In the realm of financial markets, options trading presents savvy investors with an indispensable tool to manage risk and enhance returns. Among the diverse options strategies, put options hold a pivotal position, empowering traders with the potential to profit from market downtrends. Understanding the intricacies of put option trading is fundamental to navigating this complex yet rewarding arena.

Image: tradewithmarketmoves.com

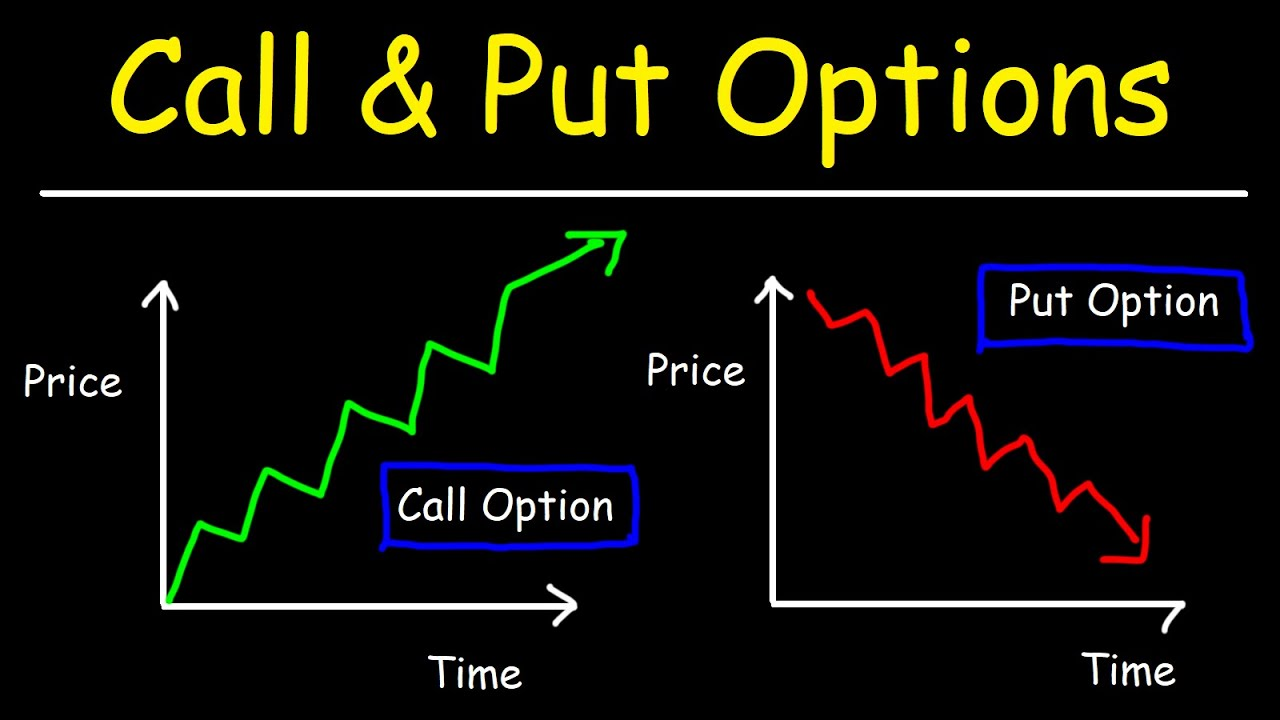

A put option, in essence, grants the holder the right, but not the obligation, to sell a specific number of shares of an underlying asset at a predetermined price, known as the strike price, before or on a specified expiration date. By entering into a put option contract, an investor gains the flexibility to capitalize on falling asset prices, protecting themselves against potential losses inherent in market volatility.

Delving into the Mechanics of Put Option Trading

Visualize the scenario where a trader anticipates a decline in the stock price of Company XYZ. They could purchase a put option contract that bestows upon them the right to sell 100 shares of XYZ stock at a strike price of $50 per share, expiring in one month. If the XYZ stock price indeed plummets to $45 per share, the trader can exercise their put option, obliging the counterparty to buy the stock at the predetermined strike price of $50. This transaction effectively allows the trader to sell their XYZ shares at a higher price than the prevailing market value, capturing the difference as their profit.

Unveiling the Key Concepts

To fully grasp the intricacies of put option trading, let’s dissect some fundamental concepts:

-

Premium: The premium is the price paid by the put option buyer to acquire the contract, representing the market’s assessment of the option’s value. The premium comprises two primary components: intrinsic value and time value.

-

Intrinsic Value: This facet of the premium measures the immediate potential profit that a put option holder stands to gain. Intrinsic value exists only when the underlying asset’s price trades below the put option’s strike price.

-

Time Value: Time value, on the other hand, embodies the speculative component of the put option premium, reflecting the remaining time until its expiration. Time value is predominant during the initial phase of an option’s life and wanes as the expiration date draws near.

Identifying Real-World Applications

Put options are a versatile tool that finds diverse applications in the financial markets, including:

-

Hedging Risk: Put options serve as an effective hedge against the risk of declining asset prices. Investors holding long positions in stocks or other assets can utilize put options to mitigate potential losses in the event of an unfavorable market turn.

-

Generating Income: Option traders can generate income by selling or writing put options. By receiving premiums from the option buyers, these sellers assume the obligation to buy the underlying asset at the strike price if exercised.

-

Speculating on Market Downtrends: Put options empower traders to speculate on anticipated downturns in the price of specific assets. By correctly predicting price declines, traders can profit handsomely from the resulting drop in the underlying asset’s value.

-

Income Enhancement: Option strategies incorporating both put options and call options, such as covered calls, can enhance the income-generating potential of an existing investment portfolio.

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

Image: keysgame.pl

What Is Put Option Trading

Image: www.projectfinance.com

Navigating the Landscape of Put Options

To successfully navigate the put option trading landscape, aspiring traders should adhere to a few essential guidelines:

- **Conduct Thor