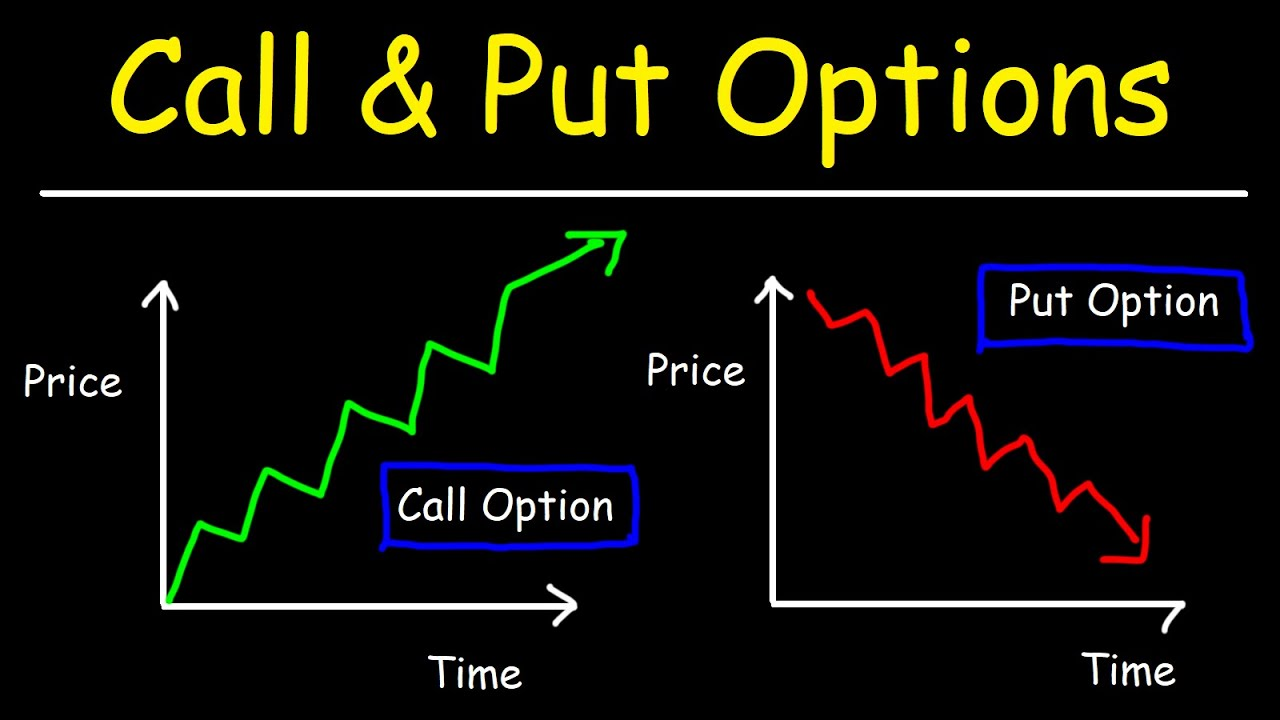

In the realm of investing, the prudent utilization of options trading strategies can amplify one’s earnings potential. Among these strategies, the enigmatic yet profoundly lucrative concept of trading put options stands tall. For the uninitiated, a put option bestows upon its holder the exclusive privilege to sell an underlying security, often a stock or an index, at a predetermined price known as the strike price, on or before a specified expiration date. Understanding and effectively trading put options require a thorough grasp of their intricacies.

Image: tradewithmarketmoves.com

Put options serve a multifaceted role, benefiting investors in a myriad of ways. Primarily, they act as hedges against potential declines in the underlying asset’s value, mitigating the financial impact of adverse market conditions. By selling a put option, an investor has the right to sell the underlying asset at the strike price, effectively setting a floor below which losses cannot penetrate.

Moreover, put options present a unique avenue for income generation. By astutely predicting market downturns, investors can sell put options at premiums that represent immediate profits. If the underlying asset’s value falls below the strike price, the option holder is not obligated to exercise their right to sell, allowing them to pocket the premium while retaining potential gains from any subsequent recovery in the asset’s value.

Executing successful put option trades hinges upon a thorough understanding of the factors that influence their pricing. These include the underlying asset’s volatility, interest rates, time to expiration, and the bid-ask spread. Volatility, a measure of the asset’s price fluctuations, bears a direct impact on option premiums. Higher volatility typically translates into higher premiums, as investors demand compensation for the increased risk.

The time value of an option gradually decays as the expiration date approaches. This decay accelerates as the option nears expiration, influencing the premium an investor can command. Understanding the intricacies of time decay is crucial for maximizing returns and minimizing losses.

Trading put options requires a keen eye for market trends and a solid grasp of technical analysis. By meticulously studying historical price data and employing technical indicators, investors can identify potential trading opportunities and make informed decisions. Discipline and prudent risk management are also essential, as options trading involves inherent risks.

While the rewards of successful put option trading can be substantial, it is imperative to acknowledge the potential risks involved. Options trading is not a get-rich-quick scheme and should only be undertaken by those who possess a comprehensive understanding of the markets and are prepared to accept the inherent risks.

Unveiling the Secrets of Put Option Trading with Expert Insights

Navigating the complexities of put option trading requires guidance from experienced professionals. Here, we present invaluable insights from industry experts to empower investors seeking to harness the potential of this versatile financial instrument.

“Thorough research and due diligence are paramount before executing any put option trade,” emphasizes Dr. Mark Richards, a renowned financial analyst. “Investors should meticulously evaluate the underlying asset, market conditions, and their own risk tolerance to make sound trading decisions.”

“Timing is everything in options trading,” advises Sarah Wilson, a seasoned options trader. “Understanding the time decay concept and its impact on option premiums is essential for maximizing returns. Traders should carefully consider the expiration date when selecting put options.”

According to John Carter, a market strategist, “Risk management is the cornerstone of successful options trading. Establishing clear profit targets and stop-loss levels before entering a trade helps mitigate potential losses and protect capital.”

Image: www.projectfinance.com

Trading Put Option

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: www.investopedia.com

Empowering Investors with Actionable Tips for Enhanced Returns

Emulating the strategies of successful put option traders can significantly enhance one’s chances of profitability. Here are some actionable tips to guide aspiring investors:

-

Identify Underlying Assets with Downward Momentum: Focus on assets exhibiting bearish trends or those likely to experience future declines.

-

Select Appropriate Strike Prices: Determine the strike price that aligns with your market outlook and risk tolerance. Consider both out-of-the-money and in-the-money options.

-

Manage Risk with Expiration Dates: Choose expiration dates that provide sufficient time for the underlying asset’s price to move in your favor while minimizing time decay.

-

Monitor Market Conditions: Stay abreast of economic news, market events, and geopolitical factors that may influence the underlying asset’s value.

-

Employ Technical Analysis: Utilize technical indicators and chart patterns to identify potential trading opportunities and confirm market trends.

-

Set Profit Targets and Stop-Loss Levels: Establish clear exit strategies to maximize gains and minimize losses. Regularly monitor your trades and adjust these levels as needed.

By integrating these expert insights and actionable tips into their trading strategies, investors can harness the full potential of put options and unlock new avenues for financial success.