Begin Your Options Trading Journey with a Simulated Environment

Options trading, a sophisticated financial strategy involving the buying and selling of option contracts, presents a multifaceted landscape of opportunities and challenges. Embarking on an options trading voyage can be daunting, especially for traders lacking practical experience. Enter the realm of trading simulators—a veritable game-changer in the world of options trading.

Image: www.warriortrading.com

Trading simulators are virtual platforms that mimic real-world markets, empowering traders with a risk-free environment to hone their skills and experiment with different strategies. Options trading simulators, in particular, offer an unparalleled avenue for traders to immerse themselves in the intricacies of this complex market without exposing themselves to potential financial losses.

In this comprehensive guide, we will delve into the world of trading simulators with options, exploring its fundamental concepts, advantages, and pitfalls. We will also provide valuable insights and best practices to help you optimize your usage of these indispensable tools. So, strap yourself in and prepare to embark on an enlightening journey through the world of simulated options trading!

Delving into the Options Trading Simulation Arena

Trading simulators with options emulate real-time market conditions, allowing traders to execute buy and sell orders for option contracts and observe the dynamic fluctuations in prices. These platforms typically offer customizable parameters, enabling traders to tailor their simulated trading experiences based on their risk tolerance and investment goals.

Historical and Real-Time Data

Options trading simulators may utilize historical market data or provide a real-time connection to actual market feeds. This data serves as the foundation for simulating price movements and option premiums, ensuring that traders confront realistic market dynamics.

Comprehensive Trading Features

Trading simulators typically encompass a wide array of features to enhance the trading experience. These may include:

- Order Types: Support for market, limit, and stop orders, mirroring real-world trading capabilities

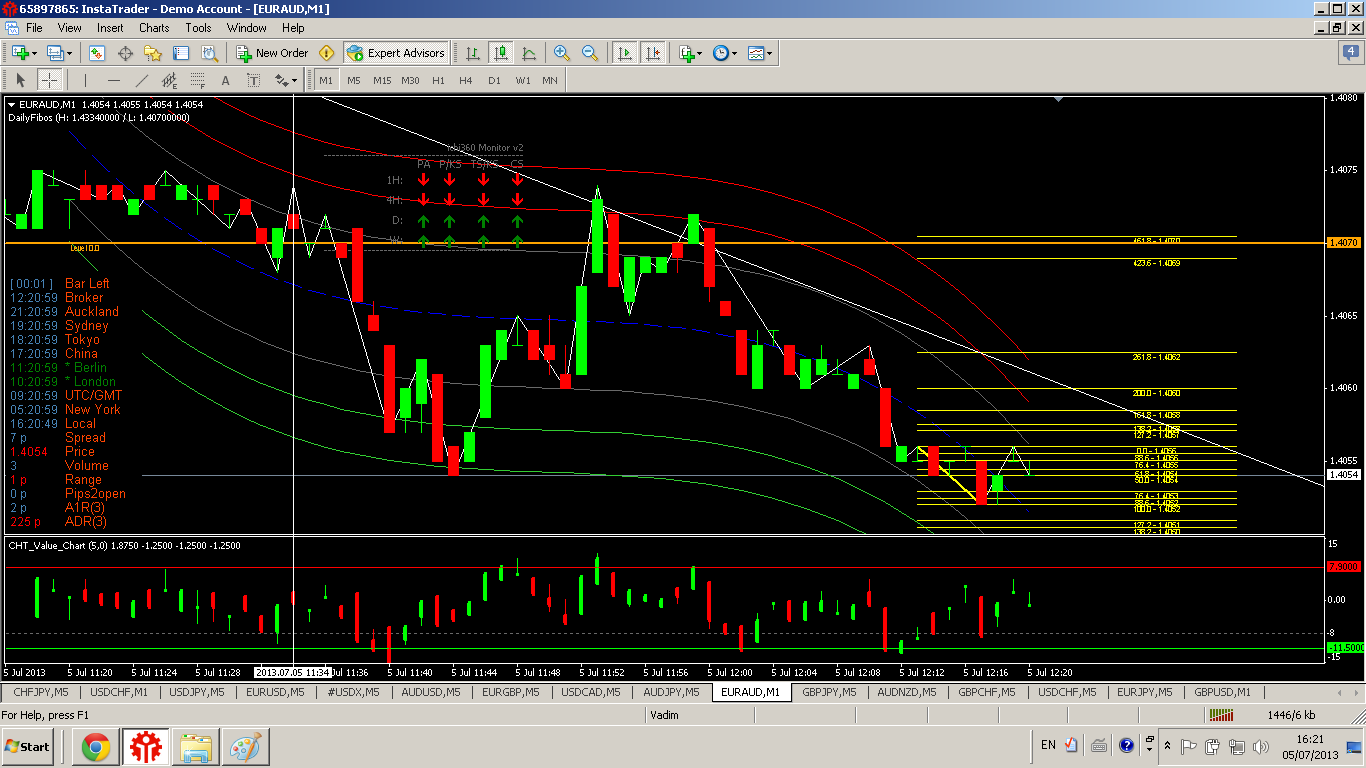

- Technical Analysis Tools: Access to charting tools and technical indicators to identify trends and make informed decisions

- Performance Tracking: Comprehensive reports and metrics to monitor and analyze trading performance over time

Image: hektra.nl

Advantages of Options Trading Simulators: Navigating the Risk-Free Zone

The allure of trading simulators lies in their inherent risk-free nature. These platforms employ virtual funds, shielding traders from the potential financial ramifications associated with real-money trading.

Risk-Free Experimentation

Traders can experiment with various options strategies, explore different markets, and test their hypotheses without jeopardizing their capital. This risk-free environment fosters a conducive atmosphere for learning and experimentation.

Enhanced Trading Psychology

Trading simulators provide a psychological haven for traders to develop emotional resilience and discipline. Risk-free trading eliminates the fear of losses, enabling traders to focus on honing their skills and developing sound trading strategies.

Acceleration of Trading Proficiency

The iterative nature of simulated trading accelerates the acquisition of trading proficiency. Traders can repeatedly execute trades, make mistakes, and learn from their experiences without incurring financial consequences.

Overcoming Potential Drawbacks: Navigating the Similarities and Differences

While trading simulators offer immense value, it’s crucial to acknowledge their limitations and potential drawbacks.

Disparities between Simulated and Real-World Trading

Despite their advanced capabilities, trading simulators remain simulations and may not fully replicate the complexities and emotional demands of real-world trading. The absence of real financial stakes can sometimes lead to overly aggressive trading behavior.

Over-Reliance on Simulation

Prolonged reliance on trading simulators may foster a false sense of security, leading traders to underestimate the risks associated with real-money trading. It is crucial to transition to real-world trading gradually and with appropriate risk management measures in place.

Data Limitations

Options trading simulators may not always incorporate all relevant market data or accurately capture the full spectrum of trading nuances. This can limit the accuracy of simulations and potentially impact decision-making.

Embracing Best Practices for Effective Simulator Usage

To maximize the benefits of trading simulators with options, traders should adhere to the following best practices:

Start with a Comprehensive Understanding

Establish a solid theoretical foundation in options trading principles before venturing into simulated trading. Attend webinars, read books, and consult with experienced traders to grasp the complexities of this domain.

Set Realistic Expectations

Recognize that trading simulators provide valuable learning opportunities but may not fully substitute for real-world trading experience. Start with small virtual investment amounts and gradually increase your simulated portfolio size as your skills progress.

Focus on Developing a Strategy

Don’t blindly execute trades in a simulated environment. Develop a well-defined trading strategy and use the simulator to test its effectiveness, refine your approach, and optimize your risk management techniques.

Keep a Trading Journal

Maintain a detailed trading journal to document your trades, observations, and lessons learned. This will help you identify areas for improvement and track your progress over time.

Seek Mentorship

Consider seeking mentorship from experienced traders who can provide guidance, support, and valuable insights into the world of options trading.

Trading Simulator With Options

Image: s3.amazonaws.com

Conclusion: Harnessing the Power of Simulation for Trading Mastery

Options trading simulators offer a