In the intricate world of finance, options trading can be likened to a high-stakes game of chess, where strategy and foresight determine the path to success. Among the many types of options available, call and put options stand out as powerful tools that can augment an investor’s portfolio. Understanding how to trade with call and put options is paramount for navigating this complex arena effectively. In this exhaustive guide, we delve into the depths of these options, exploring their mechanisms, applications, and the strategies employed by seasoned traders.

Image: efinancemanagement.com

Demystifying Call and Put Options

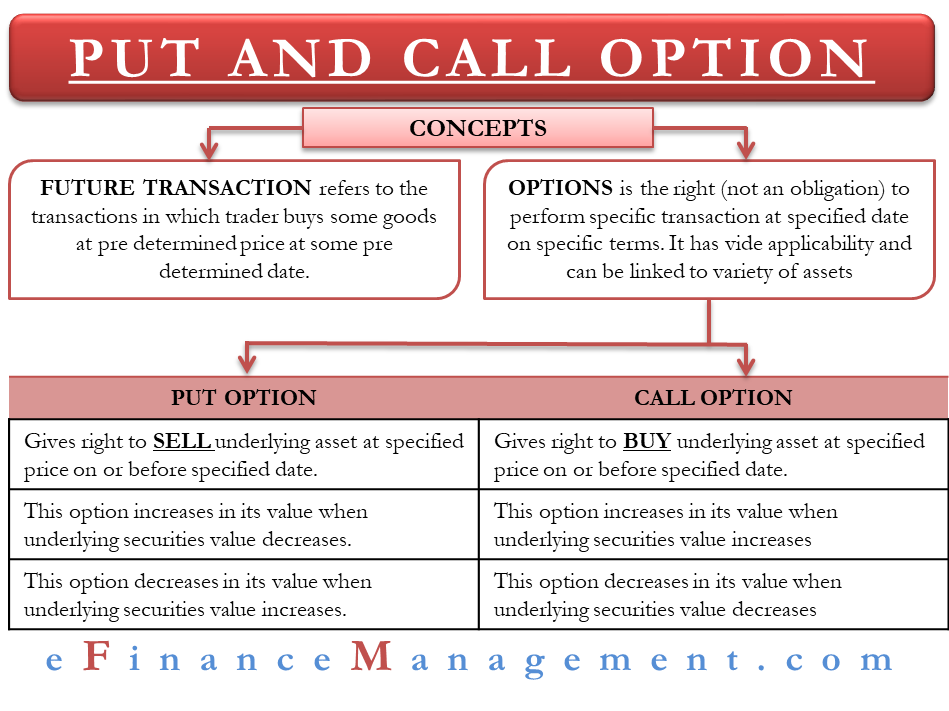

Options, in their essence, grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock, at a predetermined price (strike price) on or before a specified date (expiration date). This flexibility provides traders with the ability to capitalize on market movements without the full commitment of buying or selling the underlying asset.

A call option conveys the right to buy an asset. If an investor anticipates an upswing in an asset’s price, they may elect to purchase a call option at a strike price lower than the expected market price. This strategy allows them to purchase the asset at a more favorable rate if the prediction holds true, potentially generating substantial gains.

On the contrary, a put option provides the right to sell an asset. Traders anticipating a decline in an asset’s value may opt for put options. By securing a strike price higher than the anticipated market price, the investor obtains the right to sell the asset at a more lucrative price, mitigating potential losses.

Empowering Traders with Call and Put Options

The versatility of call and put options extends to a wide range of trading strategies, catering to diverse market scenarios and risk appetites. Here are some common applications:

- Bullish Bets: Anticipating a price surge? Call options offer a leveraged way to amplify potential gains. By leveraging the right to buy at a predetermined lower strike price, traders can magnify their profits when the market aligns with their predictions.

- Bearish Strategies: Conversely, when market conditions hint at a downturn, put options provide a means to capitalize on the decline. The right to sell at a higher strike price enables traders to generate returns even as the underlying asset depreciates.

- Hedging Positions: Options can act as a protective shield in uncertain market conditions. By simultaneously holding opposite positions in an asset and an option, traders can mitigate potential losses and preserve capital during market fluctuations.

- Income Generation: Options trading can also serve as an alternative income stream. Selling covered calls or cash-secured puts, where the trader holds the underlying asset, enables them to generate premium payments, bolstering their portfolio’s returns.

Mastering the Nuances of Options Trading

While call and put options offer tantalizing opportunities, there are inherent risks that demand prudent risk management practices. Here are some key considerations:

- Time Decay: Options have a finite lifespan, and their value erodes as the expiration date approaches. Traders must carefully assess the timing of their trades, balancing potential gains against the diminishing time value.

- Volatility Impact: Market volatility plays a crucial role in options pricing. Higher volatility implies greater potential for gains but also magnifies potential losses.

- Liquidity Considerations: Liquidity is vital in options trading, as it determines the ease with which orders can be executed at favorable prices. Traders should prioritize options with sufficient market depth to minimize slippage.

Image: www.realvision.com

Evolving Landscape of Options Trading

The landscape of options trading is continuously evolving, driven by technological advancements and regulatory changes. Here are some noteworthy trends:

- Digitalization of Trading: Online platforms and mobile apps have revolutionized options trading, making it accessible to a broader range of investors.

- Automated Trading: Algorithmic trading and artificial intelligence are increasingly used to execute options trades, enhancing efficiency and precision.

- Regulatory Developments: Regulatory bodies worldwide are actively monitoring options trading to ensure market integrity and protect investors.

Embarking on Your Trading Journey

If you’re eager to delve into the world of call and put options trading, it’s imperative to approach it strategically. Here’s how you can get started:

- Educate Yourself: Gain a thorough understanding of options concepts, mechanics, and trading strategies through books, online courses, and webinars.

- Practice with Paper Trading: Simulate real-world trading conditions without risking actual capital. Paper trading platforms allow you to test your strategies and hone your skills.

- Start Small and Gradually Increase: Begin with modest trades and gradually increase your stakes as you gain confidence and experience. Risk management is paramount.

- Seek Professional Guidance: If needed, consider consulting with a financial advisor or broker who specializes in options trading. Their guidance can enhance your trading decisions.

Trading With Call And Put Options

Image: unbrick.id

Conclusion

Call and put options are versatile tools that empower traders with diverse market strategies and the potential for substantial returns. As you navigate this intricate terrain, remember the importance of risk management, continuous learning, and adapting to evolving market dynamics. Whether you’re a seasoned trader or just starting your journey, delving into the world of call and put options can unlock a realm of opportunities and propel your financial aspirations.