In a world of ever-evolving financial landscapes, options trading has emerged as a powerful tool for those seeking to navigate the market’s complexities and potentially reap significant returns. However, mastering the intricacies of options trading requires a combination of knowledge, strategy, and a disciplined approach. In this comprehensive guide, we will delve into the most successful strategies employed by experienced traders, empowering you with the tools and insights to succeed in this dynamic arena.

Image: rmoneyindia.com

Understanding Option Trading: Laying the Foundation

Options are financial contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a designated date. At the heart of option trading lies the delicate balance between risk and reward, where the potential for substantial gains comes hand in hand with the possibility of losing the entire investment.

Uncovering Winning Strategies: A Path to Success

Mastering options trading demands a deep understanding of available strategies. Here are some of the most time-tested and proven approaches adopted by successful traders:

- Covered Calls: With a covered call, you sell (or “write”) a call option while simultaneously owning the underlying asset. This strategy generates income from the option premium while limiting your upside potential. However, it also caps your risk to the difference between the strike price and the current market price.

- Protective Puts: Protective puts provide a safety net for investors holding long positions in an underlying asset. By purchasing a put option with a strike price below the current market price, you effectively insure your portfolio against potential downturns.

- Short Strangles: Short strangles involve selling both a call option and a put option with different strike prices and the same expiration date. This strategy aims to profit from a narrow range in the underlying asset’s price movement.

- Straddles: Straddles employ options with the same strike price but different expiration dates. By simultaneously buying a call and a put option, traders attempt to capitalize on the high volatility of the underlying asset.

- Iron Condors: Iron condors are four-legged strategies that involve selling both a bull call spread and a bear put spread with different strike prices. This strategy seeks to profit from a relatively stable or slightly trending underlying asset.

The Traders’ Edge: Expertise and Practical Tips

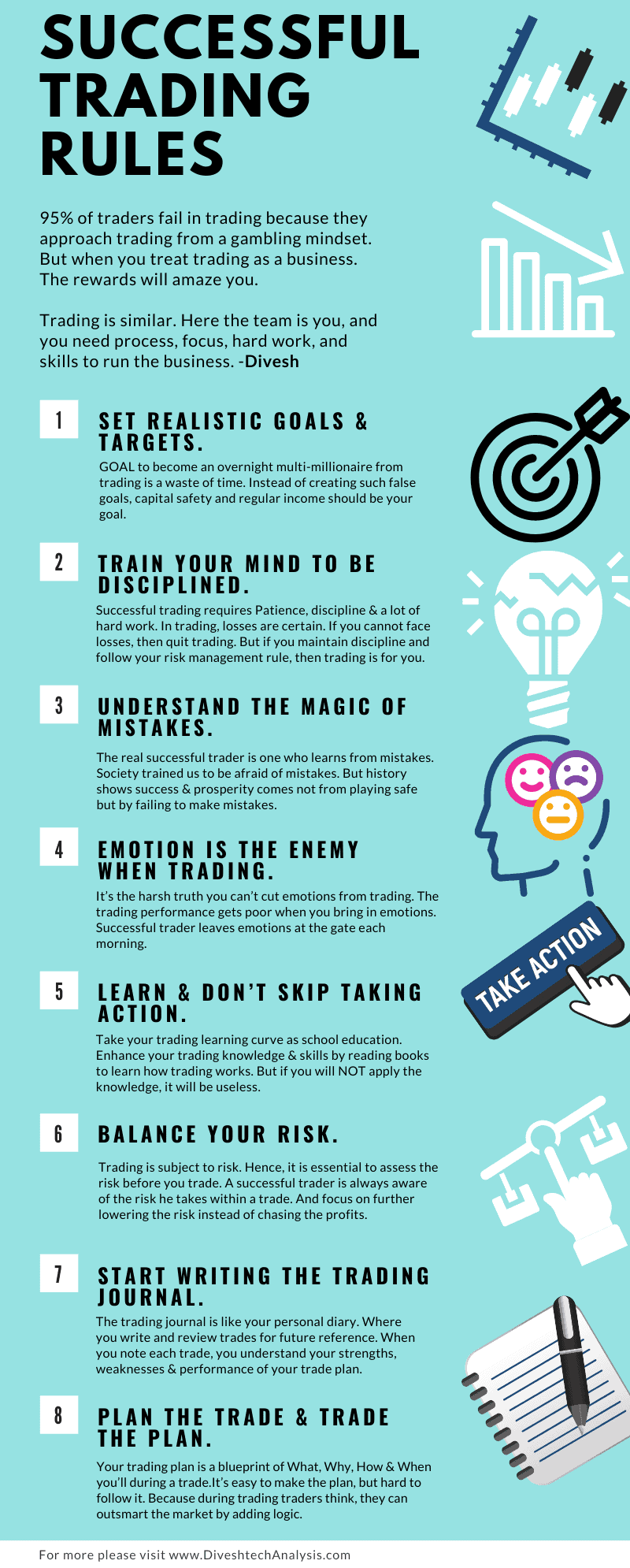

Renowned options trading experts emphasize the importance of meticulous research, risk management, and emotional discipline. They recommend:

- Thoroughly Researching: Assess market trends, company financials, and technical indicators to make informed decisions.

- Managing Risk Wisely: Use stop-loss orders, position sizing, and multiple strategies to minimize potential losses.

- Maintaining Emotional Balance: Stay calm under pressure and avoid letting emotions cloud your judgment.

Image: www.scribd.com

Successful Strategies For Option Trading

Image: www.diveshtechanalysis.com

Conclusion: Embracing Options Trading’s Potential

Options trading presents a powerful avenue for investors seeking to navigate financial markets strategically. By arming yourself with a solid foundation, embracing proven strategies, and listening to expert guidance, you can unlock the potential of options trading and achieve consistent success in this dynamic arena.

Remember, financial success requires dedication, discipline, and a willingness to learn continuously. Embrace the journey of options trading, and you will find countless opportunities to expand your wealth and secure your financial future.