**Unveiling the Secrets of Unusual Options Activity**

The world of stock market investing is filled with intricate nuances and hidden indicators that can influence market trends and stock prices. One such indicator that has garnered significant attention in recent years is unusual options activity. Options, financial instruments that provide the right but not the obligation to purchase or sell a security at a set price on a specified date, have become a battleground for sophisticated investors and those seeking an edge in the market.

Image: mastersintrading.com

Unusual options activity refers to a sudden surge in trading volume or open interest in options contracts for a specific underlying security. This activity often deviates significantly from historical patterns or expected market behavior, raising questions about potential insider information or manipulative practices.

**The Dark Side: Insider Trading and Market Manipulation**

While unusual options activity can sometimes be attributed to legitimate market forces or changes in investor sentiment, it can also be a red flag for insider trading or market manipulation. Insider trading involves the illegal trading of a security by someone who has access to material nonpublic information about the company.

In the case of options, insider traders may use their knowledge of upcoming events or company announcements to purchase or sell options that will benefit from the expected price movement. This activity can distort market prices and provide unfair advantages to those with access to nonpublic information.

**Monitoring and Prevention of Insider Trading**

Recognizing the potential for market manipulation, regulatory agencies worldwide, such as the Securities and Exchange Commission (SEC) in the United States, have implemented strict laws and regulations to combat insider trading. These include monitoring trading activity, conducting investigations, and imposing severe penalties for violations.

Exchanges and clearinghouses also play a crucial role in detecting and preventing insider trading by analyzing trading data, identifying unusual patterns, and reporting suspicious behavior to regulatory authorities. Technological advancements in data analytics and surveillance systems have further enhanced the ability to identify potential illegal activity.

**Tips and Expert Advice for Investors**

Being aware of unusual options activity can be a valuable tool for investors, especially those who trade in options. By understanding the potential implications and taking appropriate precautions, investors can protect themselves from potential risks and identify opportunities that may be based on legitimate market forces.

One recommendation is to thoroughly research any unusual options activity before making investment decisions. Consider the underlying security’s fundamentals, the historical context for options trading in that security, and any recent news or events that may have triggered market movement. Seeking professional financial advice can also provide valuable insights and help investors navigate the complex world of options trading.

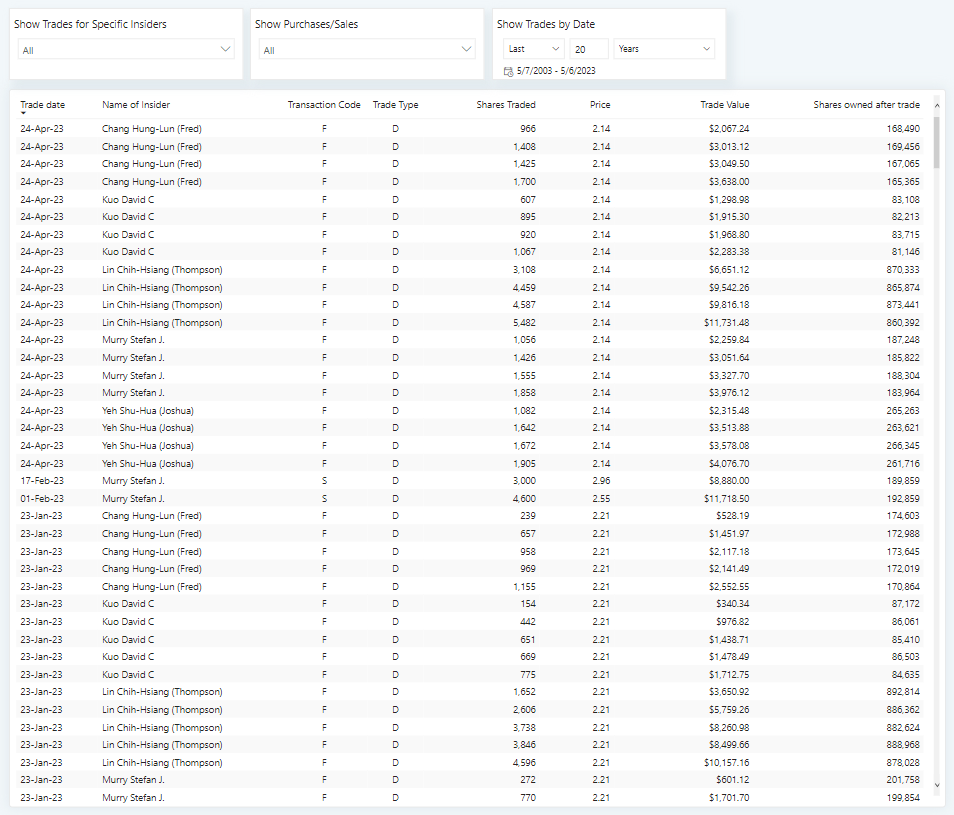

Image: businessquant.com

**Frequently Asked Questions (FAQs)**

- What is the significance of unusual options activity?

Unusual options activity can be a sign of pending market events, insider trading, or market manipulation. It warrants careful investigation to understand its implications. - How is insider trading detected?

Regulatory agencies use a combination of data analytics, surveillance systems, and whistleblowers to identify suspicious trading patterns and investigate potential insider trading violations. - What are the consequences of insider trading?

Insider trading carries severe penalties, including fines, imprisonment, disgorgement of profits, and reputational damage. - How can investors protect themselves from insider trading?

Investors should be cautious of unusual options activity, thoroughly research before investing, and seek professional financial advice when necessary.

Unusual Options Activity Insider Trading

Image: beststockstrategy.com

**Conclusion:**

Unusual options activity is a complex and often misunderstood phenomenon in the stock market. While it can provide valuable insights into market trends and potential opportunities, it is crucial to be aware of the risks associated with insider trading and market manipulation. By understanding the dynamics of unusual options activity, adhering to regulatory guidelines, and exercising due diligence, investors can navigate the市場 landscape with confidence and strive for informed investment decisions.

Do you find the topic of unusual options activity and insider trading intriguing? Are there any aspects you’d like to delve deeper into? Share your thoughts and questions in the comments below, and let’s continue the conversation!