Understanding the Connection Between Insider Trading and Option Execution

Image: capitalflow.info

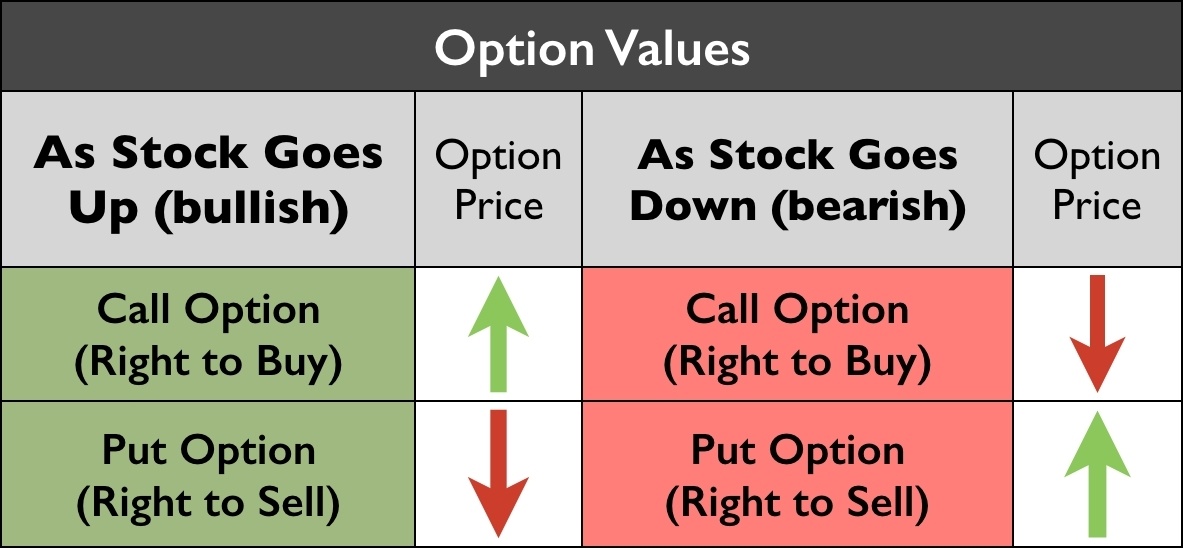

Insider trading, the illicit use of confidential information to profit from stock or option trades, is a serious offense that undermines the integrity of financial markets. Among the many ways insider trading can manifest, one significant aspect is the execution of options. Options, derivative contracts granting the holder the right (though not the obligation) to buy or sell an underlying asset at a specified price on or before a particular date, play a crucial role in certain insider trading schemes.

Options as Leverage for Insider Knowledge

Individuals with access to non-public, market-moving information often seek to capitalize on this advantage by purchasing or selling options. By doing so, they can amplify their potential gains while limiting their risk. For instance, if an insider knows that a company is about to announce a major acquisition, they may buy call options on the company’s stock, which will allow them to buy the stock at a fixed price in the future. After the announcement, the stock price typically rises, enabling the insider to exercise the option and profit handsomely.

Types of Insider Trading Options

Insider trading involving options can take various forms. One common approach is “front running,” where insiders trade ahead of a company’s material announcement, knowing that the information will significantly impact the stock price. Another tactic is “parking,” where insiders accumulate options before a known event, anticipating a price surge after the announcement. Finally, “scalping” involves rapidly buying and selling options to capture short-term price fluctuations based on insider information.

Legal Consequences of Insider Trading with Options

Insider trading is a federal crime with severe penalties. The Securities and Exchange Commission (SEC) vigorously investigates and prosecutes individuals involved in insider trading schemes. The consequences can include hefty fines, imprisonment, and the disgorgement of illegal profits. The SEC also imposes civil penalties on companies and individuals who fail to prevent or report insider trading.

Case Study: Martha Stewart and ImClone Systems

One of the most infamous insider trading cases involving options is the Martha Stewart incident in 2001. Stewart, the founder of Martha Stewart Living Omnimedia, sold 3,928 shares of ImClone Systems stock based on a tip from her stockbroker. The tip came just before the company announced disappointing clinical trial results, causing the stock price to plummet. Stewart was convicted of insider trading and sentenced to five months in prison.

Protecting Against Insider Trading

To safeguard the integrity of financial markets, it is crucial to prevent and detect insider trading. This involves:

- Establishing clear regulations and enforcing strict penalties.

- Enhancing corporate governance practices to prevent the misuse of confidential information.

- Encouraging whistleblowers to report suspicious activity.

- Promoting transparency and accountability in financial reporting.

Conclusion: The Damaging Impact of Insider Trading

Insider trading undermines the fairness and efficiency of financial markets, eroding the public’s trust in the system. By manipulating options based on confidential information, individuals profit at the expense of other investors. The SEC and other regulatory bodies continue to play a vital role in combating this illicit practice, ensuring that markets remain fair and free from unlawful activities.

Image: tradesmartu.com

What Does Option Execute Mean In Insider Trading

Image: www.angelone.in