In the ever-evolving financial landscape, Australian options have emerged as a compelling investment vehicle for individuals seeking to capitalize on market dynamics. Whether you’re a seasoned investor or just starting your journey, understanding the intricacies of Australian options trading can open doors to a world of opportunities. This comprehensive guide takes you on an immersive journey into this exciting realm, empowering you with the knowledge and strategies to navigate the complexities and unlock the potential of trading Australian options.

Image: www.australianbusinesstimes.com

A Window into the World of Australian Options

Options contracts, in essence, grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. Australian options, a subset of the options universe, offer a unique opportunity to trade on the price movements of Australian financial instruments, such as stocks, indexes, and currencies.

A Journey through Key Concepts and Terminology

To fully grasp the dynamics of Australian options trading, it’s essential to master a few fundamental concepts. Calls, options that confer the right to buy, and puts, options that provide the right to sell, form the cornerstone of this trading realm. Strike price, representing the predetermined price at which the underlying asset can be bought or sold, plays a pivotal role in defining an option contract’s potential. Two crucial dates, exercise date, when the buyer can exercise their right, and expiration date, when the option expires and becomes worthless, set the timeframe for decisive actions.

Options Strategies: A Blueprint for Success

The art of options trading lies in devising strategies that align with your risk appetite and profit objectives. Covered call writing, a conservative approach, involves selling a call option while owning the underlying asset, seeking to generate income from the premium received. Cash-secured puts, another prudent strategy, entail selling a put option while holding sufficient cash to potentially acquire the underlying asset if the option is exercised. For those seeking higher returns with increased risk, naked options strategies, such as selling naked calls or puts, offer the potential for significant profits but also carry substantial risk.

Image: stockhax.com

Expert Insights: Navigating Market Uncertainties

To gain an edge in the dynamic options market, it’s invaluable to seek guidance from seasoned experts. Listen to their wisdom, learn from their experiences, and distill their insights to refine your trading strategies. Stay abreast of market trends, analyze historical data, and never lose sight of the potential risks involved. Remember, knowledge is a powerful weapon in the hands of astute investors.

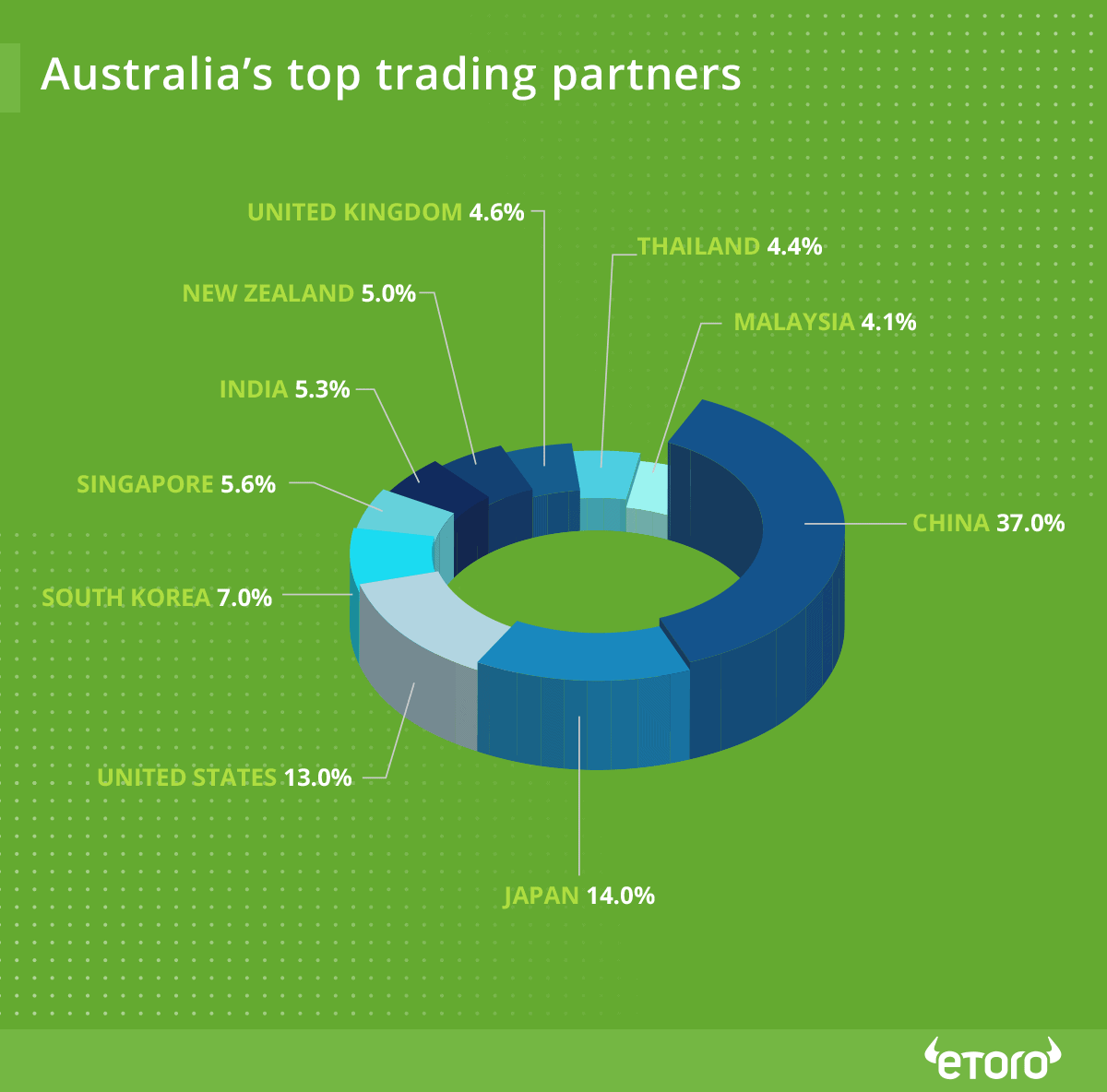

Trading Australian Options

Image: www.etoro.com

The Path to Success: A Continuous Journey

Mastering the intricacies of Australian options trading is not a destination but an ongoing journey. Stay committed to learning and growing, adapt to evolving market conditions, and consistently seek opportunities to hone your skills. The world of options trading is a treasure-trove of possibilities, and with the right approach, you can unlock its full potential.

As you embark on this exciting journey, remember that trading Australian options, like any form of investment, carries inherent risks. Always conduct thorough research, understand your risk tolerance, and seek professional guidance when necessary. With patience, dedication, and a firm grasp of the concepts outlined here, you can transform yourself into a confident and successful Australian options trader.