Introduction: Unlocking the Labyrinth of Options Trading

In the ever-evolving realm of finance, options trading emerges as a captivating avenue for investors seeking to navigate market complexities and amplify their returns. Options, versatile financial instruments, grant traders the right, but not the obligation, to buy or sell an underlying asset at a predefined price on a future date. By understanding and leveraging the myriad options trading strategies, traders can optimize their risk-reward profiles and harness the market’s potential.

Image: www.pinterest.com.mx

Navigating the Types of Options Trading Strategies

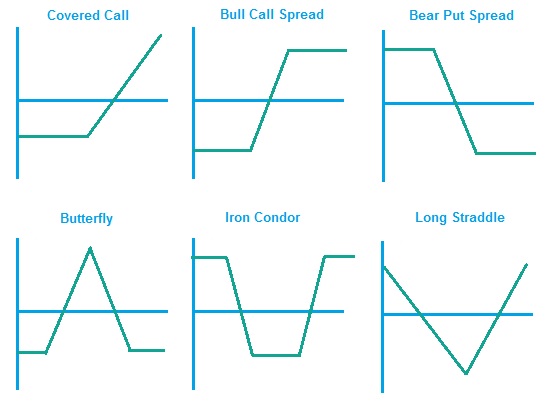

The options trading landscape encompasses a diverse array of strategies, tailored to varying risk appetites and market conditions. Let us delve into the most prevalent strategies and unravel their intricacies:

1. Covered Calls:

For those with a bullish outlook and stock ownership, covered calls offer a compelling strategy. By selling call options against owned shares, traders collect premiums while maintaining the underlying asset’s potential upside. However, they cap their profit at the strike price and face assignment if the stock rallies significantly.

2. Cash-Secured Puts:

Similar to covered calls, cash-secured puts are geared toward bullish investors with cash reserves. Traders sell put options, receiving premiums in exchange for the obligation to purchase the underlying asset if it falls below the strike price. This strategy generates income while limiting downside risk.

Image: www.tmbfiles.com

3. Naked Puts:

Embracing more risk, naked puts involve selling put options without owning the underlying asset. Traders profit if the stock remains above the strike price but face unlimited loss potential if it declines. This strategy is recommended only for experienced traders with a high-risk tolerance.

4. Bull Call Spread:

Bull call spreads cater to bullish traders who anticipate a moderate stock price increase. The strategy involves buying one call option and simultaneously selling a call option with a higher strike price, creating a defined risk and reward profile.

5. Bear Put Spread:

Bear put spreads align with a bearish market outlook. Traders purchase a put option and sell a put option with a lower strike price, capturing profits if the stock price falls within a specific range.

6. Iron Condor:

Combining elements of both bull and bear spreads, iron condors are neutral strategies that benefit from sideways market movements. Traders sell an out-of-the-money call spread and an out-of-the-money put spread simultaneously.

Harnessing Expert Insights for Trading Success

Navigating the intricacies of options trading requires guidance from seasoned experts. Here are some valuable tips to enhance your trading acumen:

-

Understand market dynamics and technical analysis techniques to identify potential trading opportunities.

-

Manage risk prudently by setting stop-loss orders and understanding the potential for loss.

-

Allocate capital wisely and diversify your portfolio to mitigate risks.

-

Practice patience and discipline, avoiding emotional decision-making during market fluctuations.

Types Of Options Trading Strategies

Image: personalfinancelab.com

Embracing the Power of Options Trading

Whether you are a seasoned trader or a budding enthusiast, options trading presents myriad opportunities to amplify your financial returns. By understanding the different types of strategies and leveraging expert insights, you can harness the power of options and embark on a rewarding trading journey.

Remember, market conditions are ever-changing, so continuous learning and adaptation are key to staying ahead of the curve. Embrace the dynamic world of options trading and unlock the potential to elevate your financial prowess.