Options trading offers investors a unique opportunity to manage risk and potentially generate profits by giving them the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a specific date. Understanding the intricacies of this multifaceted financial instrument requires a firm grasp of its fundamental terminology. This guide will delve into the essential terms and definitions associated with options trading, empowering you to navigate the complexities of this captivating market.

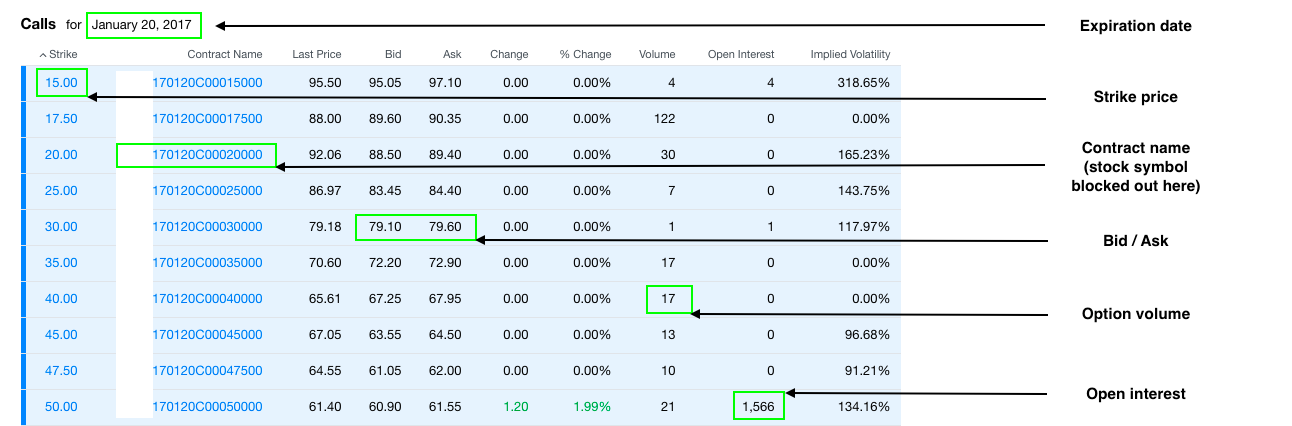

Image: www.nerdwallet.com

A Lexicon of Options Terminology

Before embarking on the path of options trading, it is imperative to familiarize oneself with the vocabulary of the realm. A call option bestows upon its holder the prerogative to purchase the underlying asset at a predetermined price (strike price) within a stipulated timeframe (expiration date). Conversely, a put option grants the holder the privilege to sell the underlying asset at the strike price by the expiration date.

The premium is the price paid for the option contract, representing the value of its embedded optionality. It fluctuates dynamically based on factors such as time to expiration, implied volatility, and underlying asset price. The intrinsic value of an option elucidates its worthiness based solely on the current price of the underlying asset relative to the strike price.

Decoding Option Strategies

Options traders employ a diverse array of strategies to exploit market inefficiencies and seek lucrative returns. Covered calls involve selling call options against an equivalent or greater number of shares of the underlying asset already owned. The premium received from the sale of the option serves to offset potential losses incurred should the underlying asset’s price decline.

Put-selling strategies encompass the sale of put options, granting the holder the right to sell the underlying asset at a specified price. These strategies thrive when the trader anticipates a stable or rising market, generating premium income while potentially benefiting from upward price movements.

Understanding Option Greeks

Greek letters are employed to quantify the sensitivity of option prices to changes in various underlying factors. Delta signifies the change in option price for every $1 change in the underlying asset’s price, providing insight into the option’s price responsiveness to underlying price fluctuations. Theta captures the rate of premium decay as time elapses, highlighting the time value component of option pricing.

Vega portrays the impact of implied volatility on option prices, an essential consideration for options traders seeking to exploit volatility dynamics. Gamma measures the change in an option’s delta for every $1 change in the underlying asset’s price, reflecting optionality’s sensitivity to price movements.

Image: financebizadviser.com

Options Trading Terms And Definitions

Image: www.pinterest.es

In the Realm of Options Trading

Options trading opens doors to a spectrum of opportunities for savvy investors and risk-tolerant traders. A deep understanding of options terminology is the cornerstone upon which successful trading strategies are built. This guide has provided the foundational knowledge needed to navigate the myriad dimensions of options trading.

To hone your options trading skills, immerse yourself in the subject matter, diligently research market trends, and seek counsel from experienced traders. Remember, a prudent approach and thorough preparation are your loyal companions on this captivating journey in the world of options trading.