Trading Earnings Options: A Lucrative Journey into Market Uncertainties

The world of options trading presents a myriad of opportunities for investors seeking to amplify their returns. Among the most adrenaline-pumping segments is trading earnings options, a strategic maneuver that requires meticulous preparation and nerves of steel. In this comprehensive guide, we will delve into the intricacies of earnings options trading, empowering you with the knowledge and tools to navigate this exhilarating arena.

Image: www.fidelity.com

Deciphering Earnings Options: A Path to Quantified Uncertainties

Earnings options are specialized financial instruments that derive their value from the underlying stock’s price volatility around an earnings announcement. These options grant investors the right, but not the obligation, to buy (call options) or sell (put options) a specific number of shares of a particular stock at a predetermined strike price on or before a set expiration date.

The allure of earnings options lies in their ability to capitalize on the unpredictable market reactions to earnings releases. When a company surpasses or falls short of analysts’ earnings estimates, the stock price can experience significant fluctuations, creating a fertile ground for astute options traders to reap profits.

Anatomy of Earnings Options Trading: Precision in the Midst of Volatility

Executing successful earnings options trades demands a meticulous approach. Here’s a step-by-step guide to help you master this art:

1. Identifying the Ideal Candidates: Pre-Earnings Screening

a. Historical Volatility: Stocks with historically high volatility during earnings seasons emerge as potential candidates for earnings options trades.

b. Analyst Expectations: Companies with widely divergent analyst estimates for upcoming earnings announcements present opportunities for both upside and downside plays.

2. Timing the Options Purchase: A Balancing Act

a. Days to Expiration: Options with expirations close to the earnings announcement date provide the highest theta decay and potential for significant gains.

b. Time Value: Purchasing options with a shorter time to expiration decreases their time value and lowers the premium you pay.

3. Selecting Strike Prices: Precision in the Face of Uncertainty

a. In-the-Money: Options with strike prices close to the current stock price amplify the potential gains in the desired direction but come at a higher premium.

b. Out-of-the-Money: Options with strike prices distant from the current stock price reduce premium costs but also limit profit potential.

Image: tradeproacademy.com

4. Managing the Trade: A Calculated Approach

a. Profit Targets: Setting realistic profit targets helps you secure gains while managing risk tolerance.

b. Stop-Loss Orders: Employing stop-loss orders protects you from excessive losses in the event of unforeseen market movements.

c. Position Sizing: Prudent position sizing ensures that your overall investment exposure aligns with your risk appetite.

Trading Earnings Options Guide

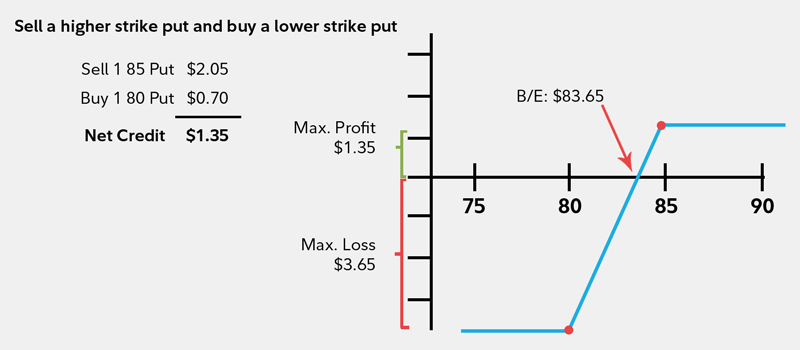

Image: pivotaloptionstrading.wordpress.com

5. Embracing the Power of Analysis Tools: Charting the Market’s Pulse

a. Technical Analysis: Utilizing technical indicators such as Bollinger Bands and moving averages can provide valuable insights into price momentum and support/resistance levels.

b. Sentimental Analysis: Gauging market sentiment through social media, news articles, and option volume data can illuminate the broader market perception of a stock.

Conclusion: Embracing Unpredictability and Maximizing Returns

Trading earnings options is not for the faint of heart. It requires a thorough understanding of options mechanics, relentless market monitoring, and an appetite for calculated risks. However, with the right knowledge and strategies, you can harness the inherent volatility surrounding earnings announcements to uncover substantial profit opportunities. By meticulously following the steps outlined in this comprehensive guide, you will be well-equipped to navigate the ebb and flow of earnings-driven market movements and emerge as a formidable earnings options trader.