Dive into the Thrilling World of Options Trading Beyond Market Closure

Options trading, a sophisticated financial strategy that involves the exchange of options contracts, knows no limits time-wise anymore. The financial world has evolved dramatically in recent years, and with it, the realm of options trading has expanded beyond the traditional market hours as extended hours trading has emerged as a lucrative opportunity for investors seeking to capitalize on the dynamic markets after the market’s primary trading session has concluded. Join us as we delve into the depths of extended hours options trading, unveiling its strategies, advantages, and potential pitfalls, empowering you to navigate this exciting frontier with confidence.

Image: www.wallstreetzen.com

The Mechanics of Extended Hours Options Trading

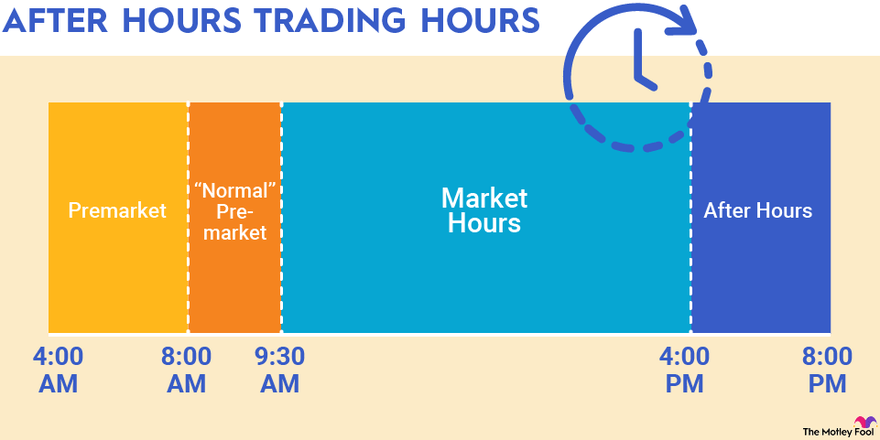

Extended hours trading, as the name suggests, extends the trading window for options contracts beyond the regular market hours. This extended trading period provides traders with an additional opportunity to execute options trades before the opening bell and after the closing bell, effectively prolonging the trading day and offering increased flexibility. Options traders can capitalize on this extended trading period to adjust their positions, take advantage of late-breaking news, or simply react to market volatility outside of regular trading hours.

The extended hours trading window is typically divided into two sessions: the pre-market session and the post-market session. The pre-market session generally begins an hour before the market opens and extends until the regular trading session commences, while the post-market session starts immediately after the market closes and runs for a period of up to two hours. Notably, not all options contracts are available for trading during extended hours. Only a select group of widely traded options contracts, known as “liquid options,” are eligible for extended hours trading. These liquid options include options on indices, such as the S&P 500 and Nasdaq 100, as well as options on individual stocks, such as Apple, Amazon, and Tesla, among others.

Unveiling the Advantages of Extended Hours Options Trading

Extended hours options trading offers several advantages that entice traders to venture beyond the confines of regular market hours. Firstly, it provides increased flexibility and convenience for traders, as it accommodates varying schedules and allows for trading outside of traditional business hours. Traders can conveniently execute trades before or after their regular work hours, allowing them to balance their trading activities with their personal commitments.

Secondly, extended hours options trading offers the potential for enhanced execution prices. Due to the reduced liquidity during extended hours, traders may encounter more favorable prices compared to those available during regular market hours. This enhanced price discovery can result in more efficient trade executions and potentially improved profitability.

Thirdly, extended hours options trading provides opportunities for news-driven strategies. Market-moving news events often occur outside of regular trading hours, such as earnings announcements or economic data releases. Extended hours options trading allows traders to swiftly respond to such events and swiftly adjust their positions to capitalize on market movements triggered by these news events.

Moreover, extended hours options trading offers opportunities for volatility trading strategies. Market volatility tends to be higher during extended hours trading sessions due to the reduced liquidity and the absence of large institutional traders. This increased volatility provides opportunities for traders to implement volatility trading strategies, such as straddles and strangles, which aim to profit from price swings in either direction.

Navigating the Potential Pitfalls of Extended Hours Options Trading

While extended hours options trading offers numerous advantages, it is essential to acknowledge its potential pitfalls to trade prudently. The reduced liquidity during extended hours can lead to wider bid-ask spreads and increased slippage, potentially affecting trade execution prices. Traders should be prepared for less favorable pricing and higher transaction costs compared to regular market hours.

Furthermore, the absence of large institutional traders during extended hours can result in a less efficient market, where price discovery may not be as robust as during regular trading hours. This reduced market depth can lead to greater price volatility and unpredictable market movements, requiring traders to exercise caution and implement proper risk management strategies.

Image: www.berotak.com

Mastering the Strategies for Extended Hours Options Trading

To succeed in extended hours options trading, traders should equip themselves with specialized strategies tailored to the unique characteristics of this trading environment. One effective strategy involves capitalizing on earnings announcements. By analyzing earnings expectations and historical price movements, traders can position themselves to profit from the often-volatile price swings that follow earnings releases, executing trades during the extended hours session immediately after the announcement.

Another strategy involves exploiting news-driven events. By monitoring news and economic data releases, traders can anticipate market reactions and swiftly adjust their options positions during extended hours trading to capture opportunities presented by these events. This strategy requires traders to stay abreast of market news and have a deep understanding of how different events can influence asset prices.

Furthermore, traders can employ volatility trading strategies during extended hours trading. Due to the increased volatility during this period, traders can implement strategies such as straddles and strangles to profit from price swings in either direction, capitalizing on the market’s uncertainty and heightened volatility. However, these strategies require a thorough understanding of options pricing and risk management techniques.

Trading Options In Extended Hours

Image: www.qmr.ai

Conclusion: Embracing the Allure of Extended Hours Options Trading

Extended hours options trading has transformed the landscape of options trading, offering traders a plethora of opportunities beyond the traditional market hours. By enhancing flexibility, providing favorable execution prices, and opening doors to news-driven strategies, extended hours trading empowers traders to capitalize on market movements and volatility outside of regular trading hours. However, it is imperative to navigate this trading environment with prudence, acknowledging its potential pitfalls and employing specialized strategies to mitigate risks and maximize rewards. Embrace the extended hours options trading arena with a blend of knowledge, agility, and strategic finesse, and unlock the captivating opportunities it presents.