Introduction

In the fast-paced world of finance, engaging in weekly options trading strategies can be a lucrative and thrilling endeavor. By leveraging the expertise of market wizard Bruce Siefert, traders can unravel the nuances of this specialized trading practice and harness its potential for exceptional returns. This guide will delve into the intricacies of weekly options trading, employing Siefert’s insights and techniques to empower traders with a comprehensive understanding of this dynamic market.

Image: stockscreenertips.com

Weekly options provide unique advantages within the options trading arena. Their shorter lifespans, expiring on Fridays of each week, grant traders flexibility to capitalize on market movements in a more immediate time frame. Moreover, the liquidity and volume associated with weekly options render them highly accessible instruments for traders seeking rapid execution.

Decoding Siefert’s Trading Techniques

Bruce Siefert, a seasoned market strategist, has dedicated years to deciphering the intricacies of options trading and has generously shared his expertise to elevate aspiring traders. His core principles revolve around managing risk, maintaining a disciplined approach, and seizing opportunities presented by market fluctuations. Siefert advocates for meticulous analysis, emphasizing the significance of technical indicators and market sentiment in identifying profitable trading setups.

Siefert’s Candle Reversal Patterns

Siefert’s trading strategies often hinge on recognizing candlestick reversal patterns, which signal a potential shift in market trend. These patterns, such as the bullish engulfing pattern or the bearish harami cross, provide valuable cues for traders to enter or exit positions at optimal moments. By studying historical price action and identifying these patterns, traders can anticipate upcoming market reversals and position themselves accordingly.

Options Chain Analysis

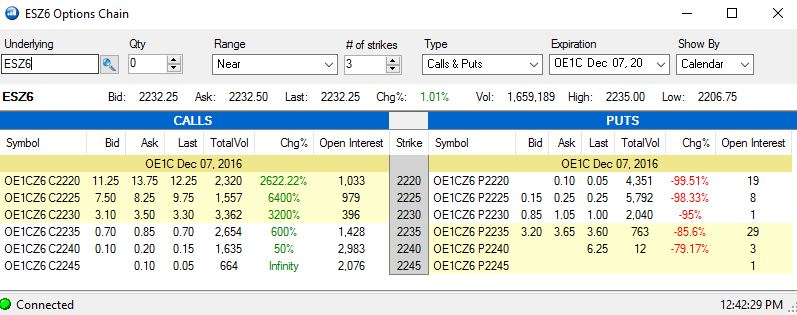

Siefert places great emphasis on thorough analysis of options chains, deeming it pivotal in identifying mispriced opportunities. By scrutinizing the premiums, Greeks, and implied volatility associated with options at various strike prices and expiration dates, traders can uncover inefficiencies in the market. Siefert believes that exploiting these inefficiencies can lead to profitable trades with favorable risk-reward profiles.

Image: www.goodreads.com

Navigating Market Sentiment and Volatility

Weekly options trading requires traders to develop an astute understanding of prevailing market sentiment and anticipated volatility levels. Siefert underscores the importance of gauging market sentiment, whether bullish or bearish, to align trading strategies accordingly. One effective approach involves monitoring news flow, investor sentiment indicators, and social media sentiment analysis to gauge the collective market psychology.

Furthermore, Siefert stresses the significance of anticipating future volatility levels, as they have a direct bearing on options premiums. By tracking historical volatility data, implied volatility, and market events likely to impact volatility, traders can make informed decisions regarding option strike prices and expiration dates, optimizing their profit potential.

Strategies for Enhanced Returns

Siefert advocates for a methodical and risk-conscious approach to weekly options trading. He recommends implementing strategies with well-defined entry and exit points, predetermined risk parameters, and profit targets. Some strategies that align with Siefert’s principles include:

Call Spreads for Bullish Outlook

Bullish traders can employ call spreads, involving the simultaneous purchase of a lower-strike call option and sale of a higher-strike call option with the same expiration date. This strategy benefits from limited risk and the potential for substantial profits if the underlying asset’s price surges.

Put Spreads for Bearish Outlook

In anticipation of a market decline, traders can opt for put spreads, which entail purchasing a higher-strike put option and selling a lower-strike put option with the same expiration date. This strategy offers controlled risk and the potential for gains in scenarios where the underlying asset’s price falls.

Iron Condors for Neutral Outlook

For traders anticipating a range-bound market, iron condors involve selling both a call spread and a put spread with different strike prices but the same expiration date. This neutral strategy generates income from option premiums and benefits from a stable underlying asset price.

Weekly Options Trading Siefert

Image: algorithmictrading.net

Conclusion

Weekly options trading, guided by the wisdom of Bruce Siefert, empowers traders with an array of opportunities to capitalize on market movements within a shorter time frame. By embracing a disciplined approach, mastering candlestick reversal patterns, and diligently analyzing options chains, traders can navigate market sentiment and volatility to optimize their trading strategies. Siefert’s insights have played an instrumental role in shaping the landscape of weekly options trading, and his unwavering focus on risk management and seizing market inefficiencies has proven invaluable for aspiring traders seeking consistent success.

Embarking on the journey of weekly options trading may seem daunting, but with perseverance, education, and the guidance of experienced market strategists like Siefert, traders can unlock the potential for exceptional returns while managing risk prudently. As you delve deeper into this dynamic trading realm, remember to conduct thorough research, embrace continuous learning, and refine your strategies to align with the ever-evolving market dynamics.