Introduction

The captivating world of options trading has captivated investors for ages, offering a thrilling blend of potential gains and inherent risks. With the advent of accessible platforms like Webull, navigating this realm has become more accessible than ever before. In this comprehensive guide, we delve into the intricacies of Webull options trading, empowering you with the knowledge to harness its potential.

Image: derivbinary.com

Options, in essence, are contracts that grant the holder the right, not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. The unique aspect of options lies in their flexibility, allowing you to tailor strategies that align with your investment goals, whether speculating on price movements, hedging against market volatility, or generating income.

Understanding Webull Options Trading Requirements

Just like any endeavor, participating in options trading on Webull necessitates meeting certain requirements. These prerequisites are designed to ensure a trader’s understanding of the complex nature of options and their inherent risks.

To qualify for options trading privileges on Webull, individuals must possess a margin account with a balance of at least $2,000. Additionally, they must complete and pass the Options Trading Knowledge Assessment, demonstrating a grasp of options terminology, trading strategies, and risk management practices.

Steps Involved in Webull Options Trading

Empowered with an approved margin account and a passing knowledge assessment, traders can embark on the journey of Webull options trading. The process unfolds seamlessly:

- Select the underlying asset: Begin by identifying the stock, ETF, or other asset you wish to trade options on.

- Determine the option type: Choose between call options (granting the right to buy) or put options (granting the right to sell).

- Specify the strike price: This represents the predetermined price at which you can exercise the option.

- Select the expiration date: Determine the time frame within which you can exercise or sell the option.

- Place the trade: Enter the order specifying the quantity and price of the options contract.

Expert Advice and Tips for Successful Webull Options Trading

Navigating the intricacies of options trading demands a combination of knowledge, experience, and strategy. To enhance your chances of success, consider the following expert tips:

- Educate Yourself Continuously: Delve into the intricacies of options strategies, risk management techniques, and market trends to gain a comprehensive understanding.

- Start Small: Begin with modest trades and gradually increase your position size as your knowledge and confidence grow.

- Manage Risk Effectively: Employ risk-limiting strategies such as stop-loss orders and position sizing to protect your capital.

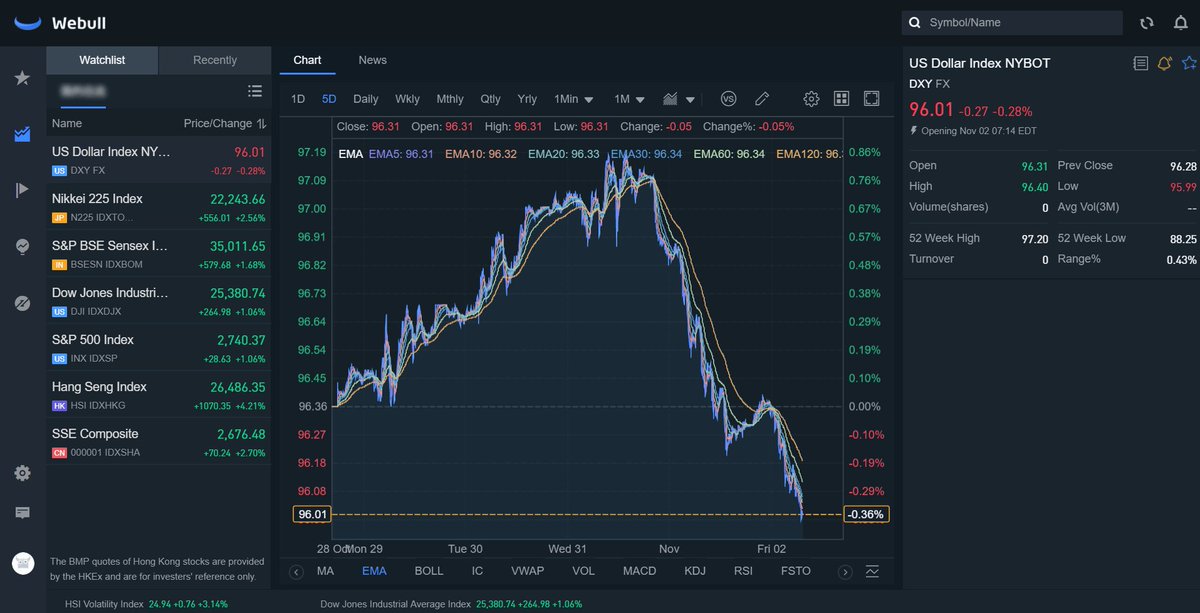

- Utilize Technical Analysis: Incorporate technical indicators and chart patterns to identify potential trading opportunities and assess market trends.

- Stay Informed: Monitor market news, earnings reports, and economic data that can influence the underlying asset’s price.

Image: ruangmenggambar469.blogspot.com

Frequently Asked Questions (FAQs) on Webull Options Trading

To address common queries surrounding Webull options trading, we present a comprehensive FAQ section:

- Q: What are the fees associated with Webull options trading?

A: Webull charges $0.50 per contract for most options trades, with a minimum fee of $1 per trade.

- Q: How do I evaluate the potential profit/loss of an options trade?

A: Utilize an options profit/loss calculator or refer to option pricing models to assess the potential outcomes based on various market scenarios.

- Q: What happens if I don’t exercise an options contract before expiration?

A: Unexercised options contracts expire worthless, resulting in the loss of the premium paid.

Webull Options Trading Requirements

Image: www.youtube.com

Conclusion

Webull options trading offers a dynamic arena for investors seeking to enhance their portfolio returns or hedge against market volatility. By adhering to the platform’s requirements, understanding the trading process, and incorporating expert advice, you can unlock the potential of this multifaceted financial instrument. As always, it is crucial to conduct thorough research, manage risk prudently, and embrace continuous learning to maximize your success in the captivating realm of options trading.

Are you intrigued by the possibilities of Webull options trading? Share your thoughts and experiences in the comments below.