Trading Option Volatility: Harnessing Market Dynamics for Profitable Returns

Image: www.winfleet.fr

Imagine piloting an aircraft on a turbulent day, where unpredictable gusts of wind can disrupt your flight path. The same uncertainty prevails in financial markets, where prices fluctuate incessantly. But amidst the volatility, there lies an opportunity to navigate the turbulence and emerge victorious. Enter option volatility, a powerful tool that empowers traders to capitalize on market dynamics.

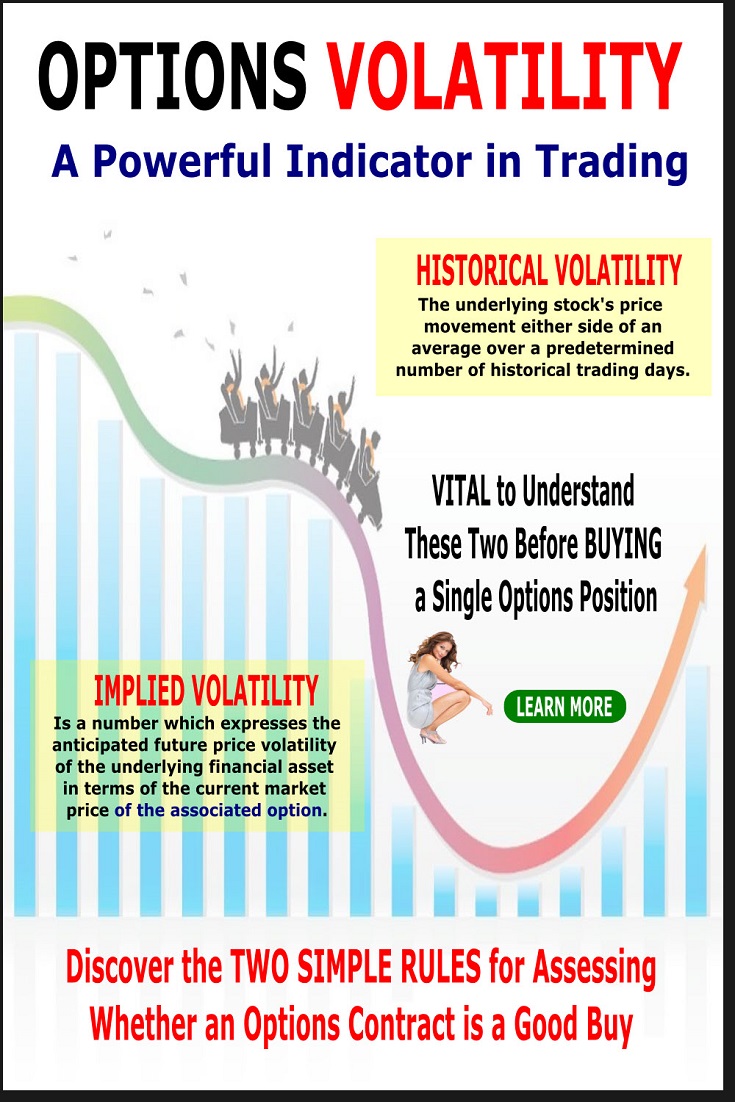

Understanding Option Volatility

An option is a financial instrument that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. Volatility, a measure of the speed and magnitude of price movements, is a crucial factor in option pricing. Higher volatility typically results in higher option premiums, as investors demand compensation for taking on increased risk.

Trading Option Volatility Strategies

Skilled traders recognize volatility as a double-edged sword, offering both risks and rewards. Several strategies allow traders to exploit market volatility:

- Long Volatility: Buying options with high volatility anticipates further price fluctuations. When volatility increases, the premium of these options rises.

- Short Volatility: Selling options with high volatility bets against significant price fluctuations. Traders profit when volatility decreases, causing the premium of these options to fall.

- Straddle: Buying both call and put options with the same strike price and expiration date. Traders benefit from large price movements in either direction.

- Strangle: Buying call and put options with different strike prices and the same expiration date. Traders expect moderate price swings within a range.

Expert Insights

“Volatility is the lifeblood of option trading,” says Mark Douglas, an experienced options trader. “Understanding and managing volatility is paramount to success.” Another renowned expert, Dr. Donald van Deventer, emphasizes the importance of scenario analysis. “Consider various volatility scenarios and develop contingency plans to navigate market uncertainty effectively.”

Actionable Tips

-

Monitor volatility indicators: Track historical and implied volatility measures to identify potential trading opportunities.

-

Set realistic expectations: Remember that volatility is unpredictable, and avoid risking more than you can afford to lose.

-

Manage risk: Use stop-loss orders and position-sizing strategies to limit your potential losses.

-

Stay informed: Stay up-to-date with market news, earnings reports, and economic data to anticipate potential changes in volatility.

Conclusion

Option volatility is an indispensable tool for navigating market turbulence and generating profitable returns. By embracing strategies, leveraging expert insights, and implementing actionable tips, traders can harness the power of volatility to enhance their investment portfolios and achieve financial success. Remember, volatility does not need to be feared but conquered with knowledge and strategy. Embrace the challenge and reap the rewards of trading option volatility.

Image: www.instafxng.com

Trading Option Volatility

Image: www.options-trading-mastery.com