In the realm of financial markets, options trading stands as an indispensable tool for risk-averse investors seeking to navigate the volatile terrain. By delving into the intricate strategies of options contracts, traders can augment their portfolios, hedge against potential losses, and amplify their return potential.

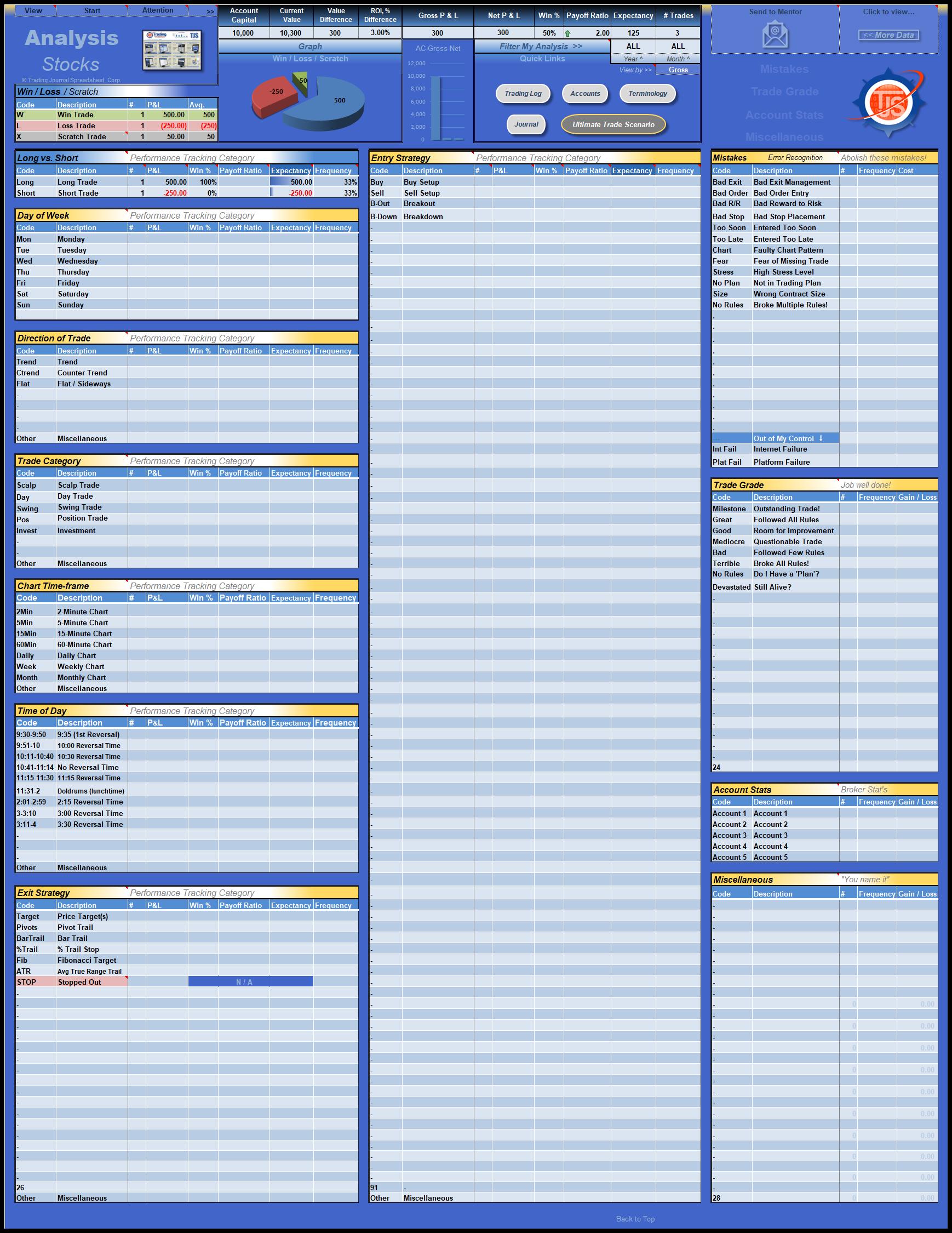

Image: trading-journal-spreadsheet.com

However, to embark on this journey with confidence, it is crucial to establish a meticulous options trading plan. This comprehensive blueprint will guide every trade, empowering you to capitalize on market opportunities while effectively managing risk. This article serves as an indispensable guide, deciphering the intricacies of options trading plans, ensuring your voyage into this realm is both profitable and secure.

Understanding Options Trading: A Primer

Options contracts, often likened to tradable insurance policies, confer upon their holders the right, but not the obligation, to execute specific actions at predetermined prices and timelines. Call options convey the right to purchase an underlying asset, while their counterpart, put options, grant the right to sell an underlying asset.

Within the intricacies of options trading, there exists an interplay of critical terms:

- Strike Price: The predetermined price at which the underlying asset can be bought (call option) or sold (put option).

- Expiration Date: The date at which the option contract ceases to exist.

- Premium: The price paid upfront to acquire an option contract.

Through a thorough understanding of these concepts, you lay the foundation for crafting a robust options trading plan.

Crafting a Comprehensive Options Trading Plan

An effective options trading plan is the cornerstone of successful endeavors in this arena. While there’s no one-size-fits-all approach, the following elements are universally essential:

1. Define Objectives and Risk Tolerance

Before embarking on the options trading odyssey, meticulously delineate your financial objectives, encapsulating both short- and long-term aspirations. Moreover, it is imperative to set a personalized risk tolerance, establishing clear boundaries beyond which you’re unwilling to venture. This crucial step ensures your trading aligns with your broader financial plans and mitigates the potential for impulsive decisions.

![Options Strategies Cheat Sheet [FREE Download] - How to Trade](https://howtotrade.com/wp-content/uploads/2023/02/options-strategy-cheat-sheet-2048x1448.png)

Image: howtotrade.com

2. Conduct Thorough Market Research

The ever-fluctuating financial markets necessitate ongoing research. Stay abreast of economic indicators, geopolitical events, and industry-specific news that can potentially influence the underlying assets you contemplate trading. By immersing yourself in market dynamics, you empower yourself to make informed decisions, maximizing your chances of successful outcomes.

3. Select Underlying Assets Strategically

The underlying asset, be it a stock, currency, commodity, or index, is the bedrock of any options contract. Carefully consider your investment goals, risk tolerance, and market knowledge when selecting the underlying asset. By aligning these factors, you increase your probability of making sound decisions and maximizing your trading potential.

4. Determine Suitable Option Strategies

The options trading universe presents an array of strategies, each tailored to specific market conditions and risk profiles. Familiarize yourself with these strategies, assessing their suitability within the context of your objectives and trading style. Some popular strategies include:

- Covered Calls: Selling call options against an underlying asset you own.

- Protective Puts: Buying put options to hedge against potential losses in an underlying asset you own.

- Bull Call Spreads: Combining a long call option with a short call option at a higher strike price.

Remember, each strategy carries its own risk and reward profile. Comprehend these nuances thoroughly before incorporating them into your trading plan.

5. Establish Entry and Exit Points

Timely entry and exit are cornerstones of successful options trading. Determine your entry points based on technical analysis, market sentiment, and your trading strategy. Simultaneously, establish clear exit points, incorporating stop-loss orders to safeguard against unwarranted losses and take-profit orders to lock in gains.

6. Monitor and Adjust Regularly

The financial markets are in a perpetual state of flux. To adapt to these ever-changing conditions, monitor your trades closely and adjust your plan as necessary. Reassess your objectives periodically, analyze market trends, and tweak your strategies accordingly. This proactive approach ensures your plan remains relevant, responsive, and aligned with the dynamic financial landscape.

Options Trading Plan

Conclusion

Embarking on options trading armed with a well-defined plan is paramount to reaping its full benefits. By following the guidance outlined in this comprehensive article, you equip yourself with the knowledge and strategies essential for navigating the options market. Remember to meticulously adhere to your plan, maintaining discipline throughout your trading journey. Like any endeavor, options trading involves risk, but with a robust plan and unwavering dedication, you can mitigate these risks and increase your chances of achieving financial success.