Introduction

In the fast-paced world of options trading, automation can be a game-changer. With the right strategies and tools, you can harness the power of technology to streamline your trading and potentially improve your profitability. Thinkorswim, a leading trading platform from TD Ameritrade, offers robust automated options trading capabilities that cater to a wide range of traders. In this comprehensive guide, we will delve into the intricacies of thinkorswim automated options trading, exploring strategies, setups, and execution techniques that can empower you in the financial markets.

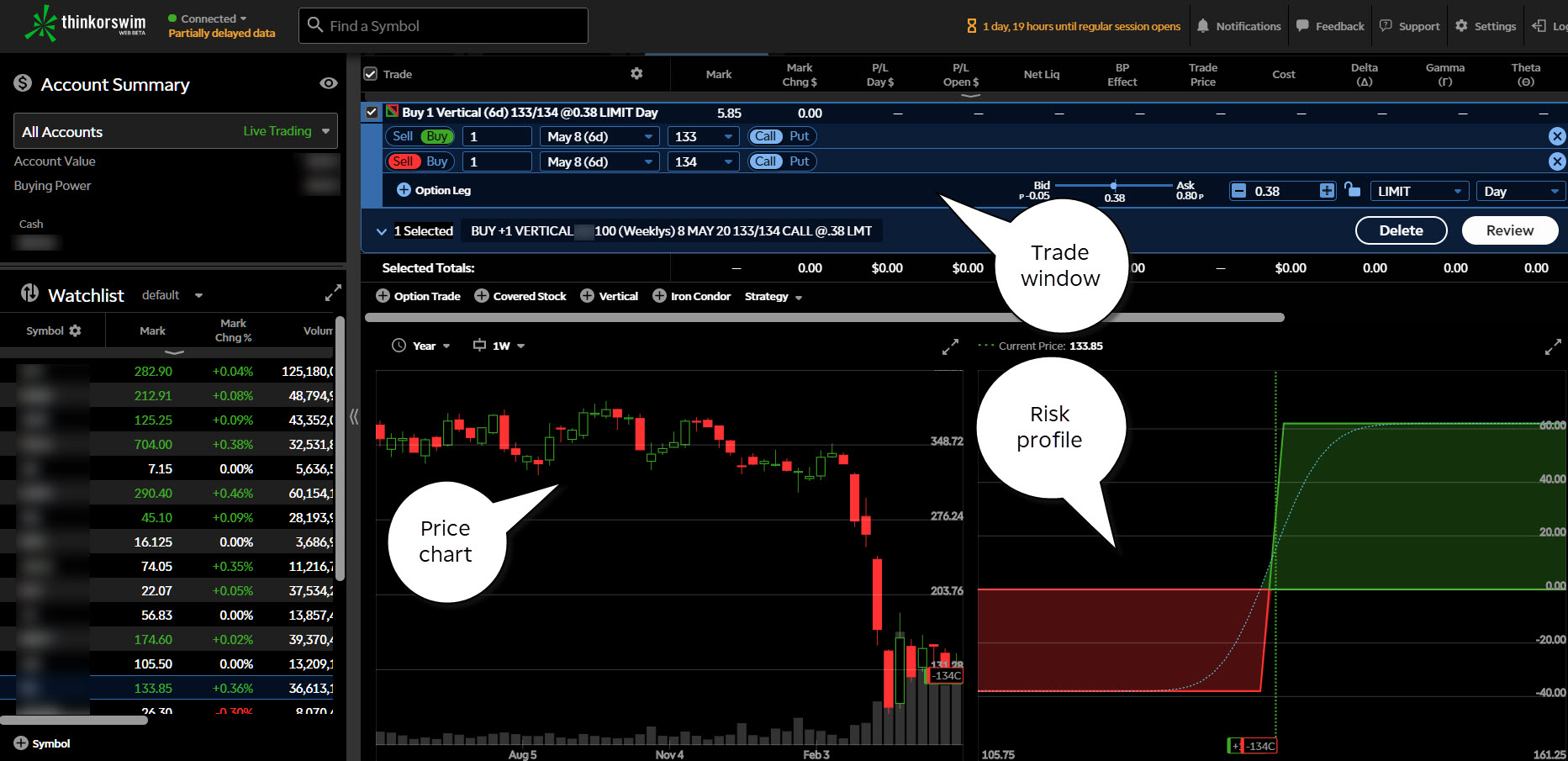

Image: www.youtube.com

Understanding Automated Options Trading with Thinkorswim

Automated options trading utilizes software or algorithms to execute pre-defined trading strategies on your behalf. Thinkorswim’s ThinkScript programming language provides a powerful and accessible platform to create automated trading systems. These systems can monitor market conditions, analyze price action, and automatically place and manage trades based on your specified parameters. By automating the trading process, you can save time, reduce emotional decision-making, and potentially enhance your consistency.

Essential Strategies for Automated Options Trading

The foundation of successful automated options trading lies in a well-defined strategy. Here are some popular strategies to consider:

- Delta-Neutral Trading: Aiming to maintain a neutral delta position, traders capitalize on time decay and volatility.

- Multi-Leg Option Strategies: Combining multiple options legs to create customized risk and reward profiles.

- Pairs Trading: Trading correlated assets in opposite directions to take advantage of price convergence or divergence.

- Trend Following: Utilizing trend-following indicators to identify and trade with market momentum.

- Volatility Trading: Exploiting price fluctuations through options strategies designed to profit from volatility.

Setting Up Automated Options Trading Systems

- Define Entry and Exit Criteria: Determine the conditions under which your system will enter and exit trades.

- Configure Risk Management Parameters: Set limits on position size, account risk, and profit targets to manage potential losses.

- Test and Optimize: Use backtesting or simulation to evaluate your system’s performance under various market conditions.

- Establish Execution Procedures: Define how and when your system will execute trades, including order placement and price thresholds.

Image: www.pinterest.com

Executing Automated Options Trades

- Monitor Market Conditions: Keep an eye on market events, news, and economic data that may affect your automated trading system.

- Review Execution Logs: Regularly check the execution logs to assess the performance of your automated trades and make any necessary adjustments.

- Manage Positions: Monitor open positions, adjust risk parameters, and close trades as per your strategy and market conditions.

- Fine-Tune Your System: Continuously evaluate your automated options trading system and make refinements to optimize its performance.

Thinkorswim Automated Options Trading

Image: www.kingdavidsuite.com

Conclusion

Automated options trading with Thinkorswim can empower traders of all levels to navigate the financial markets more efficiently and potentially increase their profitability. By embracing the power of technology, you can automate trading strategies, execute orders with precision, and maximize your productivity. However, it’s crucial to approach automated trading with a well-defined strategy, a thoughtful setup process, and a commitment to ongoing monitoring and refinement. As you gain experience and refine your systems, automated options trading can become a valuable tool in your trading toolkit, enabling you to achieve your financial goals.