Unveiling the Gateway to Active Trading Opportunities

In the fast-paced world of financial markets, option trading offers investors a unique avenue to harness the power of volatility and market movements. Among the various option trading strategies, weekly options have emerged as a popular choice for active traders due to their short duration and flexibility. This comprehensive guide will delve into the intricacies of weekly options trading on Trading.com, providing an in-depth understanding of its mechanisms, advantages, and potential pitfalls.

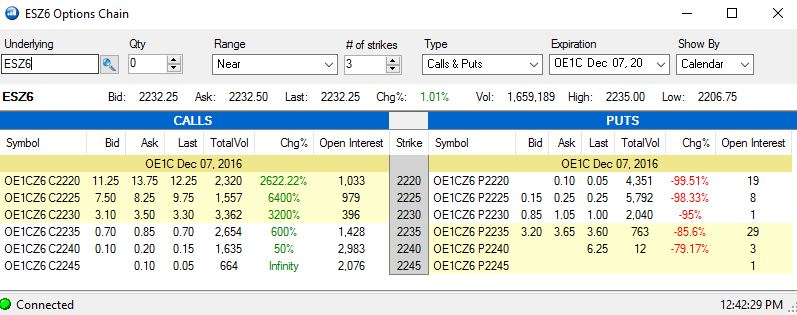

Image: algorithmictrading.net

Weekly Options: A Time-Sensitive Instrument

Weekly options, as opposed to monthly or quarterly options, have a shorter lifespan of one week from the date of issue to their expiration. This ephemeral nature makes them an ideal instrument for capturing short-term market movements and swiftly adapting to rapidly evolving market conditions.

Understanding the Benefits

Weekly options trading presents numerous advantages to active traders:

- Increased Flexibility: The short duration of weekly options allows traders to adjust their positions frequently, responding to market changes with greater agility.

- Reduced Risk: Time decay plays a more significant role in weekly options, resulting in a reduction in overall risk compared to longer-term options contracts.

- Profitability Potential: Weekly options’ shorter lifespan creates more frequent opportunities for traders to capitalize on market volatility and generate profits.

- Lower Margin Requirements: The smaller notional value of weekly options typically translates to lower margin requirements, making them more accessible to traders with limited capital.

Deciphering the Strategies

Weekly options trading on Trading.com encompasses a wide range of strategies tailored to different market conditions and trader preferences. Here are some of the most frequently employed tactics:

- Scalping: This strategy involves entering and exiting trades within seconds or minutes, utilizing the bid-ask spread to generate modest but frequent profits.

- Day Trading: Day traders open and close positions within a single trading day, capitalizing on intraday price fluctuations.

- Credit Spreads: These strategies involve selling options at higher prices than purchasing them, creating a credit position with limited profit potential but reduced risk.

- Iron Condor: A neutral strategy combining both bull and bear spreads, iron condors profit from a narrow market range and decay in volatility.

Image: www.pinterest.co.uk

Tips and Expert Advice

Harnessing the full potential of weekly options trading requires a combination of technical proficiency and strategic acumen. Here are some expert tips to enhance your trading journey:

- Master Technical Analysis: Develop a strong understanding of technical indicators and chart patterns to gain insights into price movements and identify potential trading opportunities.

- Control Your Emotions: Discipline and emotional control are crucial in managing risk and making sound trading decisions.

- Manage Your Risk: Always define your risk tolerance, using stop-loss orders to limit potential losses and employing risk management strategies to protect your capital.

- Seek Education and Practice: Continuously improve your knowledge and skills through trading webinars, books, and practical experience on a demo account.

Frequently Asked Questions

Q: What are the main differences between weekly and monthly options?

A: Weekly options have a shorter lifespan of one week, while monthly options typically expire on the third Friday of each month. This difference in duration impacts risk, flexibility, and profit potential.

Q: What is the best strategy for weekly options trading?

A: The optimal strategy depends on your risk tolerance, trading style, and market conditions. Scalping, day trading, credit spreads, and iron condors are all effective strategies commonly employed in weekly options trading.

Q: Is weekly options trading suitable for all traders?

A: Weekly options trading can be suitable for active traders with a strong understanding of options and a high level of risk tolerance. Beginners should approach this trading style with caution and consider starting with a demo account.

Weekly Option Trading.Com

Image: www.youtube.com

Conclusion

Weekly options trading on Trading.com offers a dynamic trading environment with the potential for significant profits. By leveraging the insights provided in this comprehensive guide, traders can effectively navigate the unique aspects of weekly options and develop a personalized trading strategy that aligns with their goals and preferences.

Are you ready to explore the realm of weekly options trading and uncover its transformative potential? Embark on this exciting journey today and empower your trading with the knowledge and strategies shared in this article!