Investing in the global financial arena has always been a high-stakes venture, requiring insightful decision-making and meticulous planning. The planning committee often faces the daunting task of evaluating potential investment opportunities and determining the optimal course of action. One such strategy that has garnered significant attention in recent years is options trading. Understanding the intricacies of options trading, its potential advantages, and associated risks can empower the planning committee to make informed decisions that align with their financial objectives.

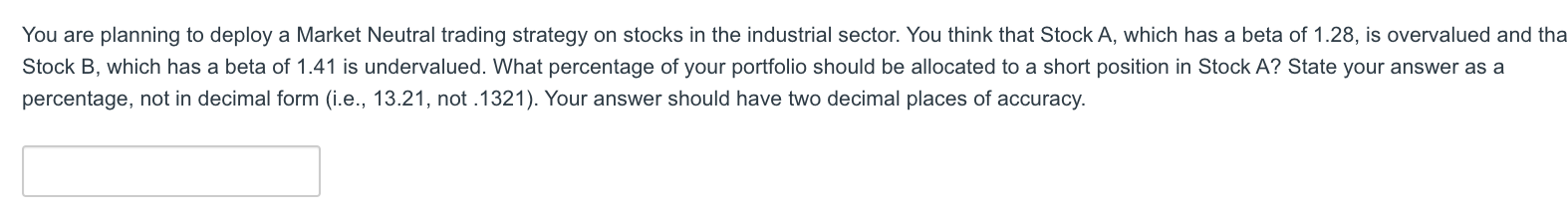

Image: www.chegg.com

What is Options Trading?

In the realm of financial markets, options trading grants individuals the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or commodity, at a predetermined price (strike price) on or before a specific date (expiration date). This flexibility allows investors to speculate on future price movements of the asset, potentially generating substantial returns.

Example: Assume the current price of a particular stock is $50. An investor optimistic about the stock’s potential growth could purchase a call option with a strike price of $55 and an expiration date in two months. If the stock price rises above $55 before the expiration, the investor can exercise their right to buy the stock at $55, yielding a profit. However, if the stock price falls below $55, the option expires worthless.

Advantages of Options Trading for Planning Committees

Options trading offers several compelling advantages for planning committees seeking to diversify their investment portfolios and manage risk. These advantages include:

-

Leverage Effect: Options provide a form of leverage, allowing investors to control a larger number of shares with a relatively smaller investment. This enables committees to amplify potential returns.

-

Hedging Against Risk: Put options serve as a valuable tool for hedging against potential losses in an underlying asset. By purchasing a put option, committees can protect their investments from adverse price fluctuations, providing a safety net against downside risks.

-

Income Generation: Options can be employed to generate income through premium writing. By selling options, committees can collect upfront payments, albeit giving up the potential to profit from significant price movements.

Risks Associated with Options Trading

While options trading presents numerous advantages, it also entails inherent risks that must be carefully considered:

-

Unlimited Loss Potential: Call options carry unlimited loss potential, as the underlying asset’s price can rise indefinitely. This risk must be diligently managed to avoid significant financial losses.

-

Time Decay: The value of options diminishes over time, even if the underlying asset’s price remains stable. This time decay, known as theta, erodes the option’s value gradually, especially as the expiration date approaches.

-

Complexity: Options trading involves a nuanced understanding of market dynamics, option pricing models, and risk management strategies. Without adequate knowledge and expertise, committees risk making poor investment decisions.

Image: brameshtechanalysis.com

The Planning Committee Is Considering Its Options Trading

Image: www.tradingwithrayner.com

Conclusion

Options trading has emerged as a powerful tool for planning committees seeking to capitalize on market opportunities while managing risk. However, it is imperative to acknowledge both the potential advantages and risks associated with this strategy. By thoroughly comprehending the concepts, mechanics, and nuances of options trading, planning committees can harness this valuable instrument to enhance their investment outcomes.