Understanding the Illicit Practice and Its Damaging Effects

Insider trading, the illegal practice of using non-public information to make profitable trades, often takes covert and intricate forms, such as option exercise insider trading. This specialized type of insider trading exploits the knowledge of future option exercises by those with access to confidential information. Recognizing the gravity of this illicit activity and its far-reaching consequences is crucial.

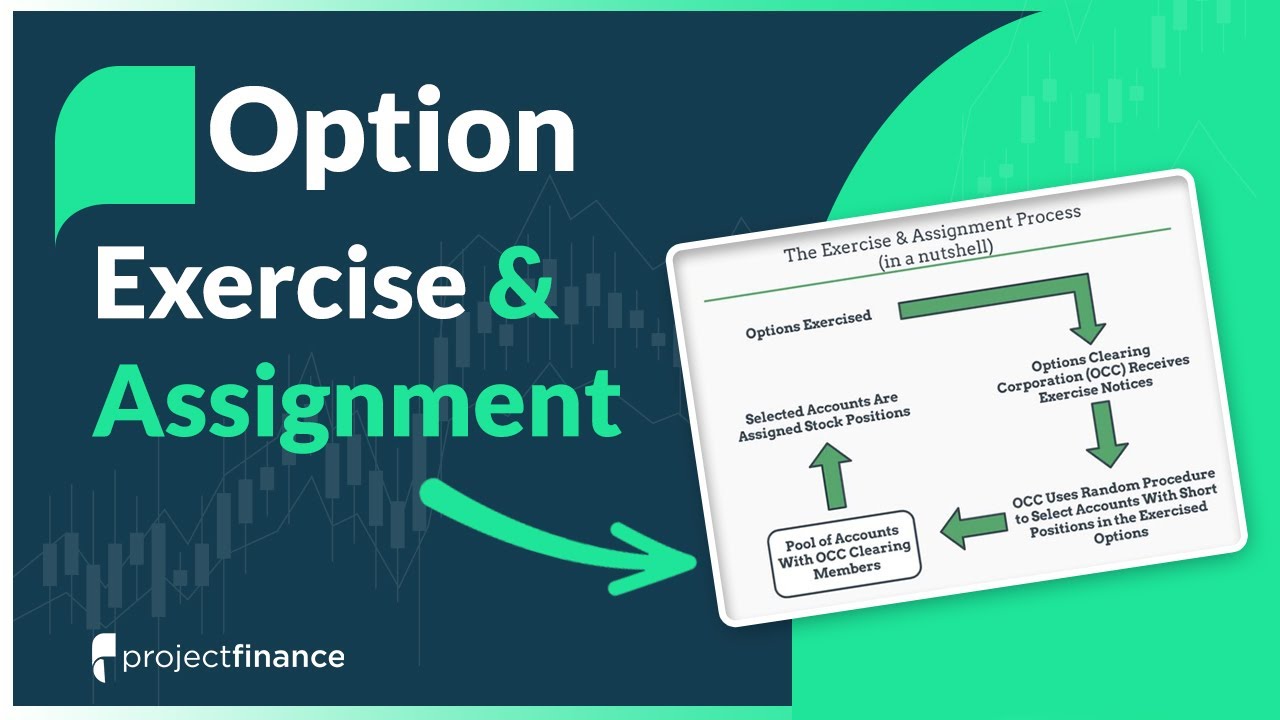

![Options: Exercise & Assignment [Guide]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607dada4d2fff8f1f69eadc3_Exercise-Assignment-Options-Trading-Option-Alpha-Handbook.png)

Image: optionalpha.com

Unveiling Option Exercise Insider Trading

Option exercise insider trading involves trading on non-public information about when insiders plan to exercise their stock options. Stock options grant employees the right to purchase a specific number of shares at a set price (the strike price), typically below the current market value, within a predetermined time frame. Exercising these options, which converts them into actual shares of stock, can significantly impact the company’s stock price.

Insiders, such as company executives or board members, are privy to confidential information regarding future events, including strategic plans, earnings projections, or impending mergers and acquisitions. This knowledge provides them with an unfair advantage over the general investing public. By using such information to time their option exercises, they can reap substantial profits at the expense of uninformed investors.

Consequences of Insider Trading: A Deeper Look

Option exercise insider trading not only violates ethical principles but also undermines the integrity of financial markets. It erodes investor confidence by creating an unfair playing field where some participants possess an unlawful edge. Market manipulation and price distortion can ensue, undermining the efficient functioning of the stock market.

Moreover, insider trading can lead to legal repercussions for perpetrators, including criminal charges, civil penalties, and disgorgement of ill-gotten gains. Regulatory authorities, such as the Securities and Exchange Commission (SEC), diligently investigate and prosecute insider trading cases, seeking to protect investors and maintain the fairness of the markets.

Uncovering the Warning Signs

Identifying potential option exercise insider trading can be challenging, but certain warning signs warrant scrutiny. Unusual trading patterns, particularly around option exercise dates, may indicate illicit activity. Additionally, unexplained price movements or sudden increases in trading volume can raise red flags.

Investors should remain vigilant and report any suspicious trading behavior to the relevant authorities. By staying informed and taking proactive measures, individuals can contribute to the fight against insider trading and safeguard the integrity of financial markets.

Image: www.youtube.com

Expert Insights: Combating Insider Trading

Dr. Jane Miller, a renowned expert in corporate governance, emphasizes the vital role of strong ethical values in preventing insider trading. “Corporate cultures that promote integrity and accountability are less likely to tolerate unethical behavior,” she explains. Dr. Miller advocates for transparent corporate policies, robust internal control systems, and ongoing ethics training programs to deter insider trading.

Professor Mark Johnson, a leading authority on financial regulation, highlights the importance of robust enforcement measures. “The SEC and other regulatory bodies play a crucial role in detecting, investigating, and prosecuting insider trading cases,” he states. Professor Johnson calls for increased resources and enhanced investigative techniques to uncover illicit activities and hold perpetrators accountable.

Empowering Investors: Protecting against Insider Trading

While insider trading remains a prevalent issue, investors can take steps to protect themselves from its damaging effects. Educating oneself about the warning signs of insider trading is essential. By remaining vigilant and reporting suspicious behavior, individuals can contribute to the fight against financial misconduct.

Moreover, investors should consider diversifying their portfolios and investing in multi-asset funds to minimize the potential impact of insider trading activities on their investments.

Option Exercise Insider Trading

Conclusion: Restoring Trust and Integrity

Option exercise insider trading undermines the fairness and efficiency of financial markets, eroding investor confidence and damaging the reputation of businesses. While detecting and prosecuting insider trading cases is complex, it is crucial to protect the integrity of markets, preserve public trust, and ensure a level playing field for all investors.

By embracing ethical practices, cooperating with regulatory authorities, and empowering investors with knowledge and resources, we can work collectively to combat insider trading, fostering a system where fair and transparent markets thrive. True market prosperity lies in adherence to ethical principles and unwavering commitment to investor protection.