As the world’s largest commercial real estate company, Realty Income Corporation (NYSE: O) has been a popular investment for many years. The company’s strong track record, consistent dividend payments, and stability during uncertain times have made it attractive to both individual investors and institutional investors.

Image: www.youtube.com

In recent years, there has been growing interest in trading RUT options. These options offer a way to speculate on the price of Realty Income Corporation stock, as well as hedge against potential losses.

When Do RUT Options Stop Trading?

RUT options typically stop trading at 4:00 PM ET on the Friday before the third Saturday of the month. This is in line with the standard expiration schedule for all U.S. stock options.

However, there are some exceptions to this rule. For example, if the third Saturday of the month falls on a holiday, RUT options will expire on the next business day. Additionally, if the stock exchange is closed on the day that RUT options are scheduled to expire, the options will expire on the next business day.

What Happens When RUT Options Expire?

When RUT options expire, they are either exercised or expire worthless.

- If an option is exercised, the holder of the option will buy or sell the underlying stock at the strike price specified in the option contract.

- If an option expires worthless, the holder of the option will lose the entire premium that was paid for the option.

It is important to note that RUT options do not have to be exercised on the day that they expire. The holder of an option can choose to exercise the option at any time before it expires.

Trading RUT Options

Trading RUT options can be a profitable way to speculate on the price of Realty Income Corporation stock. However, it is important to understand the risks involved before you start trading options.

Here are a few tips for trading RUT options:

- Do your research. Before you start trading RUT options, it is important to do your research and understand the risks involved. This includes understanding the basics of options trading.

- Start small. When you first start trading RUT options, it is important to start small and build up your experience gradually.

- Use limit orders. When you place an order to buy or sell RUT options, it is important to use limit orders. This will help you to avoid paying more than you intended for the options.

- Monitor your trades. Once you have placed a trade, it is important to monitor it closely. This will help you to make sure that the trade is going in the direction that you expect.

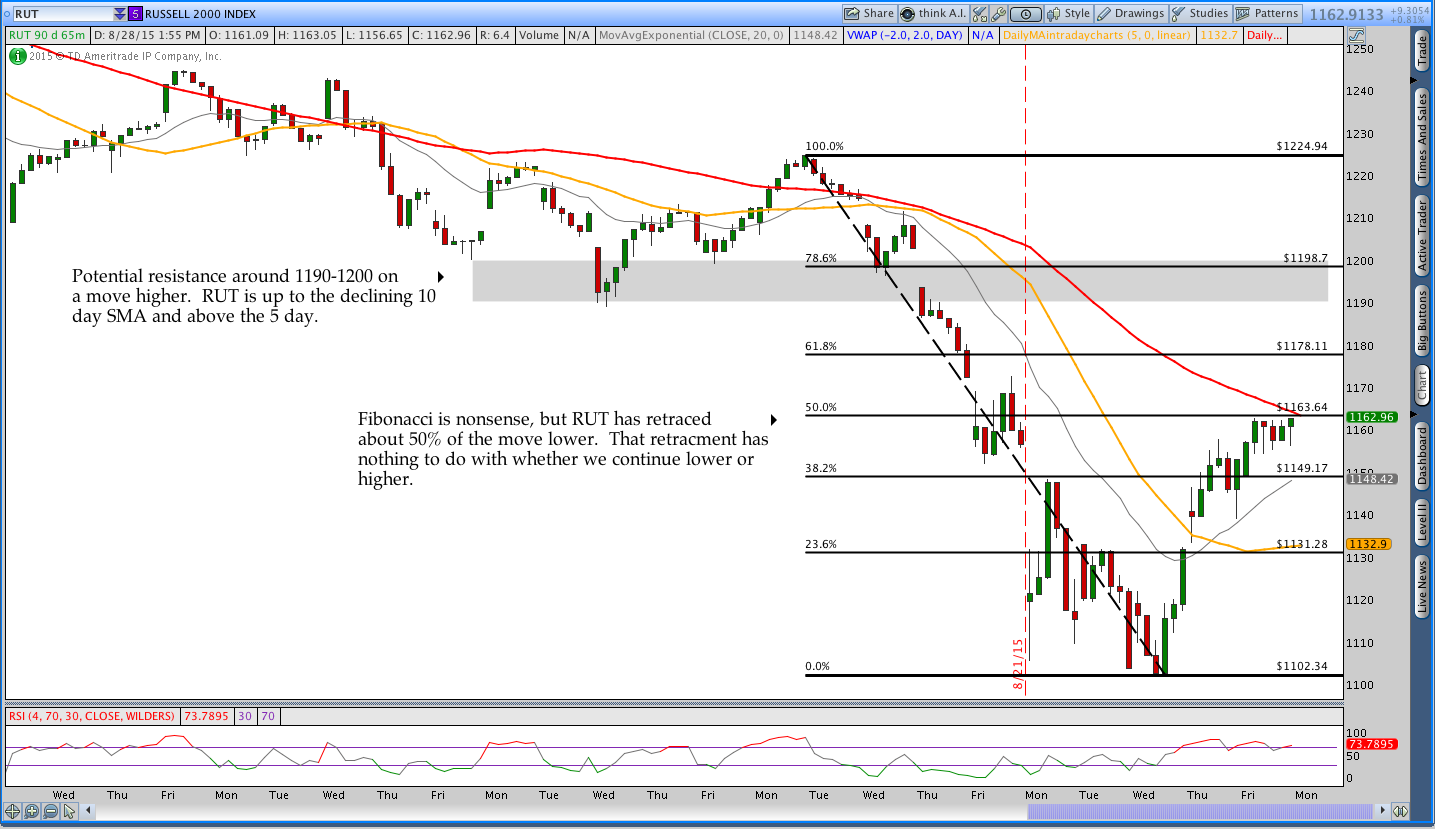

Image: www.thetatrend.com

Conclusion

RUT options can be a profitable way to speculate on the price of Realty Income Corporation stock. However, it is important to understand the risks involved before you start trading options. By following the tips above, you can start trading RUT options and potentially build a profitable portfolio.

Are you interested in learning more about trading RUT options? If so, you can find more information on the Realty Income Corporation website or by speaking with a financial advisor.

When Do Rut Options Stop Trading

Image: www.tradingview.com

FAQs on When RUT Options Stop Trading

Below are some frequently asked questions (FAQs) on when RUT options stop trading:

Q: When do RUT options typically stop trading?

A: RUT options typically stop trading at 4:00 PM ET on the Friday before the third Saturday of the month.

Q: Are there any exceptions to this rule?

A: Yes, there are some exceptions to this rule. For example, if the third Saturday of the month falls on a holiday, RUT options will expire on the next business day. Additionally, if the stock exchange is closed on the day that RUT options are scheduled to expire, the options will expire on the next business day.

Q: What happens when RUT options expire?

A: When RUT options expire, they are either exercised or expire worthless.

Q: Do RUT options have to be exercised on the day that they expire?

A: No, the holder of an option can choose to exercise the option at any time before it expires.