Introduction: Navigating the Options Trading Landscape

In the realm of financial trading, options offer a captivating mix of risk and reward, enabling traders to tap into the potential of price movements without the full commitment of buying or selling an underlying asset. However, selecting the right brokerage firm to facilitate your options trading endeavors can be a daunting task, especially for novice traders. This comprehensive guide will delve into the key factors to consider when choosing an options trading company, highlighting the advantages and disadvantages of each platform to help you make an informed decision that aligns with your trading style and objectives.

Image: www.youtube.com

Main Body:

1. Platform Functionality and Features

The cornerstone of a successful options trading experience lies in the functionality and features offered by the brokerage platform. Look for a platform that provides a user-friendly interface with intuitive navigation, real-time market data, and advanced charting capabilities. Advanced order types, such as conditional orders and multi-leg strategies, are essential for sophisticated traders seeking greater control over their trades.

2. Trading Costs: Commissions, Fees, and Margin Rates

Transaction costs can significantly impact your profitability. Compare the commissions charged for options contracts and consider any additional fees, such as per-contract fees or account maintenance fees. Margin rates for options trading can vary widely among brokers, so it’s crucial to choose a broker that offers competitive rates to maximize your leverage and trading efficiency.

Image: www.muc-con.org

3. Asset Selection and Market Depth

The range of options available for trading can influence your ability to find the optimal contracts for your strategies. Seek a brokerage firm that offers a wide selection of options contracts across diverse underlying assets, including stocks, indexes, commodities, and currencies. Market depth, or the number of open orders at various price levels, ensures that you can execute trades at favorable prices with minimal slippage.

4. Research Tools and Educational Resources

Access to comprehensive research tools and educational resources is invaluable for making informed trading decisions. Look for a broker that provides real-time stock analysis, options data, and proprietary research reports. Educational content, such as webinars, tutorials, and articles, can enhance your understanding of options trading and empower you to make better-informed choices.

5. Customer Service and Support

Exceptional customer service can make a profound difference in your trading experience. Opt for a brokerage firm with responsive and knowledgeable support staff available through multiple channels, including phone, email, and live chat. Prompt and helpful customer service ensures that your queries are addressed promptly, empowering you to navigate trading challenges with confidence.

6. Reputation and Track Record

Choosing a reputable broker with a proven track record is paramount for the safety and reliability of your trading operations. Conduct thorough research on potential brokerages, including their regulatory compliance, financial stability, and industry recognition. Positive customer reviews and a long-standing presence in the industry can serve as indicators of a trustworthy and dependable brokerage firm.

Who Is The Best Company To Use For Options Trading

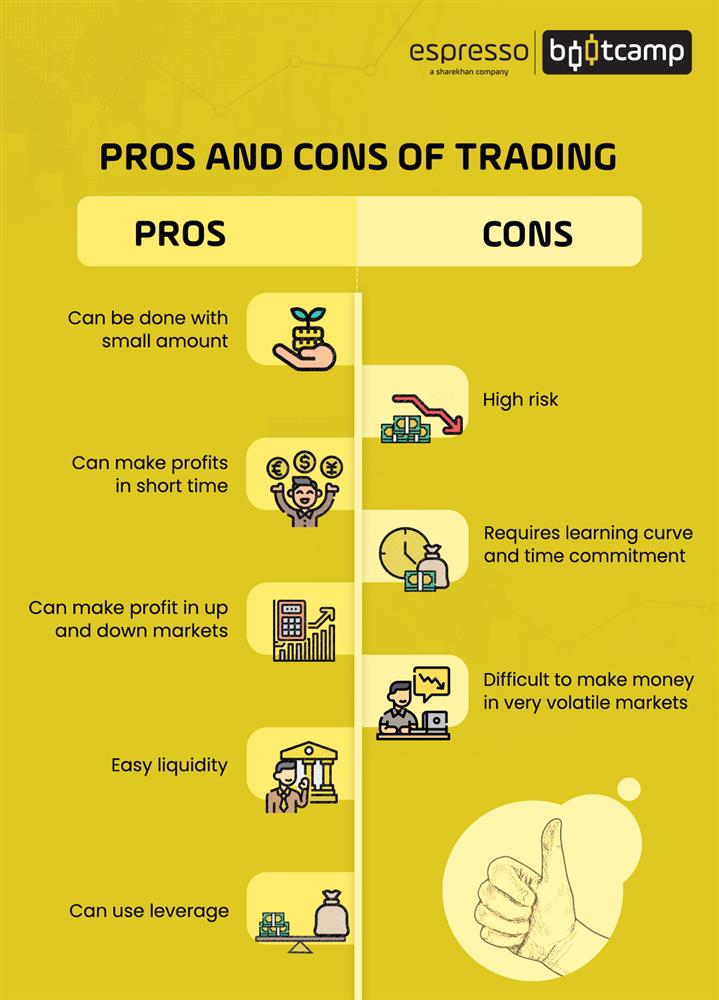

Image: www.myespresso.com

Conclusion: Embarking on a Successful Trading Journey

Choosing the right company for options trading requires a judicious consideration of platform functionality, costs, asset selection, research tools, customer service, and reputation. By carefully evaluating these factors and selecting a broker that aligns with your trading needs and expectations, you can embark on a successful options trading journey, harnessing the potential of this versatile financial instrument to achieve your investment goals.