Imagine yourself in the bustling financial district, surrounded by traders making split-second decisions that could potentially yield millions. As an aspiring trader, you may be intrigued by the allure of future and option trading, two popular yet intricate strategies that can amplify profits or magnify losses with equal intensity.

Image: www.hindustantimes.com

To navigate this complex realm effectively, it’s imperative to equip yourself with a comprehensive understanding of future and option trading. This definitive guide will unravel their intricacies, providing you with the knowledge and insights necessary to embark on this lucrative but challenging path.

**Understanding Future and Option Trading**

Definition:

- **Futures:** Contracts that obligate the buyer (or seller) to purchase (or sell) a specified amount of an underlying asset (e.g., stocks, commodities) at a pre-agreed price and a future date.

- **Options:** Contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a specified strike price before a specified expiration date.

History:

Future contracts have been around for centuries, with their origins traced back to ancient Greece. Modern futures markets originated in the early 19th century in the United States, while options trading became prevalent in the late 19th century.

Meaning:

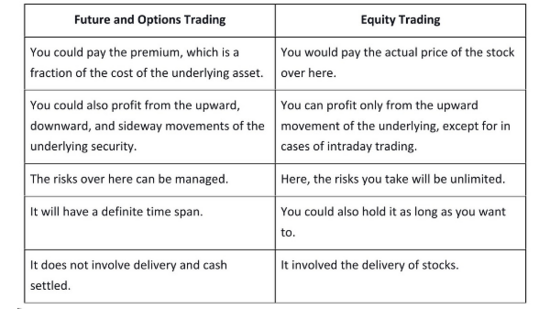

Future and option trading play a crucial role in modern financial markets. They enable investors to manage risk, speculate on future price movements, and leverage their gains. Futures are often used for hedging, while options offer traders flexibility and a variety of strategies to suit different market conditions.

**Benefits and Risks of Future and Option Trading**

Benefits:

- Amplified Profits: Futures and options have the potential to generate substantial gains, especially in volatile markets.

- Risk Management: They can be used to hedge against market risks and protect against losses.

- Flexibility: Options offer traders a wide range of strategies to tailor their investments to their goals.

Risks:

- High Losses: Futures and options can result in significant losses if not traded prudently.

- Complex Strategies: They involve advanced trading techniques that require a deep understanding to execute effectively.

- Market Volatility: Price fluctuations can impact the value of futures and options contracts, increasing the risk of losses.

**Tips for Successful Future and Option Trading**

Expert Advice:

- Understand the Market: Conduct thorough research and analyze market trends before making any trades.

- Choose Appropriate Strategies: Match your trading strategies to your risk tolerance and financial goals.

- Manage Risk: Use stop-loss orders and other risk-management tools to limit potential losses.

Explanation:

Understanding the market dynamics is essential. Monitor economic and industry news, analyze charts and technical indicators to make informed trading decisions. Selecting the right strategies for your risk appetite is crucial. Start with basic strategies and gradually progress to more complex ones as your experience grows.

Effective risk management is paramount. Stop-loss orders automatically close your positions if the price reaches a certain level, preventing excessive losses. Position sizing is also important; avoid putting too much capital at risk on any single trade.

Image: www.pinterest.com

**FAQ on Future and Option Trading**

Q: What is the difference between a futures contract and an option contract?

A: Futures contracts obligate both parties to buy or sell the underlying asset at a future date, while options give the buyer the right, but not the obligation, to do so before an expiration date.

Q: What are the key elements of a futures or option contract?

A: Underlying asset, contract size, strike price, expiration date, and premium (for options).

Q: Is future and option trading suitable for beginners?

A: While these strategies offer high potential returns, they are complex and not recommended for traders without a solid understanding of financial markets and proper risk management.

What Is Future And Option Trading Wiki

Image: www.quora.com

**Conclusion**

Embarking on future and option trading requires a blend of knowledge, skill, and prudence. By mastering the concepts, adopting effective strategies, and managing risk diligently, you can harness their power to enhance your financial gains.

Are you ready to delve deeper into the thrilling world of future and option trading? Leverage this guide as your compass, and let your journey yield bountiful returns!