In the fast-paced world of financial trading, options algo trading software has emerged as a powerful tool for traders seeking to enhance their efficiency and profitability. This article delves into the intricacies of options algo trading software, providing a comprehensive guide on its history, functionality, benefits, and strategies for successful implementation.

Image: www.angelone.in

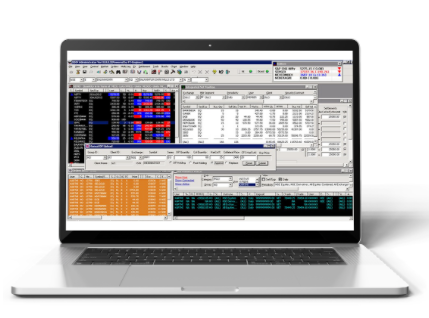

Options algo trading software, also known as options algorithmic trading software, is a computer program designed to automate the execution of options trades. Utilizing sophisticated algorithms, this software monitors market conditions in real-time, identifying and exploiting trading opportunities based on pre-defined trading strategies. By automating the trading process, traders can minimize emotional decision-making, optimize trade execution, and maximize returns.

Historical Evolution of Options Algo Trading Software

The roots of options algo trading software can be traced back to the early days of electronic trading in the 1980s. However, it was not until the 2000s that the widespread use and sophistication of this technology began to take shape. The technological advancements of the late 1990s and early 2000s, such as the advent of high-speed internet and the rise of online brokerages, paved the way for the proliferation of options algo trading software.

Initially, options algo trading software was primarily used by hedge funds and sophisticated institutional investors. However, with the increasing availability of user-friendly platforms and affordable pricing models, the accessibility of this technology has expanded to individual traders in recent years.

Basic Concepts and Functionality of Options Algo Trading Software

Options algo trading software operates on a set of predefined trading rules and algorithms. These rules typically incorporate technical indicators, mathematical models, and statistical analysis to identify trading opportunities and determine the optimal execution parameters.

The software monitors the market in real-time, analyzing vast amounts of data, including historical prices, volatility, market depth, and other relevant metrics. When a trading opportunity that meets the predefined criteria presents itself, the software automatically executes the trade in accordance with the specified parameters.

Benefits of Using Options Algo Trading Software

- Automation and Efficiency: Options algo trading software automates the trade execution process, allowing traders to focus on higher-level strategy development and market analysis.

- Speed and Precision: The software can execute trades in milliseconds, providing traders with a competitive advantage in capturing market movements.

- Objectivity and Discipline: By removing emotion from the trading process, options algo trading software helps traders adhere to their trading strategies with discipline and avoid impulsive decisions.

- Backtesting and Optimization: The software enables traders to backtest their strategies against historical data, refine parameters, and optimize performance.

- Risk Management: Options algo trading software can incorporate risk control measures, such as stop-loss orders and position sizing, to mitigate potential losses.

Image: www.adigitalblogger.com

Strategies for Successful Implementation of Options Algo Trading Software

While options algo trading software can be a valuable tool, successful implementation requires careful planning and execution. Here are some key strategies to consider:

- Understand Your Trading Objectives: Clearly define your trading goals, risk tolerance, and investment horizon before selecting a strategy.

- Select the Right Software: Choose a software platform that is reliable, user-friendly, and aligns with your trading style and objectives.

- Develop a Robust Strategy: Backtest your strategy thoroughly against historical data and refine it until you achieve satisfactory results.

- Monitor and Adjust: Regularly review the performance of your strategy and make adjustments as needed to adapt to changing market conditions.

- Manage Risk: Implement risk management measures and continuously monitor your positions to minimize potential losses.

Options Algo Trading Software

Conclusion

Options algo trading software has revolutionized the options trading landscape, providing traders with unprecedented levels of automation, efficiency, and potential profitability. By leveraging advanced algorithms and real-time market analysis, this software empowers traders to optimize trade execution, reduce risk, and achieve their trading goals. For those seeking to enhance their options trading performance, options algo trading software is a valuable tool to consider.