Introduction

Trading options is a complex and risky endeavor that can yield substantial rewards but also carries the potential for significant losses. While many investors are lured by the allure of lucrative returns, it is crucial to approach options trading with a thorough understanding of the underlying mechanisms and potential pitfalls. This article delves into the complexities of options trading, examining the factors that can lead to devastating outcomes and providing guidance for mitigating these risks.

What are Options Contracts?

Options contracts are agreements between two parties, typically a buyer and a seller, that provide the buyer with the right but not the obligation to buy (in the case of call options) or sell (put options) an underlying asset at a specified price (strike price) by a certain date (expiration date). These contracts can be used for various purposes, such as speculation, hedging against potential losses, and generating income through options premiums.

Understanding the Risks Involved

Options trading involves inherent risks, and while having a baseline understanding is essential, it does not guarantee success. Novice traders or investors often underestimate these risks, leading to substantial losses that could have been avoided with proper preparation. Some key risks associated with options trading include:

• Leverage: Options contracts involve leverage, meaning that traders can control a larger position with a smaller investment, similar to using borrowed capital. This leverage can amplify both potential gains and losses.

Image: tradingwhale.io

• Expiration: Options have a limited lifespan; their value decays rapidly as the expiration date approaches. If the underlying asset’s price does not move favorably, the option can expire worthless, resulting in a complete loss of the premium paid.

• Volatility: Options are highly sensitive to price fluctuations in the underlying asset. High volatility can lead to sharp and unpredictable swings in options prices, increasing the risk of significant losses.

Common Mistakes in Options Trading

Numerous pitfalls can lead to substantial losses for traders when engaging in options trading. These mistakes often stem from a lack of experience or a fundamental misunderstanding of options mechanics. Some common errors that traders often make include:

• Trading Without a Plan: Entering trades without a predefined strategy, risk management plan, and clear objectives increases the chances of poor decision-making.

• Exceeding Margin Requirements: Options trading typically involves trading on margin, and exceeding margin requirements can result in margin calls and forced liquidations, potentially leading to catastrophic losses.

• Ignoring or Misunderstanding Greeks: Greeks are a set of metrics used to measure an option’s sensitivity to various factors such as price changes, time decay, and volatility. Misinterpreting or disregarding Greek values can result in poor trading decisions.

Strategies for Mitigating Risks

While options trading carries inherent risks, there are practical steps that traders can take to mitigate these risks and improve their chances of success:

• Proper Education: Before engaging in options trading, it is crucial to have a thorough understanding of the different types of options, their pricing models, and how they react to changing market conditions.

• Managing Risk: Effective risk management is essential for successful options trading. This involves setting clear profit targets and stop-loss orders to limit potential losses.

• Hedging Strategies: Hedging involves implementing techniques to offset the risk associated with one position by taking a corresponding position in a correlated asset. This helps reduce overall risk exposure.

Image: www.markettradersdaily.com

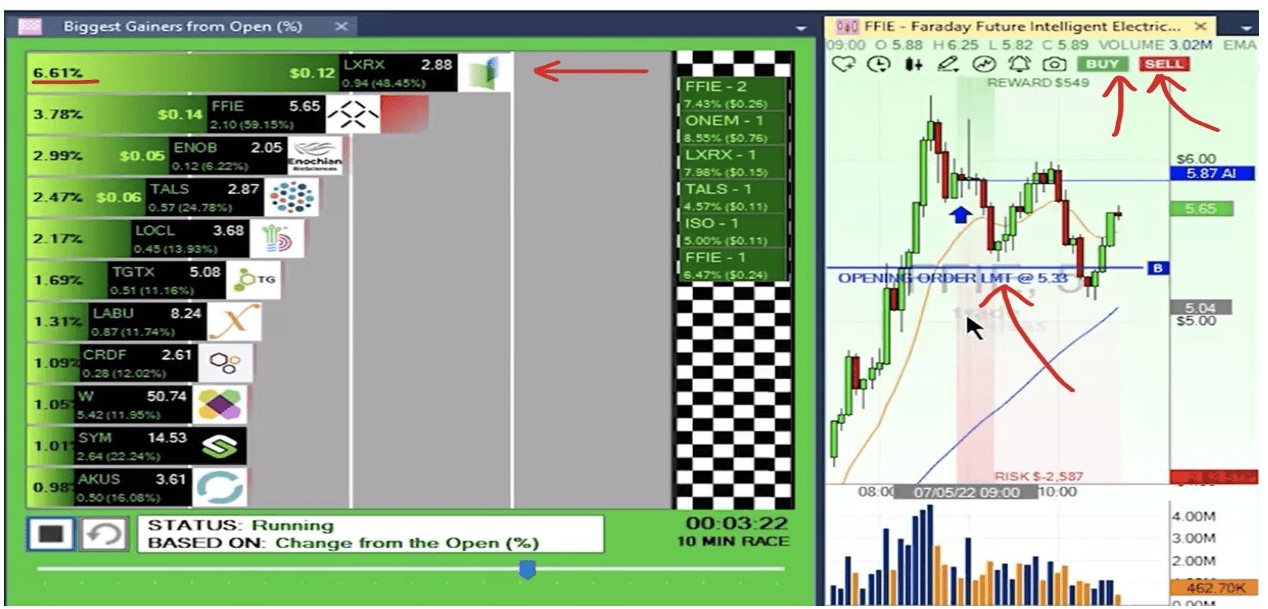

Trading Options Gone Wrong

Image: www.trade-ideas.com

Conclusion

Options trading offers the potential for high returns but is an inherently risky endeavor requiring a thorough understanding of its intricacies. Traders and investors would be well-advised to exercise caution, conduct thorough research, and seek professional guidance before engaging in options trading.