Unlocking the Potential of Options on Robinhood

Navigating the world of options trading can be daunting, especially for beginners venturing into the realm of Robinhood. This comprehensive guide will delve into the intricate tiers of options trading on Robinhood, empowering you with the knowledge to make informed decisions and enhance your trading strategy. Whether you’re a seasoned investor or a novice, understanding the tiers and their implications is crucial for a successful and rewarding options experience on Robinhood.

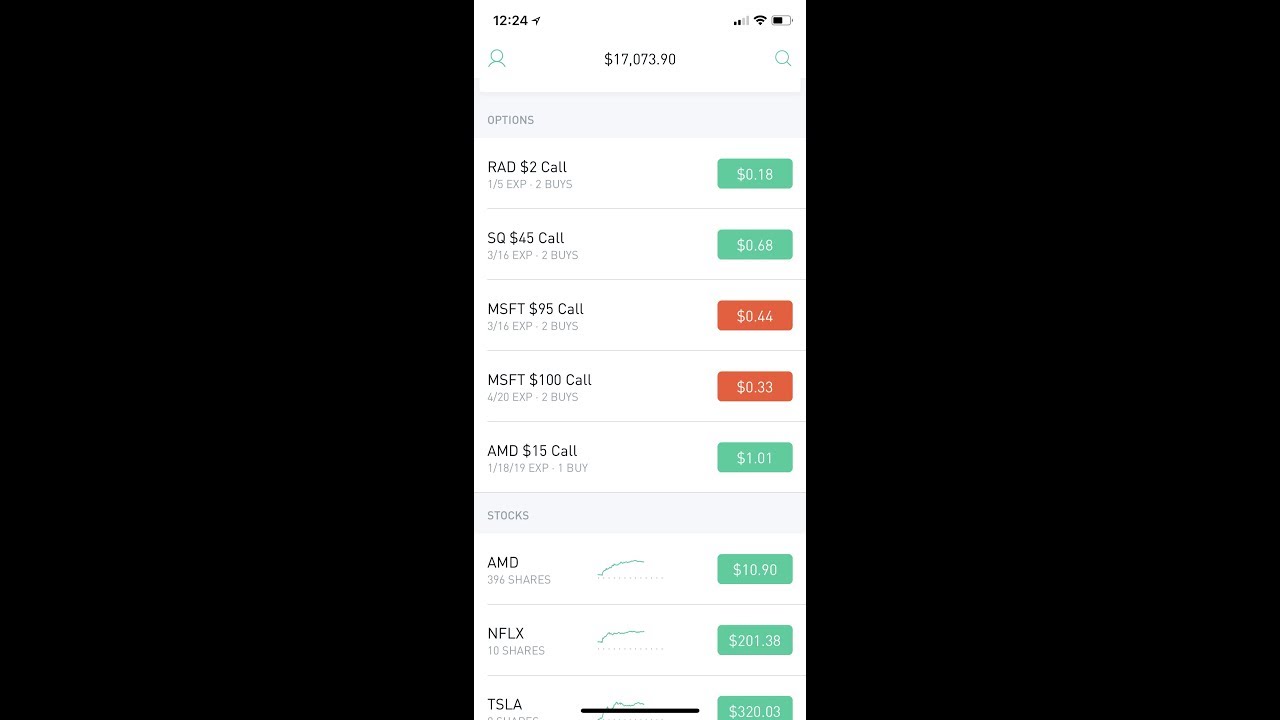

Image: www.youtube.com

Defining Options Trading

Options, in the context of financial markets, represent contracts that bestow upon the buyers the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a specific date (expiration date). Trading options involves buying or selling these contracts, enabling traders to potentially profit from price fluctuations of the underlying asset without the need for direct ownership.

Tiers of Option Trading on Robinhood

Robinhood offers multiple tiers for options trading, each with varying levels of sophistication and risk tolerance. These tiers are designed to cater to traders with different experience levels and trading goals.

Tier 1: Basic Options

This entry-level tier provides a simplistic approach to options trading, suitable for beginners with minimal experience. Basic Options allow traders to buy or sell standard call and put options, with limited complexity and advanced strategies.

Image: www.trendlynews.in

Tier 2: Cash-Secured Puts and Covered Calls

The Cash-Secured Puts tier is designed for traders who are familiar with the fundamentals of options trading. It enables them to sell cash-secured puts, where they must hold sufficient cash in their account to purchase the underlying asset if the option is exercised. This tier also grants the ability to sell covered calls, where traders own the underlying asset and sell call options against it.

Tier 3: Advanced Options

As the name suggests, the Advanced Options tier is geared towards experienced options traders. Unlocking this tier grants traders access to more complex strategies, such as multi-leg options and trading options with shorter expiration dates. It caters to those seeking higher potential returns and are comfortable with increased risk.

Tier 4: Long Options

The Long Options tier is designed for traders who prefer less risk tolerance. In this tier, traders can only hold long (positive) option positions, meaning they have the right but not the obligation to purchase or sell the underlying asset.

Tier 5: Short Options

Exclusively accessible to highly experienced and sophisticated traders, the Short Options tier allows traders to sell (write) naked put and call options. This tier carries substantial risk as traders are obligated to purchase or sell the underlying asset if the option is exercised.

Understanding the Options Approval Process

Robinhood implements a risk-assessment process before granting access to higher option trading tiers. This assessment considers factors such as trading experience, financial sophistication, and risk tolerance. Traders must complete an Options Questionnaire and may be required to provide additional information to demonstrate their proficiency.

Navigating Risk in Options Trading

Options trading, while offering the potential for high returns, also involves inherent risk. Leverage is a significant aspect, as options provide control over a large number of shares with a minimal upfront investment. This amplifies both potential profits and losses. Traders must carefully manage their risk by employing strategies such as stop-limit orders, hedging, and diversification.

Teirs Of Option Trading On Robinhood

Image: manee.xyz

Maximize Your Robinhood Options Trading

Mastering the tiers of option trading on Robinhood can significantly enhance your trading performance. Here are some tips to optimize your experience:

- Start small and gradually increase your trading volume as you gain experience and confidence.

- Monitor market conditions closely and stay updated on industry news to make informed decisions.

- Seek guidance from a financial advisor or mentor to learn best practices and mitigate risk.

- Utilize the Robinhood mobile app for convenient access to real-time market data and trade execution.

Embrace the tiers of option trading on Robinhood to unlock new possibilities and enhance your trading horizons. Remember to prioritize risk management, seek continuous knowledge, and never cease the pursuit of financial mastery.