If you’re new to the world of investing, you may have heard of options trading but are unsure of what it entails. Options are financial instruments that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain time frame. Understanding the basics of option trading can open up a realm of possibilities for investors seeking higher returns and managing risk. Let’s dive into the fundamentals of option trading in this comprehensive guide.

Image: www.visualcapitalist.com

Deciphering the Basics: Calls and Puts

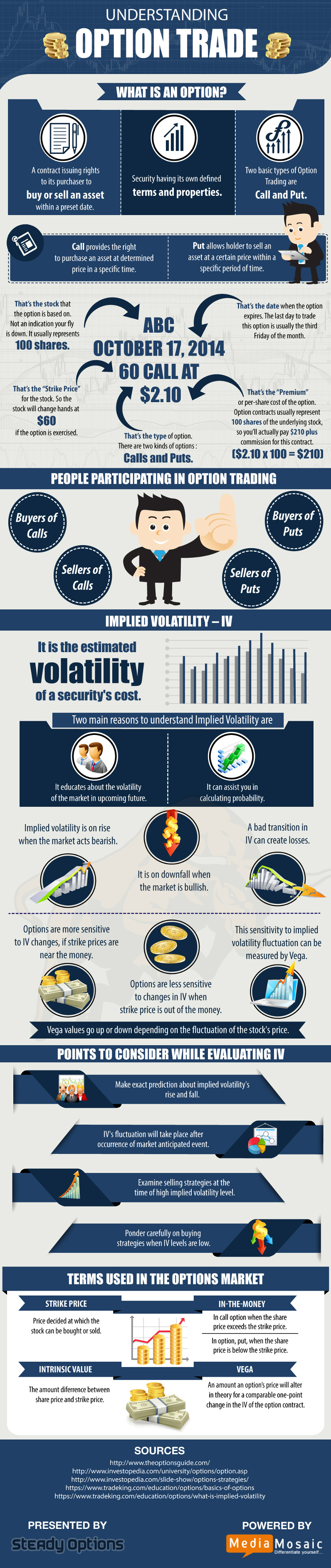

At the core of option trading lie two fundamental types: calls and puts. Calls confer the right to buy an underlying asset, such as a stock, at a specific price (the strike price) by a certain date (the expiration date). Puts, on the other hand, provide the right to sell the underlying asset at the strike price on or before the expiration date.

The buyer of an option pays a premium to the seller of the option in exchange for this right. The premium represents the price of the contract and is determined by factors such as the underlying asset’s price, volatility, time to expiration, and prevailing interest rates.

Strikes, Expirations, and Premiums: The Key Parameters

To fully grasp option trading, familiarity with key parameters is crucial. The strike price, as mentioned earlier, is the price at which the buyer can execute their option contract. The expiration date defines the timeframe within which the buyer can exercise this right. Lastly, the premium is the price paid for the contract, which can vary depending on market conditions.

Understanding the Potential Profits and Risks

The allure of option trading lies in the potential for significant profits. However, it’s equally important to acknowledge the potential risks involved. Calls have the potential for gains when the underlying asset’s price rises above the strike price, while puts can yield profits when the asset’s price falls below the strike price.

The downside to option trading is that the buyer of an option can lose the entire premium paid if the option expires out of the money (i.e., below the strike price for calls or above the strike price for puts).

Image: seekingalpha.com

Options in Action: Applications in Real-World Investing

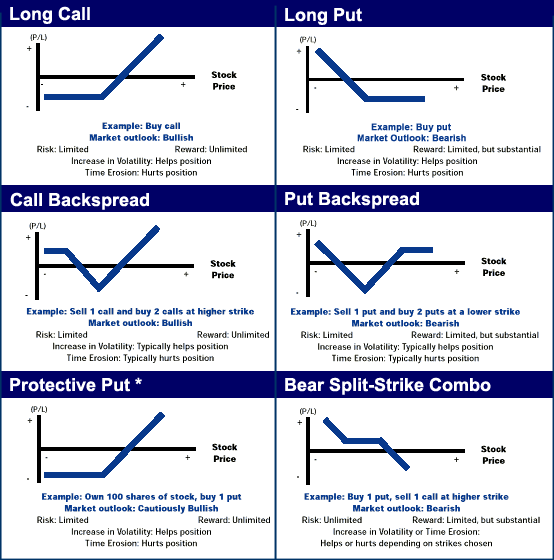

Option trading offers a versatile tool for investors, facilitating various strategies depending on their risk appetite and investment goals. For instance, investors may use options for hedging, speculating on market movements, or generating income through premium collection.

Covering a stock position with a put option can minimize potential losses in case of a price decline, while a call option can provide leverage for bullish investors seeking to amplify potential gains. Options can also offer a way to collect regular income by selling covered calls or cash-secured puts.

Choosing the Right Platform for Your Trading Journey

Selecting a reputable and reliable platform is paramount for successful option trading. Factors to consider include the platform’s user-friendliness, trading fees, educational resources, and customer support. Research different options and choose the one that aligns best with your trading needs and experience level.

Educating Yourself: Essential Knowledge for Informed Traders

Education is fundamental to thriving in the world of option trading. Begin by studying basic concepts, terminology, and strategies. Attend webinars, read books, and consult reputable sources to continually enhance your knowledge. Remember, ongoing education empowers you to make informed decisions and mitigate risks.

Option Trading Basics Pdf

https://youtube.com/watch?v=CbdaDt6rpqw

Conclusion

Mastering the basics of option trading opens up a world of possibilities for investors. From understanding the types of options (calls and puts) to deciphering key parameters (strike price, expiration date, and premium), this guide has laid a solid foundation for your trading journey.

Remember, education is key to successful option trading. By embracing continuous learning, refining your trading strategies, and leveraging the right platform for your needs, you can harness the potential of this powerful financial tool.