Introduction

In the world of investing, options trading has become a dance between risk and reward. For the uninitiated, options are derivatives that grant the right to buy (call) or sell (put) a specific asset at a predetermined price. While options trading can empower investors to harness market volatility and generate profits, choosing the right brokerage is paramount. Enter the titans of the industry: TD Ameritrade and Charles Schwab. Join us as we embark on an emotional journey to compare these platforms, unraveling their strengths, weaknesses, and the psychological impact they have on traders.

Image: smartasset.com

Understanding the Trading Landscape

Options trading, like a roller coaster ride, amplifies the thrill and potential pitfalls of investing. Unlike stocks, where ownership is outright, options provide the flexibility to “bet” on an underlying asset’s future price direction. However, this freedom comes with unique risks and challenges that require careful consideration. Selecting a brokerage that aligns with your trading style and provides the tools and support you need is essential for maximizing your chances of success.

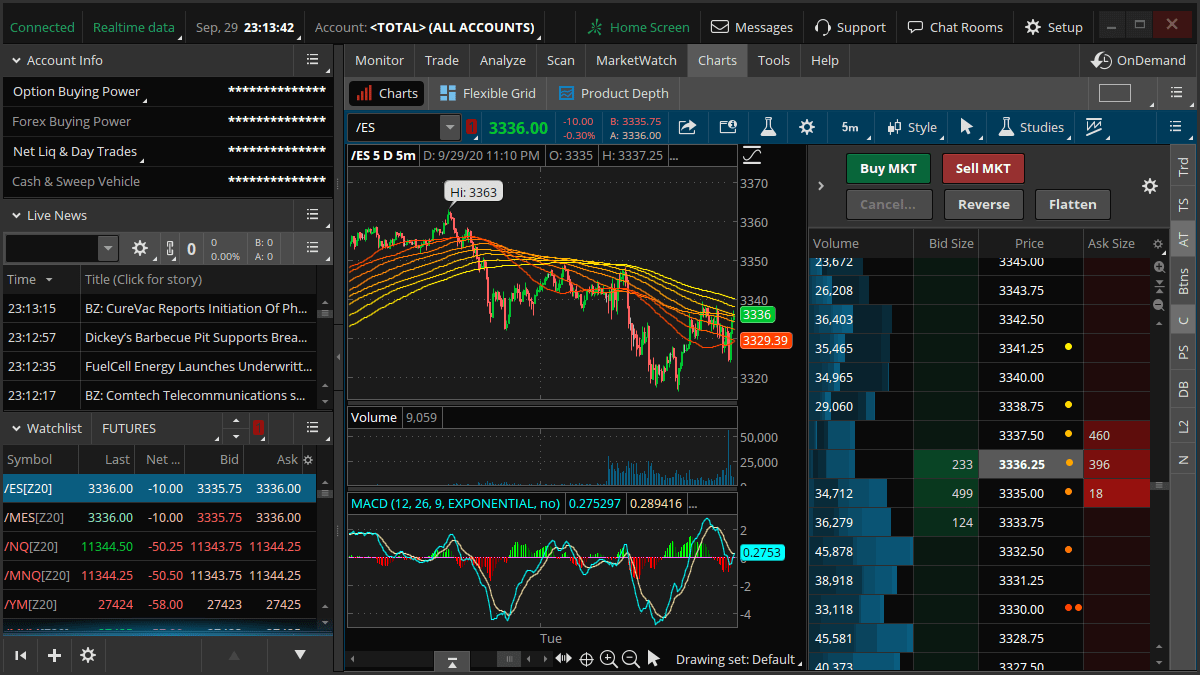

TD Ameritrade: The Trusted Partner

For generations, TD Ameritrade has been a household name in the brokerage industry. It has earned its reputation as a trusted and supportive haven for traders, especially those embracing options trading. TD Ameritrade’s Thinkorswim platform stands as a testament to its commitment to empowering traders. It’s a comprehensive trading platform that packs a punch with advanced charting, robust analytical tools, and a sleek user interface.

Traders who value customization will find solace in Thinkorswim’s ability to tailor layouts, indicators, and alerts. It’s like having a symphony of trading tools at your fingertips, allowing you to orchestrate your trades with precision and finesse. Furthermore, TD Ameritrade’s educational resources are a beacon of knowledge, designed to guide traders of all levels through the complexities of options trading.

However, the fees associated with options trading on TD Ameritrade can occasionally cast a shadow over its allure. While seasoned traders may not flinch at the costs, aspiring traders might find it a hindrance to their trading aspirations.

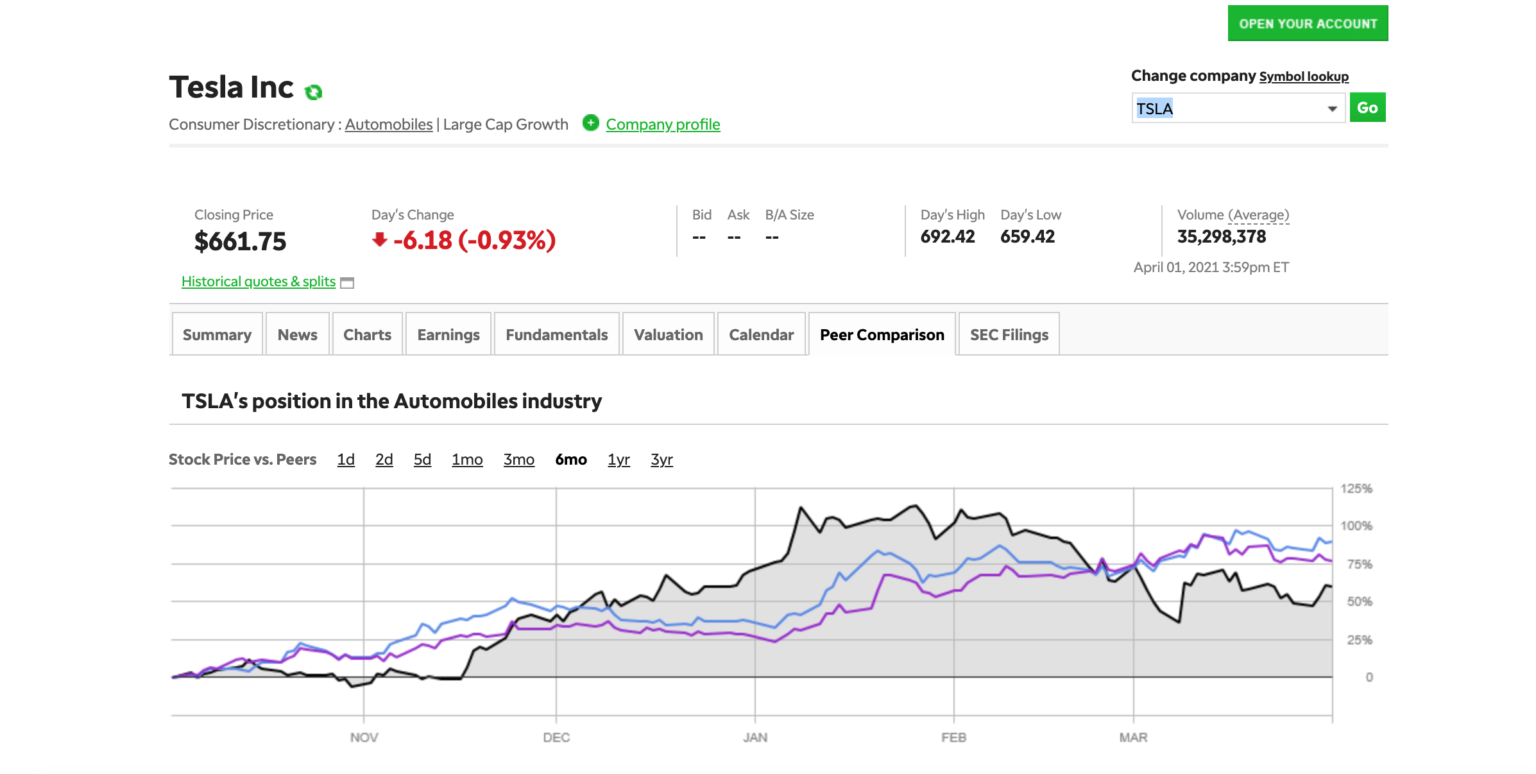

Charles Schwab: The Champion of Customer Care

Charles Schwab has carved a niche in the hearts of investors through its unwavering commitment to customer service. Its options trading platform, Schwab OptionsXpress, is a testament to this dedication, providing a seamless and intuitive trading experience. Navigation feels effortless, and the platform’s thoughtful design anticipates the needs of options traders, making it a haven for novice and experienced traders alike.

Schwab’s customer support is legendary in the brokerage world. Traders can rest assured that their queries will be met with professionalism, patience, and a genuine desire to assist. It’s like having a lifeline to a financial expert, always ready to navigate the choppy waters of options trading. However, Schwab’s commission structure for options trading may not be the most competitive, potentially dampening the enthusiasm of high-volume traders.

Image: www.wallstreetzen.com

Td Ameritrade Vs Charles Schwab Options Trading

Image: tradingplatforms.com

Making the Choice that Resounds with Your Heart

In the grand scheme of options trading, TD Ameritrade and Charles Schwab are the maestros, each symphony offering a unique blend of strengths and nuances. TD Ameritrade captivates with its powerful trading platform and extensive educational resources, while Charles Schwab enchants with its impeccable customer service and intuitive trading experience.

Ultimately, the choice between these two brokerage giants rests upon your individual trading style, aspirations, and risk tolerance. If you’re a seasoned trader who values advanced trading tools and comprehensive educational support, TD Ameritrade might be your symphony of choice. Conversely, if you’re seeking a brokerage that cherishes customer care above all else and caters to traders of all levels, Charles Schwab’s comforting embrace might be your perfect fit.

Remember, the true allure of options trading lies in your ability to harness market fluctuations to your advantage. Amidst the exhilaration and challenges that await you, the brokerage you choose will be your steadfast companion, each note played guiding you closer to your financial aspirations. May you find the symphony that resonates with your trading heart and empowers you to navigate the kaleidoscopic world of options trading.