Introduction

In the realm of finance, the allure of potentially lucrative returns has propelled stock options trading to the forefront of investment strategies. As a brokerage platform that has democratized access to financial markets, Robinhood has become the gateway for many aspiring traders to venture into the dynamic world of options. Whether you’re a seasoned investor or just starting your trading journey, understanding the ins and outs of stock options trading on Robinhood is paramount to maximizing your chances of success.

Image: marketxls.com

Delving into the Basics

A stock option is a contract that grants the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specific number of shares of an underlying stock at a predetermined price (known as the strike price) within a specified time frame. Unlike trading stocks, which involves outright ownership, options trading offers investors the unique ability to speculate on the future price movements of an underlying asset without having to own it directly.

Unveiling the Anatomy of an Options Contract

Every options contract encompasses several key elements:

- Underlying Stock: The stock on which the option is based.

- Strike Price: The price at which the buyer can purchase (for call options) or sell (for put options) the underlying shares.

- Expiration Date: The date on which the option contract expires.

- Option Premium: The price paid by the buyer of the option to the seller.

Exploring the Types of Options Strategies

Options trading encompasses a vast array of strategies, each tailored to specific market conditions and risk-return preferences. Here are some of the most common:

- Call Options: Give the buyer the right to buy the underlying stock at the strike price.

- Put Options: Give the buyer the right to sell the underlying stock at the strike price.

- Covered Call: Selling a call option while owning the underlying stock.

- Cash-Secured Put: Selling a put option while having the cash to cover the potential purchase of the underlying stock.

Image: www.youtube.com

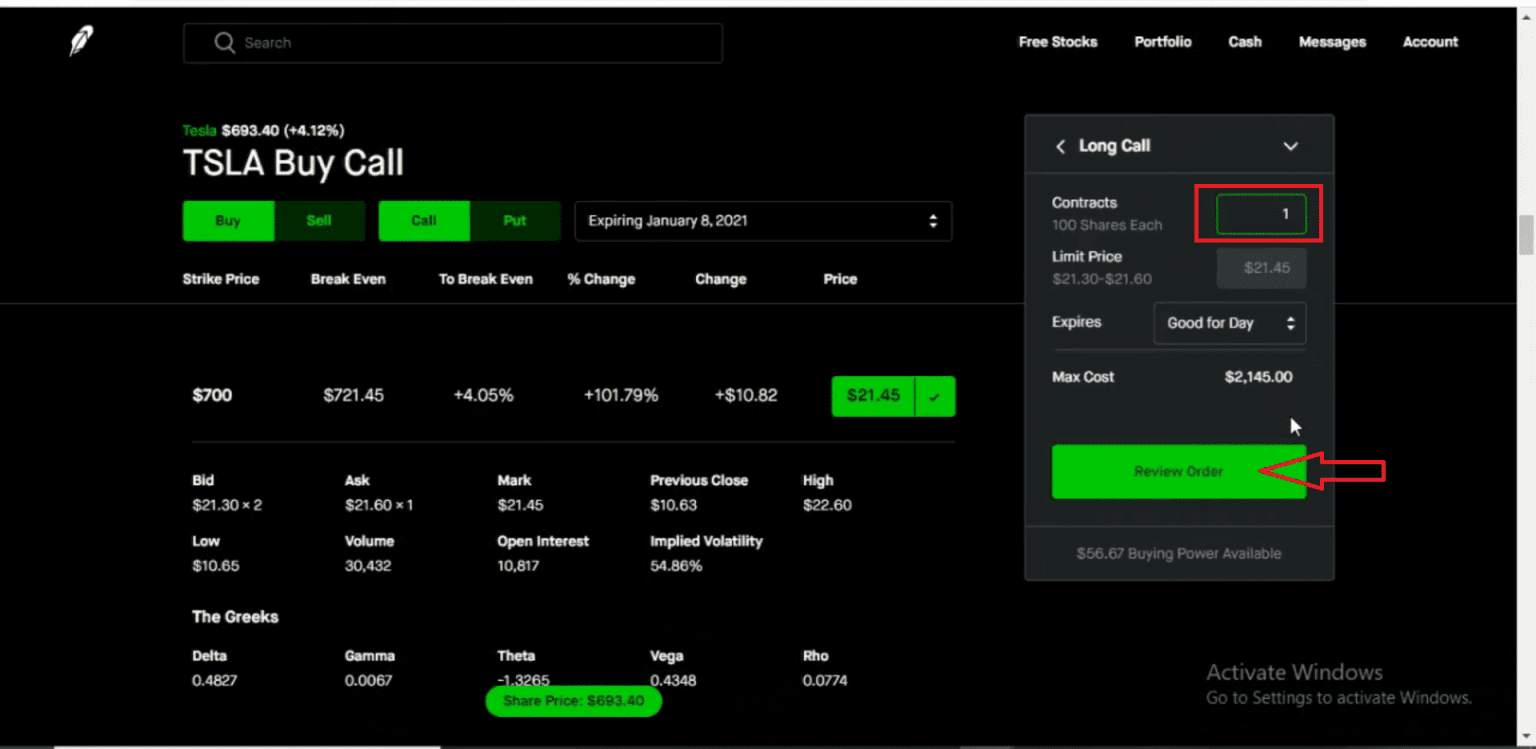

The Mechanics of Options Trading on Robinhood

Robinhood’s intuitive platform simplifies options trading for investors of all levels. To execute a trade, follow these steps:

- Open the Trade Ticket: Select the underlying stock and locate the “Option” tab within the trade ticket.

- Choose Option Type: Specify whether you want to buy a call or a put option.

- Select Expiration Date: Determine the time frame within which you expect the stock price to move in the desired direction.

- Set Strike Price: Choose the target price for the underlying stock.

- Review Contract Details: Confirm the option premium, quantity, and expiration date.

- Execute the Trade: Submit the trade order for execution.

Understanding the Risks of Options Trading

While options trading offers the potential for substantial rewards, it’s crucial to be cognizant of the inherent risks involved.

- Unlimited Loss Potential: Unlike stock trading, the potential losses in options trading can be substantial, especially for options that leverage a high degree of risk.

- Time Decay: Options lose value over time as expiration approaches, potentially rendering them worthless if not executed or closed out before the expiration date.

- Volatility Risk: Options are sensitive to fluctuations in the underlying stock’s volatility, which can amplify gains or losses.

Tips for Successful Options Trading

To improve your chances of success in options trading, consider these tips:

- Educate Yourself: Thoroughly research the topic, understand the different strategies, and consult reputable sources.

- Start Small: Begin with a small portion of your capital until you become proficient in the intricacies of options trading.

- Manage Risk: Understand your risk tolerance and establish a well-defined trading plan to mitigate potential losses.

- Set Realistic Expectations: Don’t expect to get rich quick with options trading; consistency, patience, and a long-term mindset are key.

- Seek Professional Advice: If you’re a beginner, consider seeking guidance from a qualified financial advisor to enhance your knowledge and decision-making.

Stock Options Trading Robinhood Tutorial

Image: www.youtube.com

Conclusion

Navigating the intricacies of stock options trading on Robinhood can empower you with a valuable tool for potential wealth creation. By grasping the foundational concepts, exploring trading strategies, embracing risk management techniques, and following the time-tested tips outlined in this comprehensive guide, you can embark on a journey toward options trading success. Remember, knowledge, discipline, and perseverance are the cornerstones of thriving in this dynamic and potentially rewarding financial landscape.