Introduction: Uncovering the World of Vanguard Options Trading Fees

Embarking on the dynamic realm of options trading offers a myriad of opportunities for savvy investors. Among the frontrunners in this arena stands Vanguard, renowned for its unwavering commitment to low-cost investment solutions. Delving into the intricacies of Vanguard options trading fees is paramount for investors seeking to maximize returns while minimizing expenses. This comprehensive guide will illuminate the nuances of Vanguard’s fee structure, empowering traders to make informed decisions that align with their financial goals.

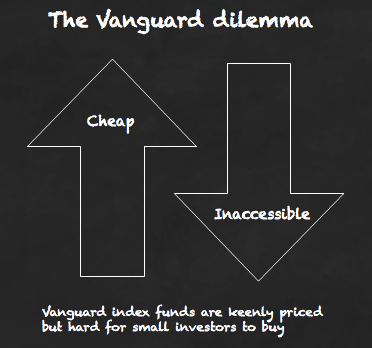

Image: monevator.com

Section 1: Unveiling the Structures of Vanguard Options Trading Fees

Vanguard’s approach to options trading fees is characterized by transparency and affordability. At the outset, a flat-rate commission fee applies to each options contract traded. This fee is typically a fraction of the industry average, enabling Vanguard clients to retain a greater portion of their trading profits. Additionally, Vanguard does not levy any account fees, annual account maintenance charges, or options assignment fees. These cost-saving measures are a testament to Vanguard’s unwavering dedication to helping investors preserve their hard-earned capital.

Section 2: Exploring the Impact of Contract Type on Fees

The specific contract type traded also influences the magnitude of Vanguard options trading fees. Equity options, which grant traders the right to buy or sell an underlying stock, typically incur lower fees compared to index options or exchange-traded funds (ETFs). Index options, on the other hand, offer exposure to a broader market segment and may be subject to higher fees accordingly. As such, traders should carefully consider the type of contract that aligns with their investment objectives and assess the associated fee implications.

Section 3: Fee Waivers: A Potential Avenue for Savings

In certain instances, Vanguard may offer fee waivers for high-volume traders or those who meet specific eligibility criteria. These waivers can significantly reduce trading costs, further enhancing the value proposition for active options traders. By exceeding specified trading thresholds or consistently demonstrating high levels of trading activity, traders may qualify for these fee reductions. It is advisable for traders to consult with Vanguard directly to ascertain their eligibility for potential fee waivers.

Image: suttonhond1960.blogspot.com

Section 4: Comparing Vanguard Fees to Industry Benchmarks

Assessing Vanguard’s options trading fees in comparison to industry peers provides valuable insights into the cost-effectiveness of their platform. Analysis consistently reveals that Vanguard’s fees are among the lowest in the industry. This competitive advantage allows traders to execute options trades with confidence, knowing that they are not sacrificing profitability to excessive trading costs. By leveraging Vanguard’s low-fee structure, investors can optimize their returns and achieve their financial objectives more efficiently.

Section 5: The Role of Margin Trading and Interest Costs

Margin trading, which involves borrowing funds to enhance purchasing power, is a strategy commonly employed by options traders. While margin trading can amplify potential profits, it also introduces the element of interest costs. Vanguard charges interest on margin balances, and these costs should be carefully considered when evaluating the overall profitability of options trades. By factoring in margin interest costs, traders can make informed decisions regarding their trading strategies and risk tolerance.

Section 6: Maximizing Value through Disciplined Trading Practices

Beyond the direct trading fees, there are additional measures that traders can implement to further maximize value while trading options with Vanguard. Discipline and sound trading practices play a critical role in achieving this goal. To minimize costs, traders should focus on executing well-researched trades with a clear understanding of the risks involved. Avoiding emotional trading, overtrading, and chasing after quick profits can help traders make rational decisions and preserve their capital.

Section 7: Vanguard’s Commitment to Client Education and Support

Vanguard recognizes the vital role that education and support play in the success of its clients. The firm provides a wealth of educational resources, including articles, webinars, and seminars, to equip traders with the knowledge and skills necessary for effective options trading. Additionally, Vanguard’s dedicated customer support team is readily available to address any questions or concerns traders may have. This commitment to client support fosters a positive trading experience and empowers investors to make informed decisions.

Vanguard Options Trading Fees

Conclusion: Vanguard Options Trading Fees: A Gateway to Profitable Trading

Vanguard’s options trading fees are designed to empower investors with a cost-effective and accessible platform for pursuing their trading objectives. By offering low flat-rate commissions, eliminating unnecessary account fees, and providing potential fee waivers, Vanguard has established itself as a leader in providing value-conscious options trading services. Understanding the intricacies of Vanguard’s fee structure allows traders to optimize their trading strategies, minimize expenses, and maximize returns. As a result, Vanguard options trading fees serve as a gateway to profitable trading for both experienced and aspiring options traders.