Introduction

In the volatile and dynamic world of financial markets, options trading has emerged as a powerful tool for investors seeking to enhance returns, manage risk, and create tailored investment strategies. Options contracts, which grant the holder the right but not the obligation to buy or sell an underlying asset at a specified price on a particular date, offer a unique blend of flexibility and potential profitability. Whether you’re a seasoned trader or a financial novice, this comprehensive guide will provide you with the essential knowledge and insights necessary to navigate the world of options trading with confidence.

Image: booksdrive.org

Understanding Options

Options contracts are fundamentally agreements between two parties: the buyer and the seller. The buyer of an option pays a premium to the seller, giving them the option to exercise their right to buy (call option) or sell (put option) the underlying asset at a specified strike price on or before the expiration date. This contractual agreement allows the option holder to potentially benefit from price fluctuations in the underlying asset without the obligation to complete the transaction.

Types of Options

The diverse nature of options trading necessitates the existence of various option types, each tailored to specific investment objectives and market conditions. Call options, as mentioned earlier, confer the right to buy an underlying asset at a specified strike price. In contrast, put options grant the option holder the right to sell the underlying asset. Both call and put options can be exercised either on the date of expiration (American-style options) or only on the expiration date (European-style options). Additionally, index options and exchange-traded funds (ETFs) provide investors with the flexibility to manage risk and potential returns in relation to a wider market or sector.

Options Strategies

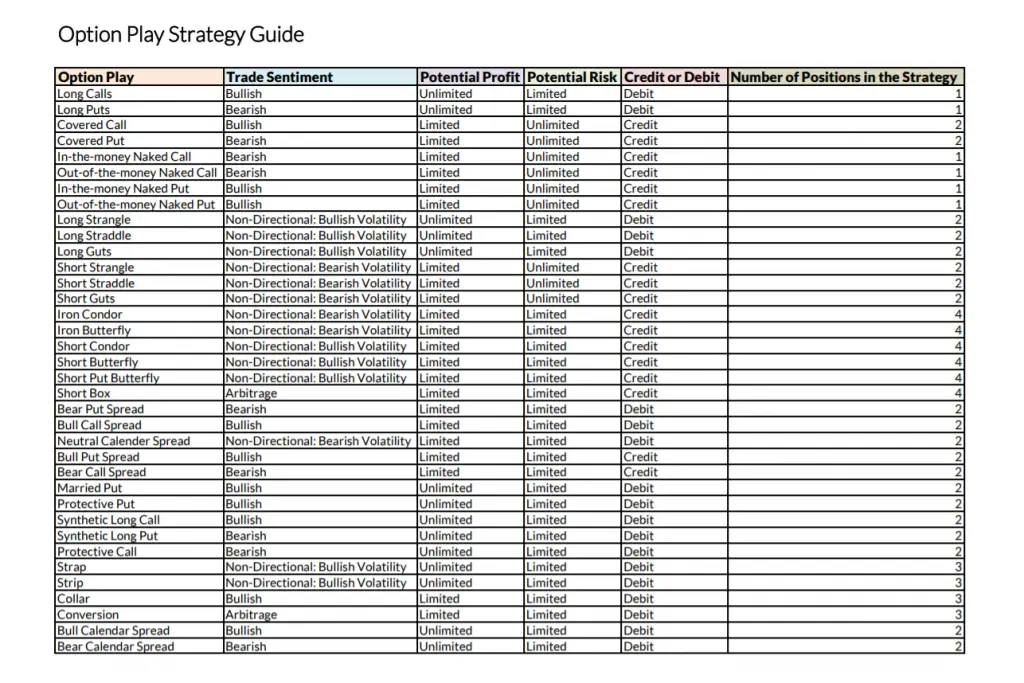

The versatility of options allows traders to construct a wide range of strategies designed to meet individual investment goals. Some popular strategies include:

- Covered Call Writing: Investors with a bullish outlook on the underlying asset can sell (write) call options against their existing position. This generates additional income in the form of premiums while potentially limiting potential upside gains.

- Protective Put Buying: For those anticipating a potential decline in the underlying asset’s value, purchasing (buying) put options provides downside protection. By setting a strike price below the current market price, the investor can potentially offset losses incurred on the owned asset.

- Long Straddle: This advanced strategy involves simultaneously purchasing both a call and a put option with the same strike price and expiration date. The potential profit lies in correctly anticipating a significant price movement in either direction.

Image: www.pinterest.com

Risk Management in Options Trading

While options trading offers the potential for substantial returns, the inherent leverage of these contracts comes with significant risks. Thus, it is crucial for investors to employ proper risk management practices.

- Proper Due Diligence: Conduct thorough research on the underlying asset, its market behavior, and potential risks involved.

- Understanding Options Greeks: Familiarize yourself with the “Greeks” – metrics that measure an option’s sensitivity to changes in market parameters – to assess potential gains or losses.

- Position Sizing: Allocate only a portion of your investment portfolio to trading options, ensuring that your overall financial strategy remains balanced.

- Monitoring and Adjustment: Regularly monitor your options positions and consider making adjustments based on evolving market conditions and your risk tolerance.

Trading Psychology and Emotional Discipline

Successful options trading extends beyond technical analysis and strategic planning. Traders must also possess a strong understanding of their own psychological biases and emotional responses.

- Avoid FOMO (Fear of Missing Out): Resist the urge to make impulsive trades based on market hype or fear. Stay disciplined and rely on your research and analysis.

- Set Realistic Expectations: Understand that options trading involves risks and may not always result in profits. Set realistic profit targets and embrace the possibility of losses.

- Learn from Mistakes: Mistakes are an inherent part of any trading journey. Analyze your past decisions objectively to identify areas for improvement.

Trading With Options Pdf

Image: www.newtraderu.com

Conclusion

Options trading empowers investors with a versatile tool to enhance their investment strategies. By understanding the fundamental concepts, exploring various options types and strategies, and embracing sound risk management practices, investors can harness the potential of options to achieve their financial objectives. Remember, education, patience, and discipline are key ingredients for successful options trading. Download our comprehensive PDF guide today and embark on a journey of financial empowerment with confidence.