Navigate the Intricate World of Options Trading

Imagine being able to predict the future and make profitable investments based on that knowledge. While that might sound like a superpower, it’s actually how options trading operates, making it a powerful tool for investors who want to enhance their financial potential. This comprehensive guide will unveil the intricacies of the options trading mechanism, empowering you with the insights and strategies to unlock its benefits.

Image: www.slideshare.net

Understanding Options: The Basic Building Blocks

Options are financial contracts that grant you the right, not the obligation, to buy or sell an underlying asset at a specified price, known as the strike price. These contracts come in two types: calls and puts. Call options give you the right to buy, while put options afford you the right to sell. The ability to make a profit comes from correctly predicting whether the underlying asset’s price will rise or fall and strategically exercising this right before the contract expires.

The Birth of Options: Origins and Evolution

Options trading has its roots in ancient Greece, where the philosopher Thales of Miletus is credited with pioneering the concept. Fast forward to the 19th century, options took shape in modern form on the Chicago Board of Trade. Today, they have become an integral part of financial markets around the globe, enabling investors to manage risk, speculate on price movements, and generate potential profits.

Option Pricing: The Intricate Web of Factors

Determining the price of an option is like unraveling a complex tapestry of influences. The most dominant factor is the underlying asset’s price and its expected volatility. Higher volatility implies a wider range of potential price swings, which in turn elevates option premiums. Other key considerations include time to expiration, interest rates, and supply and demand dynamics.

Image: globalalgoinvestment.com

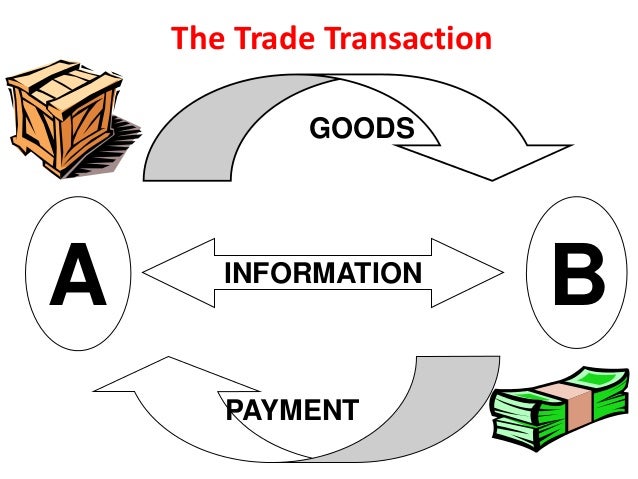

The Dynamics of Option Trading: A Two-Sided Affair

When you trade options, you enter the realm of two distinct roles: the buyer and the seller. As an option buyer, you possess the right to exercise the contract, while the seller bears the obligation to fulfill it. The buyer pays a premium to the seller for the privilege of this option, while the seller collects this premium and assumes the potential risk of being forced to buy or sell the underlying asset.

Options Strategies: The Art of Maximizing Profits

The options trading landscape is teeming with diverse strategies, each catering to specific market conditions and risk appetites. Some popular approaches include:

- Covered Calls: Selling call options against stocks you own, generating additional income by granting others the right to buy your shares at a predetermined price.

- Protective Puts: Buying put options to hedge against losses in underlying assets you hold, protecting your investments from price declines.

- Bull Call Spread: A bullish strategy involving buying a call option at a lower strike price and simultaneously selling another call option at a higher strike price, profiting when the underlying asset’s price rises above the lower strike price but remains below the higher one.

- Bear Put Spread: A bearish strategy similar to the bull call spread, but with the positions reversed, catering to expectations of a decline in the underlying asset’s price.

Trading Mechanism Of Options

Image: www.slideshare.net

Conclusion: The Power to Control Your Financial Destiny

Options trading empowers investors with unparalleled flexibility and control over their financial destiny. By understanding the intricacies of this powerful tool, you can navigate market fluctuations, mitigate risks, and maximize profits. Embark on your options trading journey today, unlocking a world of possibilities and financial empowerment.