Unveiling the Essential Strategies for Informed Decision-Making

Options trading, a vibrant and dynamic landscape, offers traders a plethora of opportunities and risks. One crucial aspect of navigating this complex realm is understanding and utilizing TradeStops. These strategic tools empower traders to manage risk, optimize returns, and make informed decisions that can profoundly impact their trading outcomes.

Image: www.asktraders.com

Simply put, TradeStops refer to pre-determined price levels at which traders execute orders to mitigate losses or secure profits. By establishing TradeStops, traders essentially create a framework that guides their actions based on predefined thresholds. This proactive approach ensures a disciplined and systematic trading approach, eliminating the influence of emotions and impulsive decision-making.

Types of TradeStops

- Stop-Loss Orders: These orders are triggered when the underlying asset’s price falls below a predetermined level, automatically selling the option to minimize losses.

- Take-Profit Orders: These orders execute when the underlying asset’s price rises above a set level, automatically selling the option to capture profits.

- Trailing Stop-Loss Orders: This dynamic type of stop-loss order adjusts its price level as the underlying asset’s price moves in a favorable direction. This feature allows traders to lock in profits while maintaining their exposure to potential upside.

Benefits of Using TradeStops

- Risk Management: TradeStops serve as a safety net, limiting potential losses in adverse market conditions.

- Discipline and Objectivity: By pre-defining clear exit points, TradeStops remove the temptation to override rational decisions with emotional responses amidst market volatility.

- Time Management: Automating order execution frees up traders’ time, allowing them to focus on other aspects of trading or pursuit of other endeavors.

Expert Tips for Effective TradeStop Implementation

Maximizing the effectiveness of TradeStops requires a strategic approach. Here are some expert tips:

- Choose Appropriate Types: Determine the most suitable type of TradeStop (stop-loss, take-profit, or trailing stop-loss) for each specific trade scenario.

- Set Realistic Levels: Avoid unrealistic price targets for TradeStops. Instead, base them on thorough technical analysis and market conditions.

- Consider Volatility: Highly volatile assets may require wider stop-loss levels to avoid premature execution.

- Monitor Market Dynamics: Stay abreast of news, economic events, and market sentiment to adjust TradeStops accordingly.

Image: tradingreview.net

FAQ on TradeStops

Q: Are TradeStops suitable for all traders?

A: TradeStops are beneficial for traders of all experience levels, from beginners to seasoned professionals.

Q: Can I use multiple TradeStops on a single trade?

A: Yes, it is possible to utilize multiple TradeStops for the same trade. This technique allows you to create more complex strategies and manage risk more effectively.

Q: How do I avoid having my TradeStops triggered prematurely?

A: Setting realistic price levels and considering volatility are crucial to prevent premature triggering of TradeStops. Additionally, using limit orders instead of market orders can provide greater precision in execution.

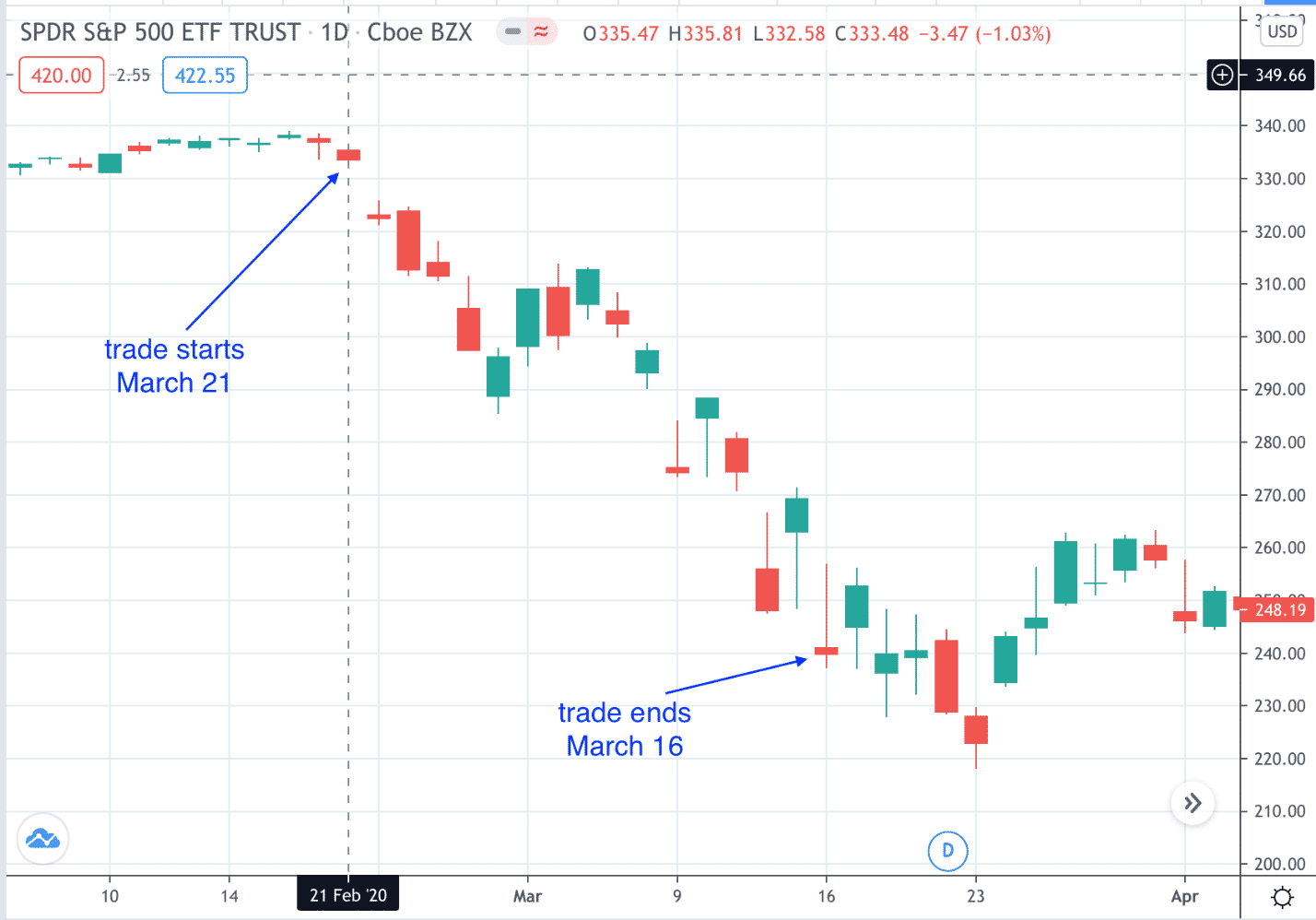

Tradestops For Options Trading

Image: optionstradingiq.com

Conclusion

Mastering TradeStops is an essential component of successful options trading. By incorporating these strategic tools into their trading plans, traders gain a significant advantage in managing risk, optimizing returns, and maintaining discipline amidst market fluctuations. Embrace the power of TradeStops and embark on a more informed and empowered trading journey.

Are you intrigued by the world of TradeStops and how they can transform your options trading experience? Share your thoughts, experiences, or any burning questions you may have in the comments section below.