A Gateway to Enhanced Profits and Risk Management

In the ever-evolving world of financial markets, traders are constantly seeking strategies to maximize returns while mitigating risks. Spread options, traded on platforms like Robinhood Advanced Tier, offer a sophisticated approach to achieve these goals. This article aims to provide an in-depth exploration of trading spread options on Robinhood, empowering traders to harness the potential of this advanced strategy.

Image: techcrunch.com

Understanding Spread Options: A Foundation for Success

Spread options are multifaceted instruments that involve the simultaneous purchase and sale of two options contracts with different strike prices. By combining two options, traders create a new strategy that exhibits distinct risk and reward characteristics compared to trading individual options alone.

Spread options can be classified into two main types: vertical spreads and horizontal spreads. Vertical spreads involve options with the same expiration date but different strike prices, while horizontal spreads involve options with the same strike price but different expiration dates. Each type offers unique strategic advantages, allowing traders to tailor their trades to specific market scenarios.

Unveiling the Advanced Strategies: A Trader’s Arsenal

Bull Call Spreads: Express optimism about rising asset prices, profiting if the underlying asset’s price exceeds the breakeven point.

Bear Put Spreads: Anticipate declining asset prices, benefiting if the underlying asset’s price falls below the breakeven point.

Iron Condors: Combine bull call and bear put spreads within a defined range, aiming to profit from market stability or low volatility.

Straddles and Strangles: Create a neutral position, profiting from large price movements in either direction, regardless of the underlying asset’s price trajectory.

Maximizing Profits, Managing Risks: The Path to Success

Mastering the art of spread options requires meticulous planning and execution. Expert traders emphasize the importance of:

- Analyzing Market Conditions: Comprehending market trends, volatility, and economic factors is crucial for informed trading decisions.

- Determining Profit Potential: Calculating profit and loss scenarios based on changing market conditions ensures a clear understanding of risk and reward.

- Managing Risk Effectively: Utilizing stop-loss orders, position sizing, and diversification strategies mitigates potential losses and enhances profitability.

Image: www.socratesperezmd.com

Harnessing the Power of Robinhood Advanced Tier

Robinhood Advanced Tier provides traders with an advanced platform designed to optimize spread options trading. Its key features include:

- Real-Time Market Data: Access to comprehensive market data and analytics tools empowers traders with up-to-date information for timely decision-making.

- Powerful Trading Tools: Intuitive charting capabilities, technical analysis tools, and advanced order types facilitate sophisticated trade execution.

- In-Depth Option Analysis: Evaluate potential trades with detailed option chains, risk and reward calculators, and historical option data.

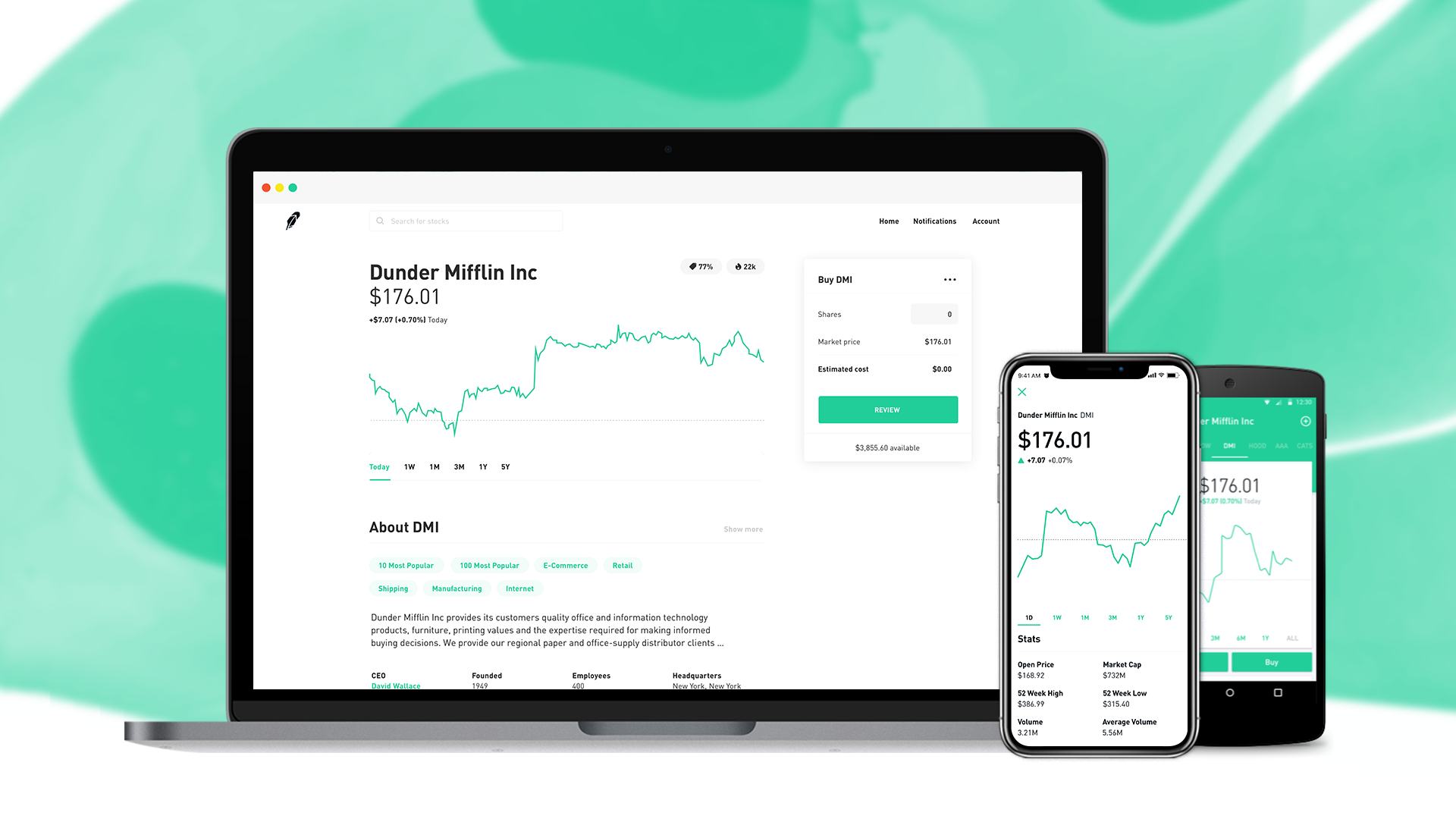

Trading Spread Options On Robin Hood Advanced Tier

Image: streetfins.com

A Glimpse into the Future: The Evolution of Spread Options Trading

Innovation continues to shape the landscape of spread options trading. The rise of synthetic spreads, algorit