In the fast-paced world of finance, options trading has emerged as a powerful tool for investors seeking to amplify their returns and manage risk. Among the various underlying assets available for options trading, the ProShares UltraPro QQQ (TQQQ) stands out as a highly leveraged ETF that tracks the daily performance of the Nasdaq 100 Index with a 3x multiplier. This means that a 1% move in the Nasdaq 100 Index translates into a 3% move in TQQQ.

Image: www.tradingview.com

Understanding the mechanics and complexities of options trading is crucial for investors venturing into this arena. This comprehensive guide will delve into the fundamentals of trading options on TQQQ, empowering readers with the knowledge and strategies to navigate this dynamic market effectively.

Understanding TQQQ

The ProShares UltraPro QQQ (TQQQ) is an exchange-traded fund (ETF) that aims to provide leveraged exposure to the Nasdaq 100 Index, an index composed of the 100 largest non-financial companies listed on the Nasdaq exchange. TQQQ’s unique design attempts to replicate a 3x daily return of the Nasdaq 100 Index.

As a result of its leveraged nature, TQQQ amplifies the daily price movements of the Nasdaq 100 Index. This means that when the Nasdaq 100 Index rises by 1%, TQQQ typically rises by approximately 3%. Conversely, a 1% decline in the Nasdaq 100 Index would lead to an approximate 3% decline in TQQQ.

Leverage in Options Trading

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a particular date. The use of leverage in options trading, such as with TQQQ, allows investors to control a larger position with a smaller amount of capital compared to outright stock ownership.

While leverage can enhance potential returns, it also carries the inherent risk of magnified losses. Therefore, it is essential for investors to carefully consider their risk tolerance and financial capacity before engaging in leveraged options trading.

Types of Options

There are two primary types of options: calls and puts. Call options provide the buyer the right to purchase the underlying asset at a specified price (strike price) on or before a specific date (expiration date). Conversely, put options offer the buyer the right to sell the underlying asset at the strike price on or before the expiration date.

Each option contract represents 100 shares of the underlying asset. For instance, if an investor purchases a TQQQ call option, they acquire the right to purchase 100 shares of TQQQ at the strike price on or before the expiration date.

Image: www.tradingview.com

Trading Options on TQQQ

To trade options on TQQQ, investors must first open an options trading account through a broker. Brokers typically provide platforms and tools specifically designed for options trading.

When selecting options contracts, investors should carefully consider factors such as the underlying asset’s price, market volatility, time until expiration, and their own investment goals. By analyzing historical price data, investors can develop a strategy that aligns with their risk profile and financial objectives.

Risk Management

Risk management is paramount in options trading, especially with leveraged assets like TQQQ. Investors must diligently monitor market conditions and manage their positions proactively to minimize potential losses. Options trading strategies like hedging and stop-loss orders can help mitigate risks and preserve capital.

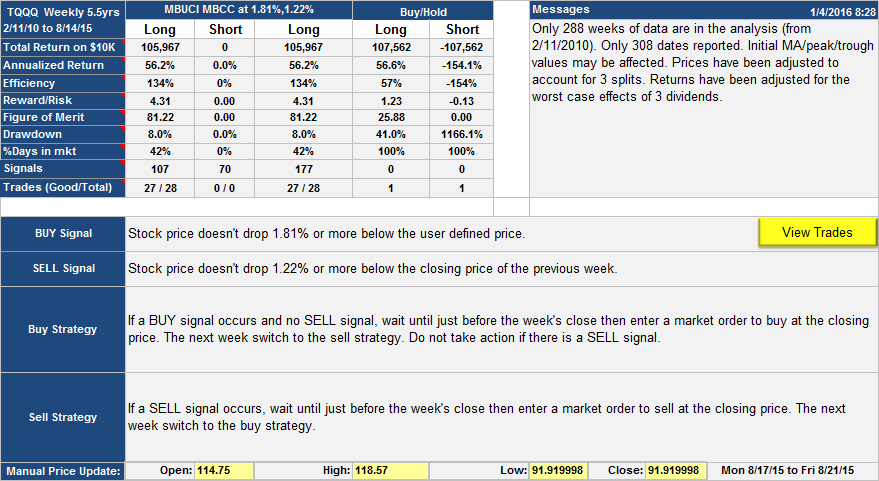

Trading Options On Tqqq

Image: www.signalsolver.com

Conclusion

Trading options on TQQQ offers the potential for significant returns by providing leveraged exposure to the Nasdaq 100. However, it involves inherent risks that investors must fully comprehend before engaging in this sophisticated market. By understanding the fundamentals of options trading, utilizing appropriate strategies, and adhering to robust risk management principles, investors can harness the power of TQQQ to tap into the growth potential of the technology sector while managing downside risks effectively.