As an avid investor, I meticulously navigate the ever-fluctuating stock market, seeking opportunities to enhance my portfolio’s value. Stock options have emerged as an intriguing realm that offers both potential rewards and risks. Fascinated by the intricate mechanisms behind options trading, I delved into researching and crafting a comprehensive stock options trading system that would guide my investment decisions.

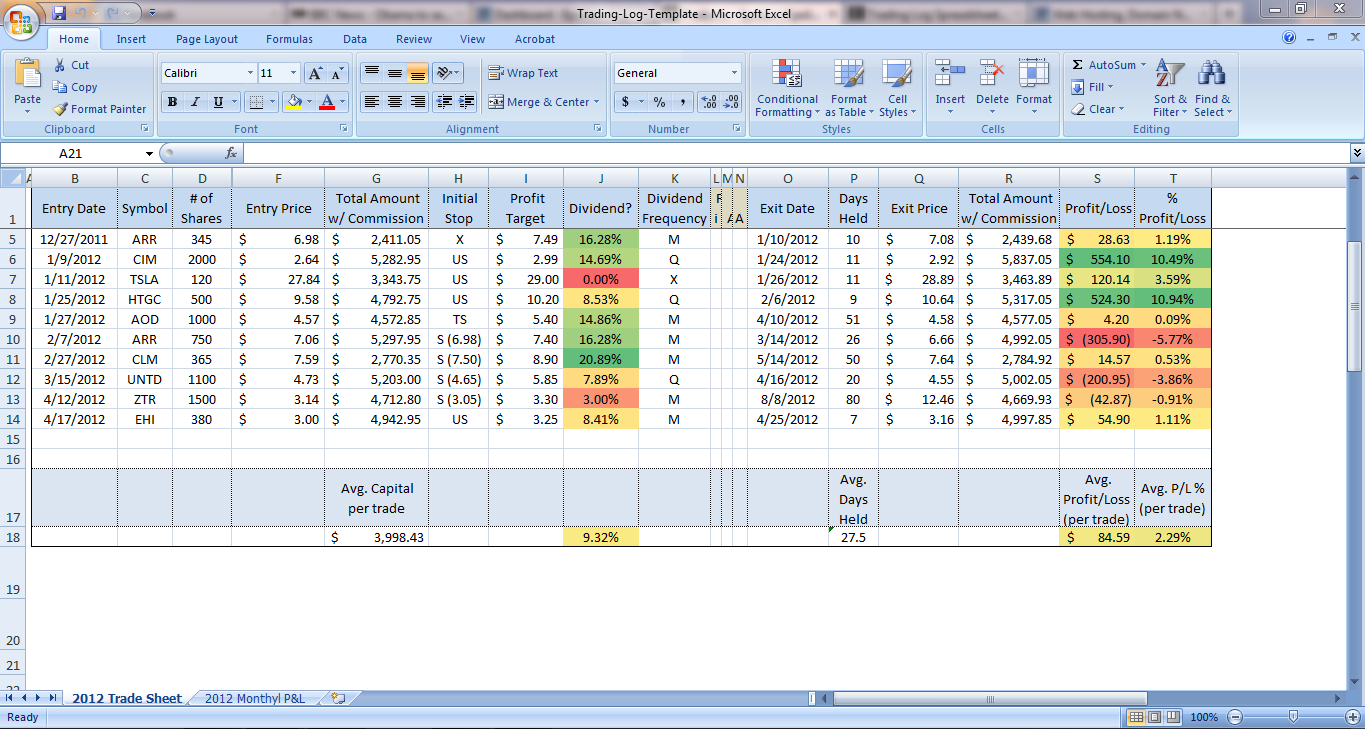

Image: db-excel.com

Stock Options: A Powerful Tool for Market Success

Stock options confer upon investors the right, but not the obligation, to either buy (call option) or sell (put option) an underlying security at a predetermined price (strike price) on or before a specific date (expiration date). This flexibility allows for sophisticated trading strategies that leverage market volatility and time decay to generate substantial gains.

Decoding the Mechanics of Options

Call options grant the holder the right to purchase a stock at the strike price, even if its market price has soared above it. Put options, on the other hand, bestow the right to sell a stock at the strike price, regardless of a potential decline in its market value. These options expire on a specified date, rendering them null and void thereafter.

Leveraging Options for Profitable Outcomes

Options trading empowers investors to construct tailored positions that align with their risk appetite and market outlook. Call options prove effective in bullish scenarios, where expectations of rising stock prices prevail. Conversely, put options provide downside protection during bearish market conditions where stock prices are anticipated to fall. By skillfully combining these options, investors can craft strategies that amplify gains and mitigate losses.

Image: www.audible.ca

Unveiling the Cutting-Edge Stock Options Trading System

My stock options trading system leverages a combination of fundamental and technical analysis to identify potential trading opportunities with enhanced accuracy and profitability. Fundamental analysis delves into financial ratios, earnings reports, and industry trends to assess a company’s intrinsic value.

Technical Indicators for Trend Identification

Technical analysis employs various indicators, such as moving averages, Bollinger Bands, and relative strength index (RSI), to decipher price patterns and forecast market trends. Combining fundamental and technical analysis, my system pinpoints stocks with strong underlying fundamentals poised for growth or decline, ripe for options trading.

Customizing Trading Strategies for Enhanced Returns

The system encompasses a range of customizable trading strategies to cater to varying risk profiles and market conditions. These strategies seamlessly align entry and exit points with identified market trends, maximizing profit potential while managing risk.

Market Trends and Innovations Shaking the Options Landscape

The advent of exchange-traded options (ETOs) has revolutionized options trading. Unlike traditional over-the-counter (OTC) options, ETOs trade on standardized exchanges, offering increased liquidity and transparency. This evolution has opened up new avenues for retail investors to participate in the options market.

Expert Tips for Successful Options Trading

- Acquire Comprehensive Knowledge: Delve into the intricacies of options trading through books, online courses, and webinars to equip yourself with a solid understanding of the nuances involved.

- Practice Using Virtual Trading Platforms: Utilize simulation platforms to hone your trading skills without risking real capital. Paper trading allows you to experiment with different strategies and build confidence before venturing into live markets.

Navigating the Options Market: Frequently Asked Questions

- Q: What is a stock option premium?

A: The premium is the price paid to acquire an options contract, representing the upfront cost of entering an options trade.

- Q: How does time decay impact options values?

A: As an option nears its expiration date, its time value diminishes, reducing its overall worth.

- Q: What are the risks associated with options trading?

A: Options trading carries inherent risks, including the potential for significant losses. Proper risk management and understanding of the risks involved are crucial.

Stock Options Trading System

Image: www.asktraders.com

Conclusion: Embark on the Path to Successful Options Trading

Whether you’re a seasoned investor or a curious novice, the stock options trading system outlined in this article provides a comprehensive framework for navigating the complexities of the options market. By embracing the insights shared, you can develop a robust system tailored to your individual needs and market conditions, empowering you to reap the rewards that options trading has to offer.

Are you eager to delve deeper into the realm of stock options trading? Share your queries and embark on a journey towards enhanced profitability. Let us collectively unlock the boundless potential of this captivating financial instrument.