Introduction

Picture this: you decide to take the day off work to go for a hike, neglecting the urgent task of double-checking the date on your plane ticket to go on a pre-planned trip to Paris. To your dismay, upon arriving at the airport, you realize it’s the day after your scheduled flight. Imagine the intense disappointment and inconvenience you would experience due to such a silly oversight.

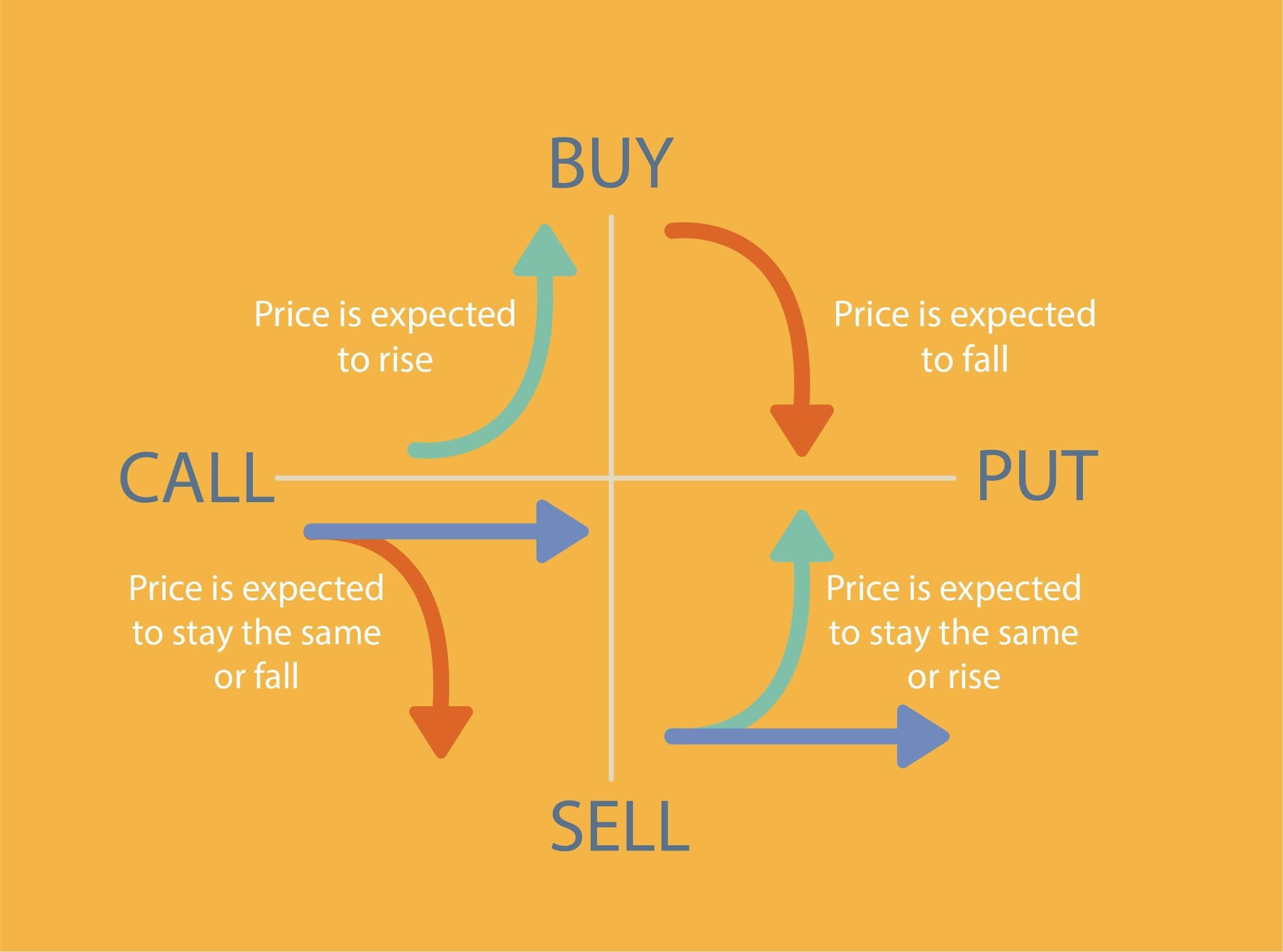

Image: optiontiger.in

In the world of options trading, there’s an equally agonizing consequence associated with overlooking a crucial element – time decay. This phenomenon can lead to substantial losses if not properly understood and managed. In this article, we’ll delve into everything you need to know about options time decay.

Unveiling the Nature of Time Decay

Time decay, also known as theta decay, refers to the gradual decline in the value of an option as time passes. This happens when there’s no change in other factors that influence the option’s price, such as the underlying asset’s price or implied volatility. Time decay occurs because as the expiration date of an option approaches, there’s a reduced amount of time to exercise or sell the option before it expires worthless.

Intrinsic Value VS Time Value

Options have both intrinsic value and time value. Intrinsic value represents the difference between the option’s strike price and the underlying asset’s current price. Time value, meanwhile, reflects the market perception of the potential for the option to reach its strike price before expiration. As the option nears its expiration, time value decays, while intrinsic value may remain relatively constant or fluctuate depending on underlying price movements.

Impact of Time Decay on Different Options

Time decay affects various types of options differently. Out-of-the-money (OTM) options, which have a strike price significantly different from the underlying asset’s price, experience rapid time decay. In-the-money (ITM) options, with strike prices below current market price, decay at a slower pace, particularly deep ITM options. At-the-money (ATM) options, hovering around the strike price, exhibit a balanced decay rate, falling between OTM and ITM options.

Factors Accelerating Time Decay

Several elements can exacerbate the impact of time decay on options:

- Time to Expiration: Closer to expiration, time decay intensifies.

- ATM Options: ATM options are the most susceptible to time decay.

- Low Volatility: Decreasing implied volatility increases decay since there’s a lower chance of the option reaching its strike price.

- Interest Rates: Higher rates translate into a reduced incentive to hold an option.

- Dividends: Dividends paid on the underlying can accelerate decay in certain situations.

Image: www.markettradersdaily.com

Managing the Impact of Time Decay

Understanding time decay is essential for successful options trading. Traders can strategize around this phenomenon to minimize its impact:

- Avoid OTM Options Near Expiration: These options decay rapidly and may lead to significant losses.

- Consider Leaps (Long-Term Options): Leaps have a longer-term horizon, reducing the effects of time decay.

- Monitor Decay Rate: Use a decay or theta calculator to estimate how much decay an option is likely to experience.

- Hedge Against Decay: Employ strategies like buying deep ITM call options or selling back-month call options to mitigate decay.

- Sell Options: Selling options can generate time value decay and lead to profits if held until expiration.

What Is Time Decay In Options Trading

Image: www.merrilledge.com

Conclusion

Time decay is a fundamental aspect of options trading that can significantly affect profitability. By comprehending its effects, traders can make informed decisions, employ protective strategies, and potentially reap the benefits of time value decay. Are you intrigued by this fascinating topic and eager to gain further insights? Explore the vast resources available on options trading and delve into the intricacies of the financial markets.