Introduction:

The world of finance offers a myriad of avenues for investors to achieve their financial goals. Among the most sophisticated and potentially lucrative strategies is options trading. Options, as financial instruments, empower traders with the flexibility to navigate market dynamics, hedge risks, and amplify potential returns. Understanding the intricacies of options trading can pave the way for investors to maximize their market opportunities.

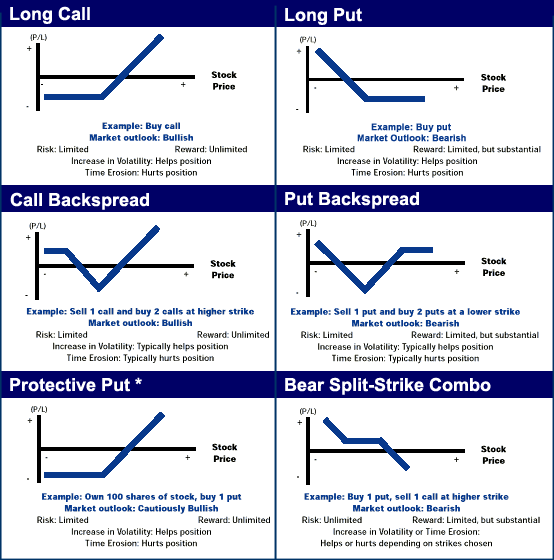

Image: www.tradethetechnicals.com

Options, in essence, represent contracts granting the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This unique characteristic allows traders to speculate on the future price movements of various assets, including stocks, indices, and commodities.

Options Trading Strategies:

Navigating the options market demands a thorough grasp of various trading strategies. Each strategy entails unique objectives, risk profiles, and profit potential. Some of the most commonly employed options trading strategies include:

1. Covered Call:

A covered call strategy involves selling (writing) call options while simultaneously owning the underlying asset. The option seller receives a premium from the option buyer in exchange for the obligation to sell the asset at the strike price if the option is exercised. This strategy is suitable for investors who are bullish on an asset but wish to generate income from their holdings.

2. Protective Put:

Protective put strategies involve purchasing (buying) put options as a hedge against potential declines in the value of an asset. If the asset’s price falls below the strike price, the put option can be exercised, enabling the trader to sell the asset at a predetermined price, thus protecting against losses.

Image: seekingalpha.com

3. Long Straddle:

A long straddle strategy entails buying both call and put options with the same strike price but different expiration dates. The aim of this strategy is to profit from significant price fluctuations in either direction, as its value increases with increased volatility.

4. Iron Condor:

Iron condor strategies involve selling both call and put options with different strike prices and expiration dates. This strategy is employed when traders anticipate a period of low volatility in the underlying asset. A successful iron condor strategy generates income from the premium received from option buyers.

Risk Management in Options Trading:

Options trading carries inherent risks, making it imperative for traders to prioritize risk management. Effective risk management practices include:

1. Understanding Greeks:

The Greeks, such as Delta, Gamma, and Theta, measure how an option’s value responds to changes in underlying asset prices, time, and other variables. Comprehending these Greeks aids traders in understanding the potential risks and returns of an options position.

2. Position Sizing:

Thoughtful position sizing involves allocating only a portion of capital to each options trade. This strategic allocation mitigates the impact of any potential losses on the overall portfolio.

3. Monitoring Market Conditions:

Continuously monitoring market conditions, such as volatility levels, news events, and economic data, empowers traders to make informed decisions and adjust their strategies accordingly.

The Ultimate Options Trading Strategy

Image: sites.psu.edu

Conclusion:

Options trading presents a powerful tool for investors seeking advanced financial strategies. By harnessing the understanding of different options trading strategies, managing risks judiciously, and maintaining a proactive approach to market monitoring, traders can exploit market opportunities and strive towards maximizing their financial potential.