Introduction

The world of trading offers an array of opportunities to profit from the rise or fall of different financial instruments. Among them, commodity options stand out as alluring prospects, offering investors the potential for substantial returns. But embarking on this trading journey requires careful preparation and an understanding of the optimal time to enter the game. In this comprehensive guide, we delve into the intricate details of commodity options trading and provide discerning insights into the ideal time to initiate your trading endeavors.

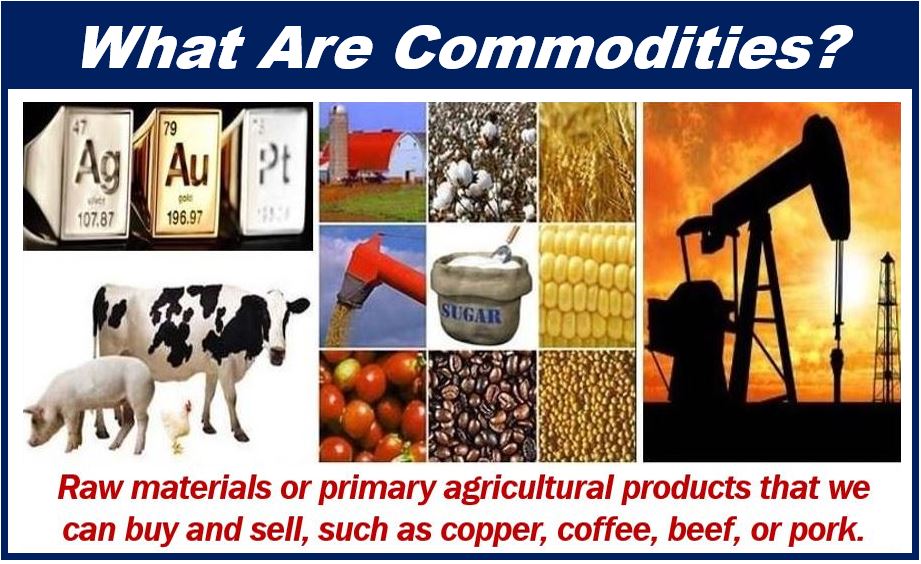

Image: marketbusinessnews.com

Emerging from the realm of financial derivatives, commodity options empower traders to capitalize on price fluctuations of underlying commodities, such as gold, oil, and wheat, without the burden of physical delivery. These contracts grant holders the right, but not the obligation, to buy (call option) or sell (put option) specified quantities of a particular commodity at a predetermined price on or before a specific date. Hence, they bestow the flexibility of profiting from favorable price movements while mitigating the risk of adverse outcomes.

Factors to Consider

Timing is paramount when it comes to commodity options trading. The ideal time to initiate trading is influenced by a confluence of factors that discerning traders must meticulously analyze to maximize their chances of success. These factors can be broadly categorized into three primary considerations:

1. Market Conditions

The prevailing market conditions set the stage for profitable trading opportunities. Seasoned traders keep a watchful eye on macroeconomic indicators, global events, and industry-specific news that collectively impact commodity prices. Bullish markets, characterized by rising prices and positive sentiment, tend to favor call options as traders anticipate further price appreciation. Conversely, bear markets, marked by declining prices and negative sentiment, offer suitable conditions for deploying put options to capitalize on falling prices.

2. Volatility

Volatility, a measure of price fluctuations, plays a crucial role in determining the timing of commodity options trades. Elevated volatility levels often accompany periods of heightened uncertainty and market turbulence, leading to wider price swings. This volatility provides fertile ground for options traders, as it amplifies the potential profits achievable from correctly predicting price direction. When the markets exhibit increased volatility, it may be an opportune time to consider trading commodity options.

Image: tradingstrategyguides.com

3. Seasonality

The influence of seasonality on commodity prices cannot be overlooked. Certain commodities exhibit predictable price patterns throughout the year due to factors such as harvest cycles, consumer demand fluctuations, and weather conditions. For instance, the price of agricultural commodities like corn and soybeans tends to rise during planting and harvesting seasons. Adept traders leverage this knowledge to time their trades strategically, aligning their options positions with seasonal price movements.

Suitability Assessment

Beyond external market conditions, aspiring commodity options traders must also conduct a thorough self-assessment to ensure their suitability for this demanding yet potentially lucrative endeavor. Several key attributes characterize successful options traders:

1. Knowledge and Understanding

Trading commodity options demands a solid foundation in financial markets, options concepts, and commodity dynamics. Aspiring traders should invest time in education and research to fully comprehend the intricacies of the trade.

2. Risk Tolerance

Options trading involves inherent risk, making it crucial for traders to possess an appropriate risk tolerance level. Thoroughly evaluate your financial situation, risk appetite, and emotional fortitude before venturing into this arena.

3. Discipline and Patience

Commodity options trading necessitates discipline and patience. Resist the allure of impulsive trades and adhere to a well-defined trading plan that aligns with your risk tolerance and market analysis.

When Start Commodity Option Trading

Image: delifyinvestments.com

Conclusion

Selecting the opportune moment to embark on commodity options trading encompasses a multifaceted approach. By meticulously monitoring market conditions, assessing volatility levels, considering seasonality, and conducting a thorough suitability self-assessment, you can enhance your chances of reaping the rewards of this dynamic trading avenue. Remember, knowledge, discipline, and a measured approach serve as the cornerstones of successful commodity options trading. Embrace these principles, and you will be well-equipped to navigate the complexities of this captivating market.