An Introduction to Trading Option Strategy

In the ever-evolving financial realm, navigating the complexities of trading options can be a daunting prospect. But equipped with the right strategy, you can unlock the boundless potential of the options market. An option, in its essence, grants you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified expiration date. Harnessing the power of options can empower you to mitigate risks, capture optimal returns, and decipher the intricacies of market fluctuations.

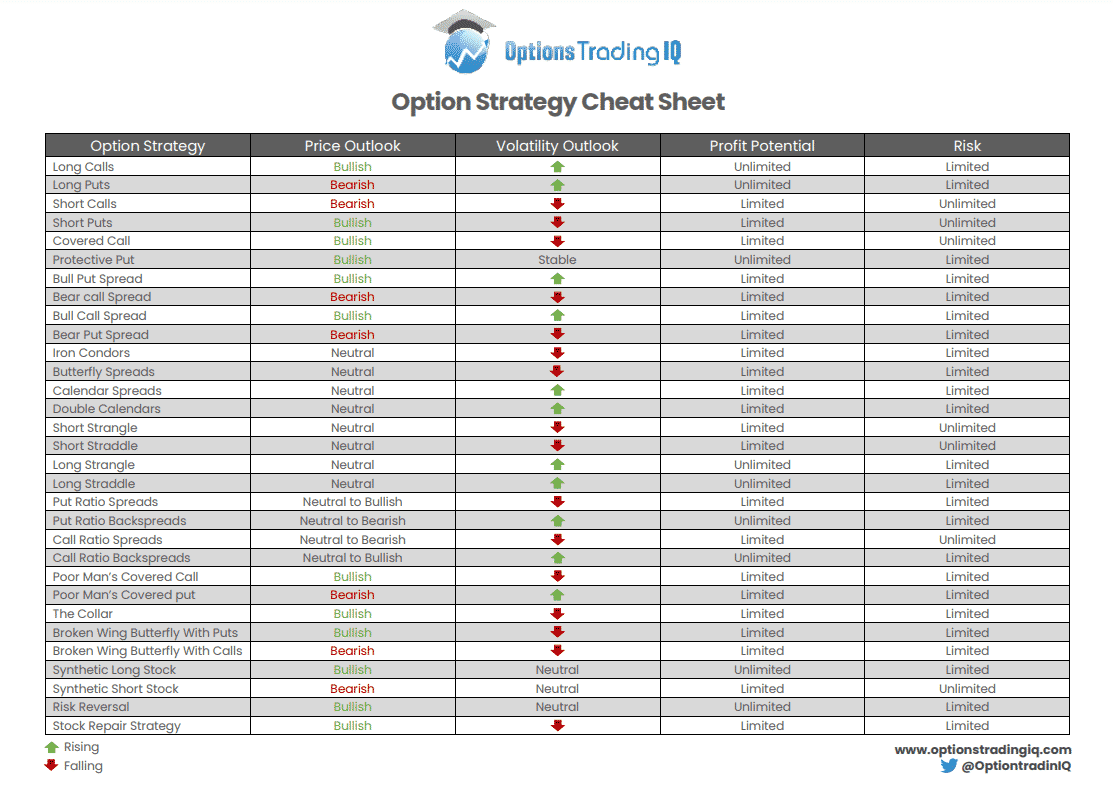

Image: optionstradingiq.com

Types of Trading Option Strategies

The options world presents a vast array of strategies, each tailored to specific market conditions and investor goals. Among the most prevalent are:

- Long Call: Gives you the right to buy an underlying asset. You profit if the asset’s price rises above the strike price minus the premium paid.

- Long Put: Grants you the right to sell an underlying asset. You profit if the asset’s price falls below the strike price minus the premium paid.

- Short Call: Gives you the obligation to sell an underlying asset. You profit if the asset’s price falls below the strike price minus the premium received.

- Short Put: Grants you the obligation to buy an underlying asset. You profit if the asset’s price rises above the strike price minus the premium received.

Essentials of a Winning Option Strategy

Crafting a successful option strategy requires meticulous planning and execution. Here are the guiding principles:

- Define Your Objectives: Clarify your investment goals, whether it’s mitigating risks, maximizing returns, or speculating on market movements.

- Analyze Market Trends: Study historical price data and stay abreast of current events that may influence your underlying asset’s value.

- Choose the Right Strategy: Align your strategy with your risk tolerance, investment horizon, and market conditions.

- Manage Your Options: Carefully monitor your option positions and adjust them as market dynamics evolve.

- Control Your Risk: Implement risk management techniques like stop-loss orders and margin monitoring to protect your portfolio.

Leveraging Expert Insight

Seasoned traders provide invaluable advice to help you navigate the trading option strategy landscape. Here are some words of wisdom:

- Start Cautiously: Begin with small trades until you gain experience and confidence.

- Monitor Positions Regularly: Keep a watchful eye on your option positions to address any unexpected market shifts.

- Diversify Your Options: Spread your risk by investing in multiple option strategies.

- Keep Learning: The market is constantly evolving. Stay updated on the latest trends and trading techniques for optimal performance.

- Seek Professional Advice: Consult with an experienced financial advisor to gain personalized guidance and align your strategies with your unique circumstances.

Image: maddisonmoss.z13.web.core.windows.net

FAQs on Trading Option Strategy

Q: What is the difference between American and European options?

A: Only American options allow exercise before the expiration date, while European options can only be exercised on the expiration date.

Q: How does a bull call spread differ from a simple long call?

A: A bull call spread gives you the right to buy an asset at a lower strike price and sell it at a higher strike price, limiting potential losses.

Q: When should I use a covered call?

A: Covered calls are best suited when you have a bullish outlook, own the underlying asset, and are willing to sell it at or above the strike price.

Best Trading Option Strategy

Image: kurskpu.ru

Conclusion

Unlocking the potential of trading option strategy requires a multifaceted approach that blends strategic planning, tactical execution, and a relentless pursuit of knowledge. By embracing the insights shared here, you can navigate the complexities of the options market with confidence.

May you venture into the world of trading options with a spirit of exploration and the wisdom to seize opportunities and navigate obstacles alike.