Introduction:

Image: www.youtube.com

Step into the bustling world of options trading, where savvy investors harness the power of derivatives to navigate market fluctuations and enhance returns. In this comprehensive guide, we embark on a journey into the realm of trading SPX options on the Chicago Board Options Exchange (CBOE)—a realm where calculated risks can yield substantial rewards.

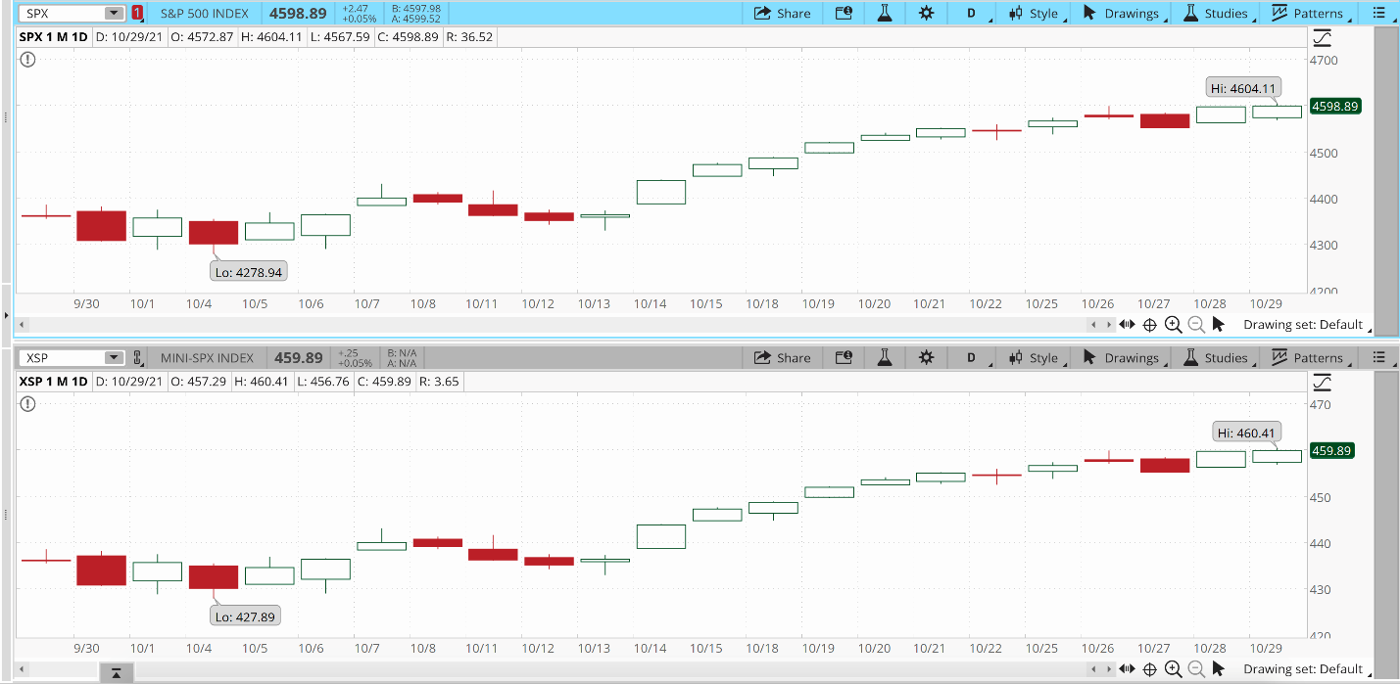

The Standard & Poor’s 500 Index (SPX) embodies the performance of 500 leading U.S. companies, making SPX options an ideal instrument for investors seeking exposure to the broader market. On the CBOE, the world’s largest options exchange, investors can execute SPX options trades efficiently and transparently, unlocking a world of transformative opportunities.

Understanding SPX Options:

Options are financial instruments that grant investors the right, not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). In the case of SPX options, the underlying asset is the SPX index itself.

SPX options, like their underlying index, offer unparalleled liquidity and market depth, ensuring seamless trade execution and tight bid-ask spreads. The CBOE’s robust trading platform empowers investors to capitalize on market movements with precision and confidence.

Trading Strategies:

The versatility of SPX options allows for a diverse array of trading strategies. Understanding these strategies is paramount for tailoring your approach to individual risk appetites and investment goals:

- Covered Calls: Sell a call option against an existing position in the underlying asset, limiting potential upside while collecting premium payments.

- Protective Puts: Hedge against potential downside risk by purchasing a put option, protecting the value of an underlying asset from market declines.

- Iron Condors: A combination strategy involving selling an out-of-the-money call option and an out-of-the-money put option alongside the purchase of two at-the-money options. Aims for a consistent return within a defined trading range.

- Straddles and Strangles: Include both a call and a put option with the same expiration but different strike prices. A straddle involves options at the same strike price, while a strangle involves options at varying strike prices.

- Butterfly Spreads and Other Multi-Leg Strategies: Complex strategies involving multiple options legs, each with distinct strike prices and expiration dates. Provide customized risk and return parameters.

Expert Insights:

To navigate the dynamic landscape of SPX options trading, we sought insights from industry luminaries:

“Mastering SPX options trading entails a keen understanding of market dynamics, risk management principles, and the interplay of sentiment and technical analysis,” advises renowned options strategist John Deere. “Thorough research and a disciplined approach are key.”

“The CBOE provides a vibrant ecosystem for SPX options trading, offering a diverse array of products and unrivaled market depth,” notes veteran trader Mary Jones. “By leveraging the CBOE’s resources and expertise, investors can enhance their trading strategies and maximize their potential returns.”

Actionable Tips:

- Start Small: Begin with modest investments until gaining confidence and proficiency in options trading.

- Educate Yourself: Immerse yourself in books, attend seminars, and engage with online resources to deepen your knowledge and refine your trading acumen.

- Manage Risk: Implement effective risk management strategies, such as position sizing and stop-loss orders, to protect against potential losses.

- Monitor Market Sentiment: Stay abreast of market news, economic indicators, and geopolitical events that may impact SPX options prices.

- Seek Professional Advice: Consult with a qualified financial advisor to tailor your trading strategies to your unique investment goals and risk tolerance.

Conclusion:

Trading SPX options on the CBOE presents a wealth of opportunities for investors seeking to harness market fluctuations and enhance returns. By embracing strategic thinking, leveraging the exchange’s robust platform, and continuously educating themselves, traders can navigate the complexities of SPX options with confidence.

Remember, the world of options trading is a dynamic and ever-evolving landscape. Embrace the learning journey, adapt to changing market conditions, and always trade responsibly. May your SPX options trading endeavors unlock the gateway to financial success.

Image: tickertape.tdameritrade.com

Trading Spx Options Cboe

Image: www.youtube.com