In the bustling arena of financial markets, where fortunes are won and lost with every tick of the clock, a realm of possibilities awaits those who dare to explore the world of exchange-traded options. These versatile instruments empower investors with unprecedented flexibility, granting them the ability to hedge risks, speculate on market movements, and generate substantial returns.

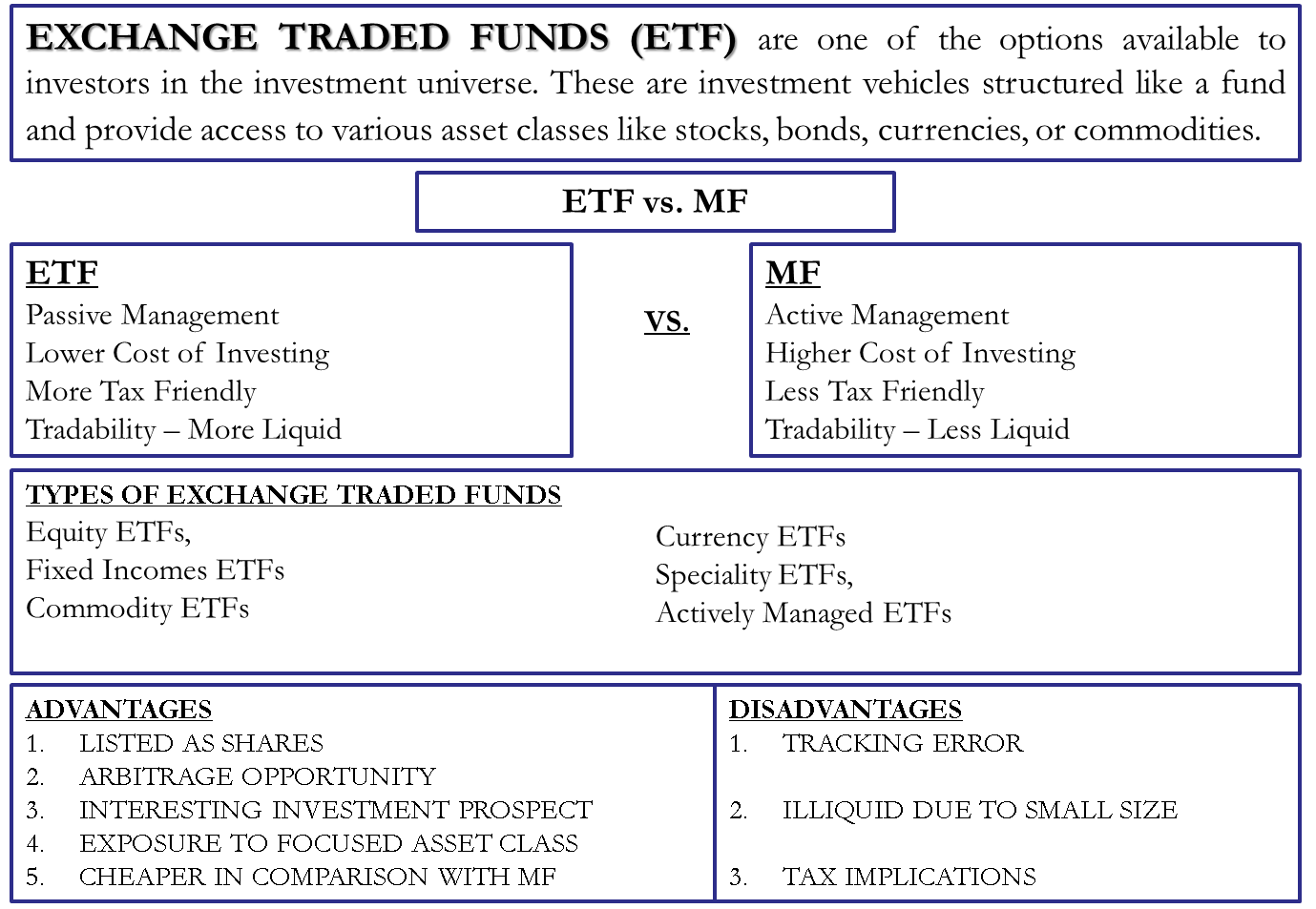

Image: efinancemanagement.com

Options trading may seem like an arcane art reserved for Wall Street wizards, but this comprehensive guide will demystify the concepts, unravel the complexities, and guide you towards becoming a proficient options trader.

Options: A Financial Swiss Army Knife

Exchange-traded options are contracts that grant the right, but not the obligation, to buy or sell a specific underlying asset at a predetermined price on a specified date. Unlike forwards and futures, options provide traders with the choice of exercising their contracts, making them a powerful tool for risk management and speculation.

Options are typically traded in pairs, consisting of call options, which bestow the right to buy, and put options, granting the right to sell the underlying asset. The price at which the option can be exercised is known as the strike price, and the date on which it expires is termed the expiration date.

The Symphony of Option Pricing

The value of an option is determined by a symphony of factors, including the intrinsic value, the time value, and the volatility of the underlying asset. Intrinsic value represents the difference between the strike price and the current market price of the underlying asset. Time value captures the premium investors are willing to pay for the remaining time until expiration. Lastly, volatility measures the fluctuations in the underlying asset’s price, which impacts the option’s value.

Expert Insights for Masterful Trading

Seasoned options traders have honed their skills through years of study and experience. By distilling their wisdom, we can glean invaluable insights for our own trading prowess.

1. Define Your Strategy: Before embarking on options trading, clearly define your investment objectives and risk tolerance. Determine whether you seek to generate income, hedge against volatility, or enhance diversification.

2. Master Risk Management Techniques: Understand that options trading carries inherent risks. Employ stop-loss orders, hedge your positions, and thoroughly research the underlying assets to mitigate potential losses.

3. Stay Abreast of Market Trends: Keep a watchful eye on market news, economic indicators, and geopolitical events, as these can significantly influence the price of options contracts.

4. Patience is a Virtue: Options trading rewards patience. Avoid the temptation to react impulsively to market fluctuations. Allow time for your strategies to play out and reap the full benefits.

Image: rltshows.com

Navigating the Options Landscape

Q: What are the key elements of an options contract?

A: An options contract includes the underlying asset, strike price, expiration date, and call or put designation.

Q: How does volatility affect options trading?

A: Volatility can amplify the potential returns from options trading but also amplifies the associated risks.

Q: Are options suitable for all investors?

A: Options trading is not suitable for investors with limited financial experience or those who cannot tolerate significant risk.

Trading Exchange Traded Options

Image: purepowerpicks.com

Conclusion: Embracing the Power of Options

Exchange-traded options represent a powerful investment tool that can elevate your trading strategies to new heights. By embracing the concepts outlined in this guide and seeking the wisdom of experienced traders, you can unlock the potential of these versatile contracts. Whether you seek to tame market volatility, seize speculative opportunities, or simply enhance your investment portfolio, options can be the key to unlocking your financial aspirations.

Are you ready to explore the world of options trading and embark on a journey towards financial empowerment? Embrace the challenge, master the intricacies, and let the power of options be your guiding force in the relentless pursuit of profit.