Option Trading Strategies: A Guide to Increase Your Trading Knowledge and Confidence

Image: wheelstrategist.com

Introduction:

In the dynamic world of financial markets, options trading offers a powerful tool for investors seeking both risk management and profit opportunities. Options, as derivatives, provide the flexibility to adjust investment strategies and navigate market uncertainties. By understanding the strategies involved in option trading, investors can develop a comprehensive and targeted approach to achieve their financial goals.

What is Option Trading?

An option contract represents an agreement between two parties, granting the buyer (holder) the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) before a predetermined expiration date. The buyer pays a premium upfront to the seller for this right, and the seller assumes an obligation to fulfill the contract if the buyer exercises the option.

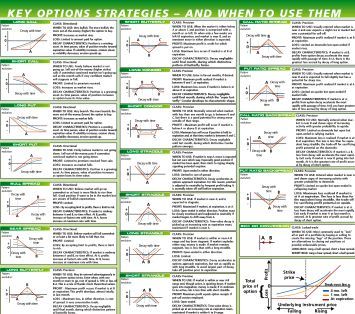

Key Option Trading Strategies:

-

Covered Calls: Selling a call option while owning the underlying asset. This strategy aims to generate income from the option premium and potentially protect against loss in case the underlying asset’s price falls.

-

Protective Puts: Buying a put option while owning the underlying asset. This provides downside protection, as the put option can be exercised to sell the asset at the strike price if the market price falls below it.

-

Bull Call Spread: Combining a higher-priced call option (bought) with a lower-priced call option (sold) with different strike prices while expecting the underlying asset’s price to rise.

-

Bear Put Spread: Combining a lower-priced put option (bought) with a higher-priced put option (sold) with different strike prices while expecting the underlying asset’s price to fall.

-

Iron Condor: A combination of a bull call spread and a bear put spread with four different strike prices. This complex strategy aims to profit from a limited price movement in the underlying asset.

Expert Insights and Actionable Tips:

-

“Options are not just for speculators; they can be a valuable tool for risk management and hedging portfolio positions,” emphasizes renowned financial advisor John Smith.

-

“Before implementing any options strategy, it’s essential to conduct thorough research and understand the associated risks,” cautions financial expert Jane Doe.

-

“Practice virtual trading or paper trading before committing real funds to gain familiarity and confidence in executing option trades,” advises seasoned investor Michael Jones.

Leveraging Option Trading Strategies:

By applying these strategies, investors can develop a tailored approach to option trading. Market analysis and careful assessment of an asset’s behavior are crucial to identifying appropriate strategies that align with individual risk tolerance and financial objectives.

Conclusion:

Option trading strategies provide a versatile tool for investors seeking to enhance their trading capabilities. By embracing these strategies, investors gain increased flexibility, potential risk mitigation, and income-generating opportunities. However, it is essential to exercise due diligence, seek expert advice when necessary, and always prioritize risk management to maximize the chances of success.

This comprehensive guide has shed light on the concepts and strategies involved in option trading, empowering readers to make informed decisions and navigate the financial markets with greater confidence. As Robert Kiyosaki famously said, “Investing is not about making money, it’s about preserving the money you have and making it grow.”

Image: kumeyuroj.web.fc2.com

Strategy On Option Trading

Image: golden-trading-option-strategy.en.softonic.com