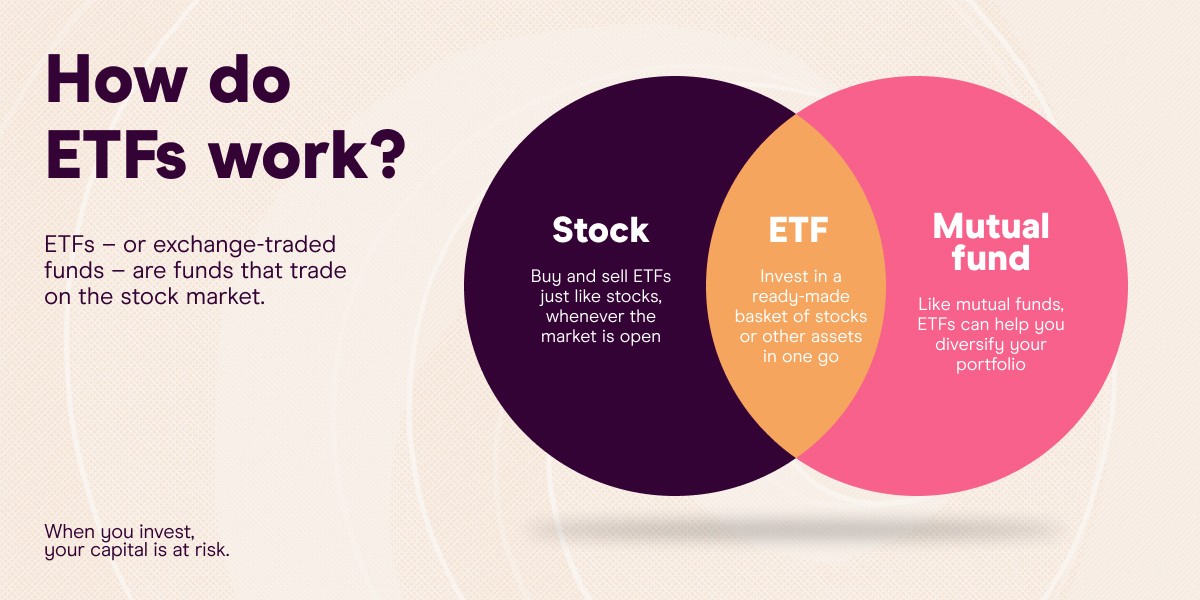

In today’s fast-paced financial landscape, Exchange-Traded Funds (ETFs) have emerged as a cornerstone for investors seeking diversification, flexibility, and cost-efficiency. But there’s more to ETFs than meets the eye; their potential extends beyond traditional buy-and-hold strategies through the exciting realm of options trading.

Image: crudeoiltrader.blogspot.com

Options, derivative financial instruments, provide investors with the right but not the obligation to buy or sell an underlying asset at a pre-determined price (strike price) before a specified date (expiration date). Understanding the intricacies of options trading with ETFs can empower investors to enhance their investment strategies, manage risk, and potentially capitalize on market movements.

ETF Options: A Primer

An ETF option represents a contract that grants the holder the right to buy (call option) or sell (put option) the underlying ETF at the strike price on or before the expiration date. Unlike stock options, which grant ownership of individual shares, ETF options confer ownership of the entire ETF basket, providing exposure to a diversified portfolio of assets.

Investors can use ETF options for various purposes, including speculating on the future price movement of the ETF, hedging against potential losses, or generating income through premiums. However, it’s crucial to note that options trading involves both opportunities and risks, and investors should carefully consider their risk tolerance before diving in.

Types of ETF Options Strategies

The versatility of ETF options allows for a wide range of trading strategies tailored to different risk appetites and investment goals. Here are some of the most common strategies:

-

Covered Call: This strategy involves selling a call option on an ETF that you already own. The option premium earned represents additional income, while the potential for unlimited losses is limited to the current market value of the ETF.

-

Protective Put: Investors can hedge against potential losses in a long ETF position by purchasing a put option. If the ETF price declines, the put option gains in value, offsetting losses in the underlying investment.

-

Bull Call Spread: This strategy involves buying a lower-strike-price call option and simultaneously selling a higher-strike-price call option. This strategy limits potential losses while still allowing for substantial profits if the ETF price rises.

Current Trends and Developments

The ETF options market has witnessed notable growth in recent years, driven by increasing ETF popularity, volatility in the broader market, and technological advancements. Several significant trends are shaping this market:

-

Increased ETF Liquidity: The growing popularity of ETFs has led to increased trading volumes, resulting in enhanced liquidity for ETF options. This liquidity allows for faster execution of trades and tighter bid-ask spreads.

-

Expansion of ETF Products: Fund providers have expanded their ETF offerings to include an array of asset classes, sectors, and strategies. This diversity provides investors with a wider selection of ETF options to choose from, meeting their specific investment needs.

-

Advancements in Options Trading Platforms: Online brokerages and trading platforms have made ETF options trading more accessible and user-friendly. Advanced features and analytical tools available on these platforms empower investors to make informed trading decisions.

Image: www.options-trading-mastery.com

Trading Options With Etf

Image: www.linkedin.com

Conclusion

Embarking on the journey of trading options with ETFs can be a rewarding experience for savvy investors. By understanding the basics, familiarizing yourself with different strategies, and staying abreast of industry trends, you can unlock the potential of this dynamic and versatile financial instrument. Remember to approach options trading with caution and consider employing risk management techniques to mitigate potential losses. The world of ETF options awaits your exploration, empowering you to navigate the ever-evolving financial markets with greater confidence and sophistication.