Introduction

Are you curious about using a credit card for option trading? It’s a strategy that can be employed to magnify potential profits, but it also comes with substantial risks. Before diving into the intricacies of this technique, it’s crucial to understand its underlying principles and potential pitfalls.

Image: www.youtube.com

Understanding Option Trading

Option trading involves speculating on the future price of an asset, such as a stock, without actually owning it. Traders can speculate using two primary types of options: calls and puts. A call option conveys the right to buy an asset at a specific strike price, while a put option provides the right to sell an asset at a specific strike price. Options are available with various expiration dates, and each contract represents 100 shares of the underlying asset.

Leverage in Option Trading

One advantage of option trading is its ability to enhance leverage. This means traders can potentially control a significant position with a relatively small investment, thereby magnifying potential gains. However, this leverage also magnifies potential losses. If the underlying asset’s price doesn’t move as anticipated, traders may lose their entire investment promptly.

Using a Credit Card for Option Trading

Using a credit card for option trading can be tempting as it provides access to funds beyond one’s cash balance. However, it’s essential to remember that credit card debt can accrue substantial interest charges. This can significantly reduce any profits earned from option trading.

Image: support.cloudally.com

Risks and Considerations

Before using a credit card for option trading, carefully consider the following risks:

- High Trading Costs: Option trading fees and commissions can eat into your profits.

- Margin Calls: If the underlying asset’s price moves against your position, you may receive a margin call requiring you to deposit more funds to cover potential losses.

- Volatility Impacts: Option premiums fluctuate based on underlying asset volatility. Increased volatility can magnify potential losses rapidly.

- Time Decay: Time decay erodes the value of options as they approach their expiration date. This can lead to losses if the underlying asset’s price doesn’t move as anticipated within the option’s lifetime.

Tips and Expert Advice

If you’re contemplating using a credit card for option trading, consider the following advice from experienced traders:

- Trade with Discretion: Only trade with funds you can afford to lose and only speculate on assets you thoroughly research.

- Manage Risk: Implement proper risk management strategies such as stop-loss orders and maintaining a sensible trading plan.

- Avoid Overtrading: Option trading can be addictive. Avoid the temptation to trade too frequently, as excessive trading increases the likelihood of losses.

- Seek Professional Guidance: If you’re new to option trading or lack experience in managing leverage, consulting with a financial advisor or working with a regulated broker can provide valuable guidance and support.

FAQ

- Is it legal to use a credit card for option trading? Yes, it’s legal, but your brokerage firm may have restrictions or limitations.

- Is it advisable to use a credit card for option trading? It’s not recommended due to the inherent risks and high interest charges.

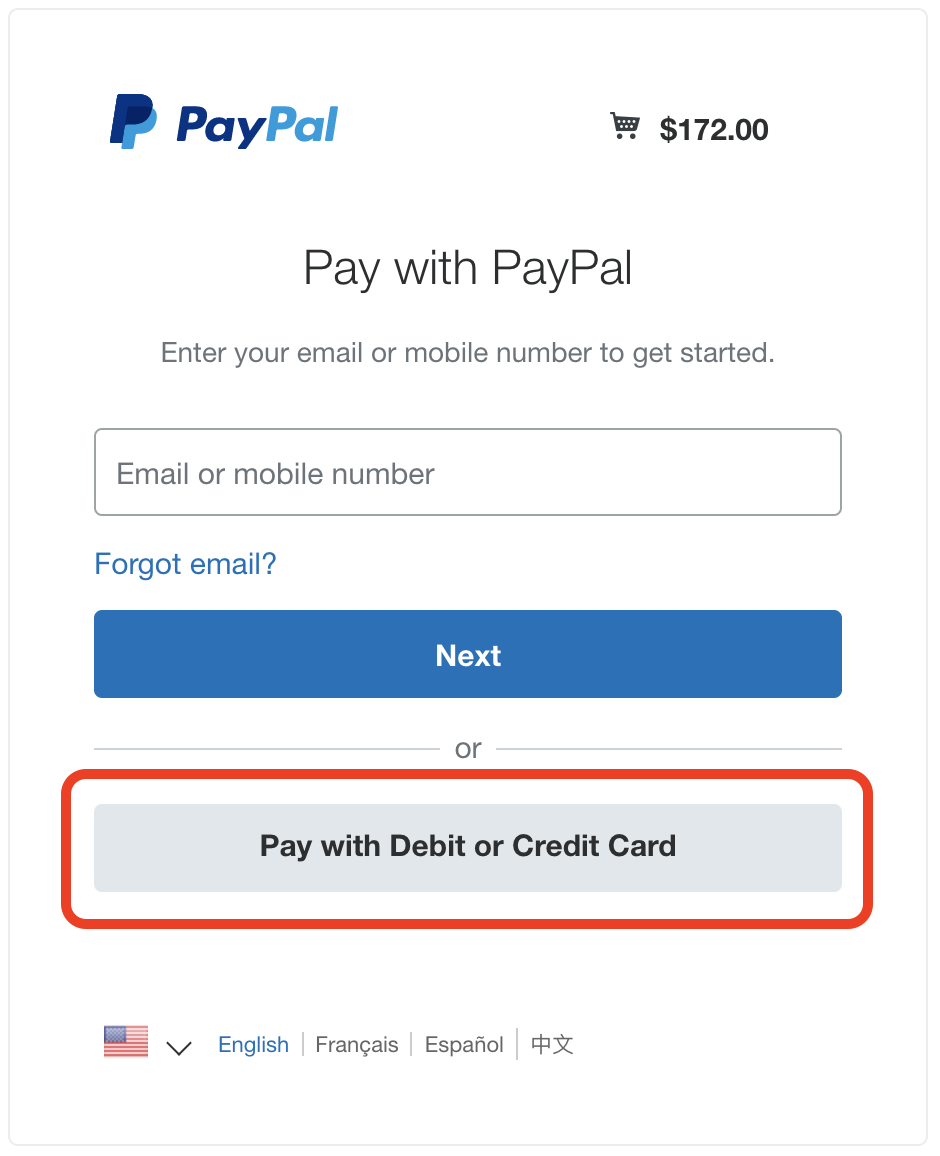

- What alternatives to credit cards can I use? You can consider a margin account, specialized options trading platforms, or a personal loan.

- What are the benefits of option trading? Potential for high returns, leverage, and flexibility.

- What are the drawbacks of option trading? High risks, complex strategies, and potential for significant losses.

Using A Credit Card For Option Trading

Image: www.dreamstime.com

Conclusion

Using a credit card for option trading can be a double-edged sword. While it offers the potential for enhanced leverage and profits, it also magnifies risks and increases the likelihood of substantial losses. If you consider using this strategy, proceed with caution, conduct thorough research, and always prioritize risk management.

Are you contemplating using a credit card for option trading? Join the discussion and share your thoughts or experiences in the comments section below.