Introduction

Image: t3technologyhub.com

In the realm of investing, options trading has emerged as a lucrative yet nuanced strategy. Charles Schwab, a renowned brokerage firm, offers a comprehensive platform for traders to navigate the complexities of options trading. Whether you’re a seasoned veteran or a novice seeking to expand your financial horizons, this article will guide you through the ins and outs of Charles Schwab trading options, empowering you with the knowledge and confidence to make informed trades.

Understanding Charles Schwab Trading Options

Options trading involves contracts that provide buyers with the right but not the obligation to buy or sell an underlying asset at a predetermined price on or before a specific date. Charles Schwab provides access to a wide range of options, including calls, puts, spreads, and combinations, catering to diverse trading strategies.

Advantages of Trading Options with Charles Schwab

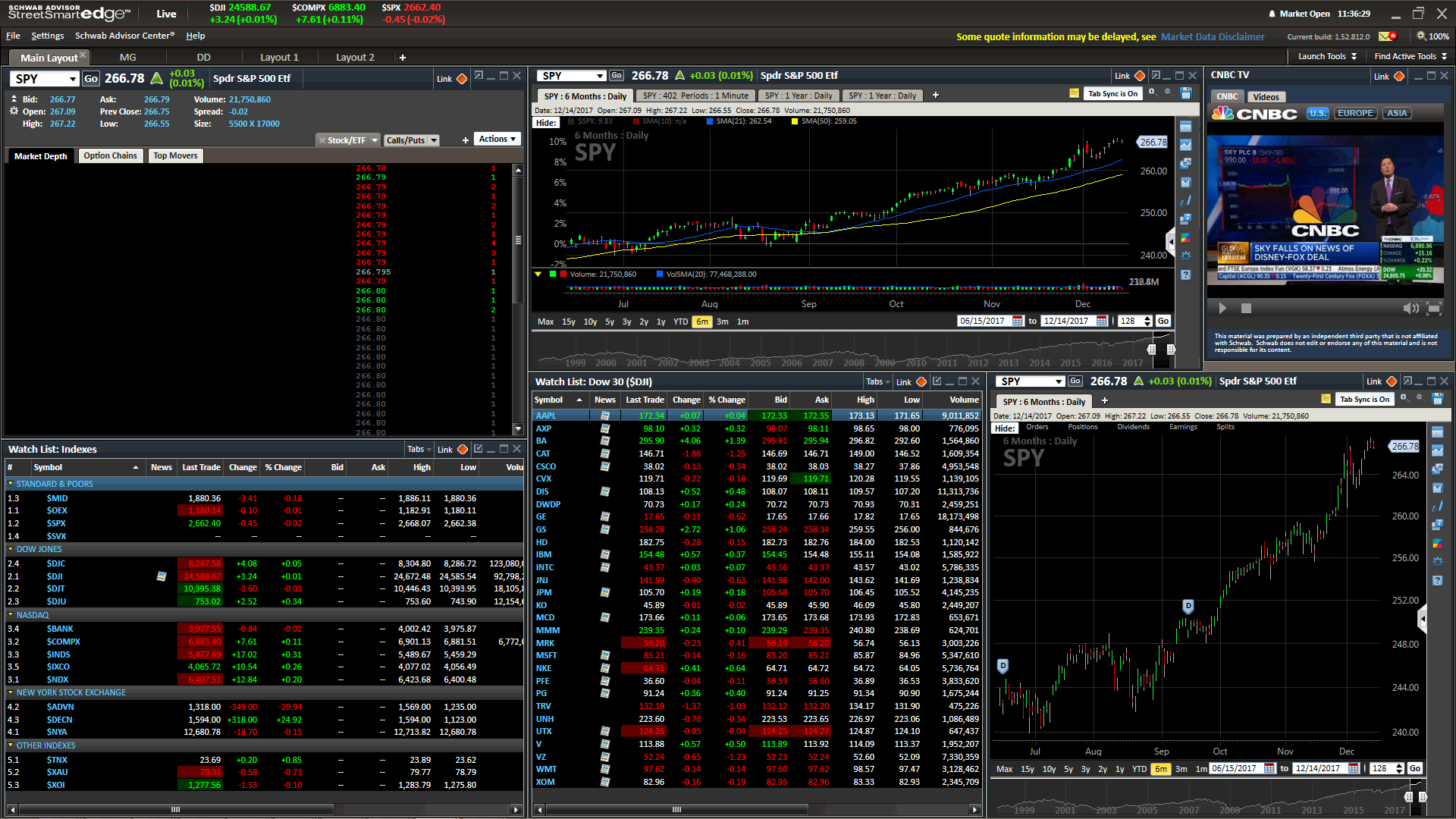

- Robust Platform: Charles Schwab’s online trading platform, StreetSmart Edge, features advanced charting tools, sophisticated analysis, and real-time market data, empowering traders with the resources they need to make informed decisions.

- Educational Resources: Schwab offers a plethora of educational materials, such as webinars, courses, and tutorials, to help traders of all levels enhance their knowledge and skills.

- Dedicated Support: Traders have access to a dedicated support team that can provide guidance, answer questions, and assist with account-related matters.

Strategies for Trading Options on Charles Schwab

- Covered Call Strategy: This strategy involves selling call options while already owning the underlying asset. It generates additional income from options premiums while limiting the downside risk.

- Put Selling Strategy: Traders sell put options while expecting the underlying asset to rise in value. If the asset price does not decline below the strike price, traders collect premiums as income.

- Iron Condor Strategy: This strategy involves selling call and put options at higher and lower strike prices, creating a range where the trade is profitable.

Tips for Successful Options Trading with Charles Schwab

- Understand Options Concepts: Familiarize yourself with the fundamentals of options trading, including terminology, risk factors, and trading mechanics.

- Manage Risk: Options trading carries significant risk. Use proper risk management techniques, such as stop-loss orders and position sizing, to mitigate potential losses.

- Stay Informed: Keep up with market trends and economic news that can impact the value of underlying assets and options premiums.

Conclusion

Charles Schwab trading options provides a powerful opportunity for investors to enhance their financial returns and manage risk. By leveraging the robust platform, educational resources, and strategies outlined in this article, traders can navigate the complexities of options trading with confidence. Remember, investing involves inherent risk, and it’s crucial to conduct thorough research, manage risk effectively, and seek professional advice where necessary. Embrace the world of options trading with Charles Schwab and embark on a journey of financial empowerment and prosperity.

Image: www.schwab.com

Charles Schwab Trading Options