can impact options prices.

FAQs

- Q: What is the difference between an option and a stock?

A: Options represent the right to buy or sell an underlying asset, while stocks represent direct ownership in a company. - Q: Can I lose money in options trading?

A: Yes, options trading involves significant risk and it is possible to lose your entire investment. - Q: How do I choose the right option strategy?

A: The optimal strategy depends on factors such as market outlook, risk tolerance, and investment goals. Seek guidance from experienced traders or consult reputable resources.

Options Trading Primer

Conclusion

Options trading provides investors with a powerful tool for capitalizing on market opportunities and mitigating risk. By thoroughly comprehending the concepts, strategies, and market dynamics involved, you can become a formidable player in the options trading arena.

Are you ready to embark on the exhilarating journey of options trading? Let us know your thoughts and questions in the comments section below.