A Thriving Hub for Options Traders

Within the bustling financial center of London, options trading flourishes as a dynamic and lucrative market. London serves as a magnet for aspiring traders, seasoned veterans, and global financial institutions seeking to capitalize on the opportunities presented by this sophisticated investment instrument.

Image: www.annacoulling.com

Options trading in London is a captivating fusion of art and science, where calculated risks meet the potential for significant returns. Traders navigate the ever-evolving landscape, deciphering market movements and leveraging intricate strategies to maximize their profits.

Understanding Options Trading

Options, often referred to as “derivatives,” derive their value from underlying assets such as stocks, bonds, commodities, or currencies. These contracts convey the right, but not the obligation, to buy or sell the underlying asset at a predetermined price (the “strike price”) by a specific expiration date.

Options provide traders with flexibility and leverage. They allow for tailored risk profiles, enabling traders to hedge against potential losses or speculate on future market movements. Moreover, options trading requires less upfront capital compared to purchasing or selling the underlying asset outright.

Latest Trends and Developments in Options Trading London

London’s options market remains at the forefront of innovation and technological advancements. Algorithmic trading, artificial intelligence (AI), and blockchain are revolutionizing the way options are traded and analyzed.

These advancements empower traders with real-time market data, predictive analytics, and automated execution capabilities. Consequently, traders can make informed decisions and execute trades with unparalleled precision and efficiency.

Expert Advice for Options Traders

While options trading can be a rewarding endeavor, it also demands a prudent approach. Here are some tips and insights from seasoned traders:

– Start small: Begin with modest trades to gain familiarity with options mechanics and market dynamics.

– Education is paramount: Diligently study options trading strategies, risk management techniques, and market analysis.

– Manage risk effectively: Develop a robust risk management plan that outlines your trade parameters, position sizing, and exit strategies.

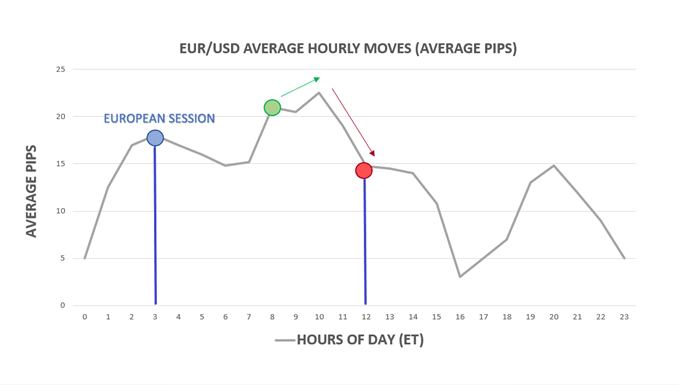

Image: todaysforexnews.com

Frequently Asked Questions about Options Trading in London

- Q: Is options trading suitable for beginners?

A: While options offer flexibility, they are inherently more complex than traditional stock trading. It’s essential to acquire a solid understanding of options trading mechanics and strategies before venturing into this arena. - Q: What are the advantages of options trading in London?

A: London provides access to a deep and liquid options market, a vast pool of experienced traders, and cutting-edge trading infrastructure. - Q: How can I get started with options trading in London?

A: To commence options trading, open an account with a regulated broker offering options trading services.

Conclusion

Options trading in London offers a boundless realm of opportunities for astute traders. By embracing the power of options, traders can harness the potential for robust returns while managing risk strategically. Whether you’re a seasoned veteran or a curious novice, the allure of options trading in London beckons.

Options Trading London

Call to Action

Are you yearning to delve into the captivating world of options trading in London? Explore the resources available online, network with industry professionals, and seek mentorship to cultivate your trading acumen. The vibrant options market awaits your exploration and conquest.