Unveiling the Potential and Risks of Option Trading in High-Fluctuating Stocks

The world of stock market trading is filled with a spectrum of opportunities and risks. For thrill-seekers and experienced traders alike, volatile stocks offer a tantalizing arena where astronomical gains can be made – but remember, with great rewards come great volatility. Options trading, a derivative strategy that grants the right but not the obligation to buy or sell an underlying asset, allows traders to amplify their returns in these dynamic markets. Here, we delve into the top 20 most volatile stocks that present both immense potential and inherent risks for option traders.

Image: www.youtube.com

Section 1: Understanding Volatility and Option Trading

Volatility, a measure of the rate at which stock prices fluctuate, is a double-edged sword in the world of options trading. On the one hand, it magnifies potential profits as options premiums tend to be higher for more volatile stocks. On the other hand, it augments risk, making volatility a crucial factor for traders to consider. Options contracts, derived from underlying assets like stocks, allow traders to capitalize on price movements, betting on future directions without the full commitment of ownership. By purchasing an option, traders gain the right but not the obligation to buy (call option) or sell (put option) an underlying stock at a set price on or before a specific date.

Section 2: Unveiling the Top 20 Most Volatile Stocks

1. Tesla (TSLA): The electric vehicle giant has consistently captured headlines with its disruptive approach and ambitious goals, leading to significant price swings.

2. GameStop (GME): The infamous “meme stock” of 2021, GME remains highly volatile due to its large retail investor base and social media hype.

3. AMC Entertainment (AMC): Another “meme stock” that has experienced extreme volatility, AMC benefits from the resurgence of movie theater attendance and strategic acquisitions.

4. Bed Bath & Beyond (BBBY): The home goods retailer has faced significant challenges but has witnessed occasional spikes due to short squeezes and activist investor involvement.

5. Rivian Automotive (RIVN): The electric vehicle startup has faced production delays and supply chain issues, impacting its stock price volatility.

6. Nvidia (NVDA): A leader in the semiconductor industry, NVDA’s stock is swayed by technological advancements, chip demand, and global economic conditions.

7. Advanced Micro Devices (AMD): A formidable competitor to Intel, AMD’s stock reflects fluctuations in the tech sector and broader market sentiments.

8. DraftKings (DKNG): The sports betting and gaming company experiences volatility tied to industry regulations, competition, and user engagement.

9. Coinbase (COIN): The cryptocurrency exchange platform’s stock is highly sensitive to the fluctuations and sentiments in the crypto market.

10. Beyond Meat (BYND): The plant-based meat producer’s stock has experienced volatility due to consumer preferences, supply chain challenges, and industry competition.

11. Tilray (TLRY): The Canadian cannabis company’s stock is impacted by regulatory changes, industry consolidation, and global legalization trends.

12. Moderna (MRNA): A pioneer in mRNA vaccines, MRNA’s stock is heavily influenced by COVID-19 news, pandemic developments, and vaccine efficacy.

13. Pfizer (PFE): The pharmaceutical giant’s stock is swayed by drug approvals, clinical trial results, and the overall healthcare landscape.

14. Zoom Video Communications (ZM): The video conferencing platform’s stock has shown volatility due to post-pandemic transitions, competition, and changing workplace dynamics.

15. ChargePoint Holdings (CHPT): The electric vehicle charging infrastructure provider’s stock is impacted by EV adoption rates, government incentives, and technological advancements.

16. Virgin Galactic (SPCE): The space tourism company’s stock is highly speculative and reacts to flight delays, launch announcements, and overall space exploration enthusiasm.

17. Workhorse Group (WKHS): The electric vehicle and drone manufacturer’s stock has experienced volatility due to production challenges, competition, and regulatory scrutiny.

18. QuantumScape (QS): The solid-state battery developer’s stock is influenced by technological breakthroughs, industry competition, and investor sentiment towards emerging technologies.

19. Faraday Future Intelligent Electric (FFIE): The Chinese electric vehicle startup’s stock is swayed by production timelines, funding challenges, and the competitive EV landscape.

20. Nikola Corporation (NKLA): The electric and hydrogen truck manufacturer’s stock has been volatile due to regulatory investigations, production delays, and skepticism surrounding its technology.

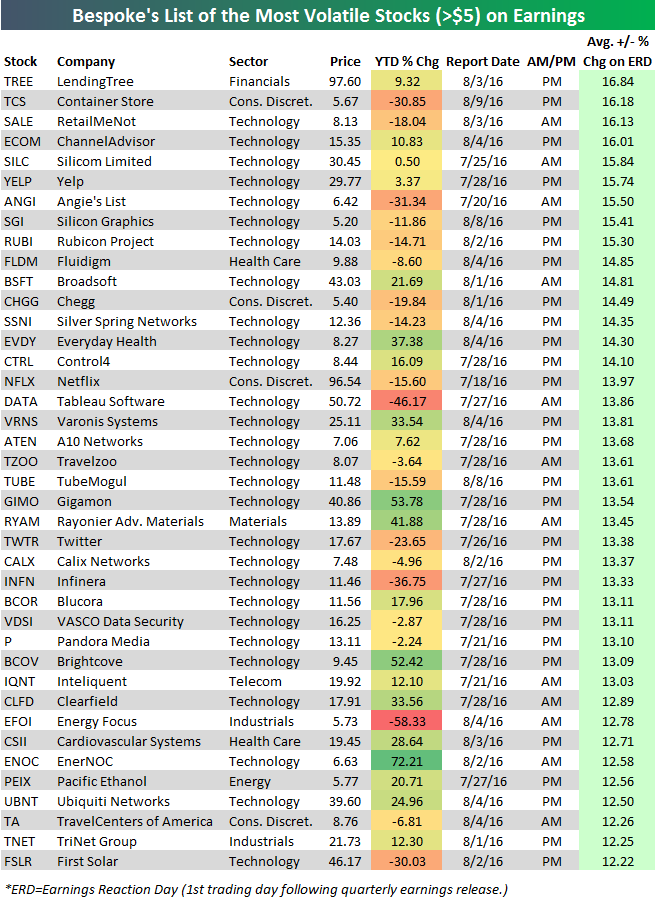

Image: www.bespokepremium.com

Top 20 Most Volatile Stocks For Trading Options

Image: www.tradingsim.com

Conclusion

For those seeking both high rewards and the accompanying risks, the top 20 most volatile stocks present a compelling opportunity for options trading. Before venturing into these dynamic markets, traders must thoroughly research individual stocks, understand the complexities of options strategies, and exercise proper risk management techniques. Remember, the pursuit of rapid profits should always be balanced with prudence and a clear understanding of both the potential and the pitfalls that await in the world of volatile stocks.